The Wall Street Economist

The Wall Street Economist

Dr. Edmond J. Seifried

Friday, Jan. 29, 2016, was an important day for Wall Street. At 8:30 a.m. EST, the Bureau of Economic Analysis (BEA) released the Real Growth Domestic Product data for the final quarter of 2015. The news release had been embargoed until precisely that time; only a handful of individuals knew the contents of the release and they were sworn to secrecy under penalty of law. When the release went live, economic pundits, financial analysts, Fed watchers and others from around the world let out a combined groan. The U.S. economy had disappointed the world. Economic growth was a paltry 0.7 percent from the previous quarter. The release was specific regarding the “heroes and villains” that contributed to the sluggish growth.

The BEA news release indicated that real gross domestic product – the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes – increased at an annual rate of 0.7 percent in the fourth quarter of 2015 compared with the third quarter, when real GDP increased by 2.0 percent. The increase in real GDP in the fourth quarter primarily reflected positive contributions from personal consumption expenditures, spending on housing and federal government spending. The BEA continued by noting that these positive results were partly offset by negative contributions from private inventory investment, exports and nonresidential fixed investment. Lastly, the BEA announced that imports, which are a subtraction in the calculation of GDP, increased.

The BEA next warned the investment community that this growth rate was only the first of three estimates, and that future estimates for the final quarter of 2015 might be higher or lower than the published 0.7 percent growth rate. The BEA noted that the fourth-quarter advance estimate is based on source data that may be incomplete or subject to further revision. The "second" and third or “final” estimate for the fourth quarter, based on more complete data, will be released on Feb. 26 and March 25, 2016, respectively.

This entire process will be repeated again on April 26, 2016, when the BEA will announce to the world the performance of the U.S. economy during the first quarter of 2016. As of this writing in mid-February, it is hardly possible to make a precise prediction as to what the U.S. GDP growth rate will be for the first three months of 2016. However, if history is any guide, it is pretty certain that the first quarter growth rate will be weak, and more than likely the lowest of the four quarters in 2016. Why? The major culprit seems to be winter storms.

In late January 2016, winter storm Jonas dumped more than 30 inches of snow over much of the mid-Atlantic region of the U.S., pounding Washington, D.C., Baltimore, Philadelphia and New York City with high winds and massive snow totals. Much of the area was at a virtual standstill for two to four days, and economic activity basically ground to a halt. In fact, the same region had battled similar snow events in 2014 and 2015, and the GDP results for the first quarter of those years were not good either, at 0.9 percent and 0.6 percent respectively.

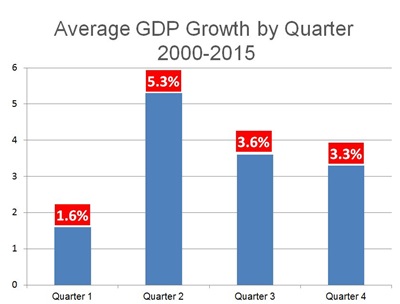

Looking back over the years since 2000, the first quarter of each year seems to be the runt of the litter. Is weather that important? The chart below shows the average growth rate in the U.S. GDP by quarter. Notice the first quarter average growth rate is much lower than the average for the other quarters.

The second quarter average makes one wonder about the re-energizing power of spring.

Dr. Ed Seifried is Chief Economist and Strategic Advisor at BNK Advisory Group. He is also professor of economics and business at Lafayette College in Easton, PA, and a faculty member of numerous graduate banking schools, including Stonier Graduate School of Banking and the Graduate School of Retail Bank Management. He also serves as dean of The West Virginia and Virginia Banking Management Schools. Dr. Seifried is a nationally recognized speaker and is the author of both academic and popular articles and books. He is the co-author of BNK's Art of Strategic Planning in Community Banks and The Art of Risk in Community Banks, a series for the committed bank director. He holds his doctorate in economics and business from West Virginia University.

© Northwest Farm Credit Services 2016

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe