The Wall Street Economist

The Wall Street Economist

Dr. Edmond J. Seifried

The BEA reported that the increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), exports, and nonresidential fixed investment. These were partly offset by negative contributions from private inventory investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The BEA noted that the reasons for the acceleration in the growth rate from 0.8% in the first quarter to 1.4% in the second quarter were an acceleration in PCE and an upturn in nonresidential fixed investment and in exports.

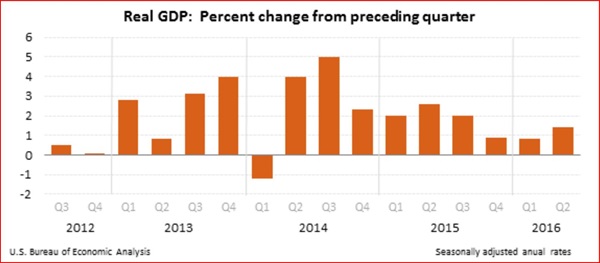

The graph below shows the GDP growth rates for the last few years.

While the economy is currently near the end of the third quarter, the first estimate of growth for quarter number three is still weeks away, and the final estimate will take almost three months to be generated. However, there are a number of forecasts available which attempt to predict the current GDP growth rate. Of all the forecasts available, one of the most respected is the forecast prepared by the Atlanta Federal Reserve Bank. Their virtual real-time estimate of GDP is called “GDPNOW”.

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2016 was a reported 2.8 percent on September 28, down from 2.9 percent on September 20. If the September 28th GDPNow forecast of 2.8% growth turns out to be a close approximation of the actual growth rate, it would be the first time in years that our growth rate is even close to the 3.0% level. Let’s keep our fingers crossed.

Dr. Ed Seifried is Chief Economist and Strategic Advisor at BNK Advisory Group. He is also professor of economics and business at Lafayette College in Easton, PA, and a faculty member of numerous graduate banking schools, including Stonier Graduate School of Banking and the Graduate School of Retail Bank Management. He also serves as dean of The West Virginia and Virginia Banking Management Schools. Dr. Seifried is a nationally recognized speaker and is the author of both academic and popular articles and books. He is the co-author of BNK's Art of Strategic Planning in Community Banks and The Art of Risk in Community Banks, a series for the committed bank director. He holds his doctorate in economics and business from West Virginia University.

© Northwest Farm Credit Services 2016

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe