Northwest FCS News

Federal Open Market Committee (FOMC) Meeting Results

FOMC highlights:

1. The Fed pledges to use its full range of tools to assist the economy. The Fed did not change rates - it keeps the interest rate range at 0.0% - 0.25%.

2. The Fed claims that progress on COVID-19 vaccinations has helped, and the economy is much stronger because of it.

3. The Federal Reserve announced that it will speed up the taper of its bond buying. Bond buying to end by March of 2022.

4. The Fed forecast that it could increase interest rates three times in 2022.

Economic Highlights:

Job growth and economic activity continue to strengthen, but inflation is high.

- With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen.

- The sectors most adversely affected by the pandemic have improved in recent months but continue to be affected by COVID-19. Job gains have been solid in recent months, and the unemployment rate has declined substantially.

- Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation.

- Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

- The path of the economy continues to depend on the course of the coronavirus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain, including from new variants of the coronavirus.

- In light of inflation developments and the further improvement in the labor market, the Committee decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities.

- Beginning in January, the Committee will increase its holdings of Treasury securities by at least $40 billion per month and of agency mortgage backed securities by at least $20 billion per month.

- The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook.

- The Federal Reserve's ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

- In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals.

- The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

- The Board of Governors of the Federal Reserve System voted unanimously to maintain the interest rate paid on reserve balances at 0.15%, effective Dec. 16, 2021.

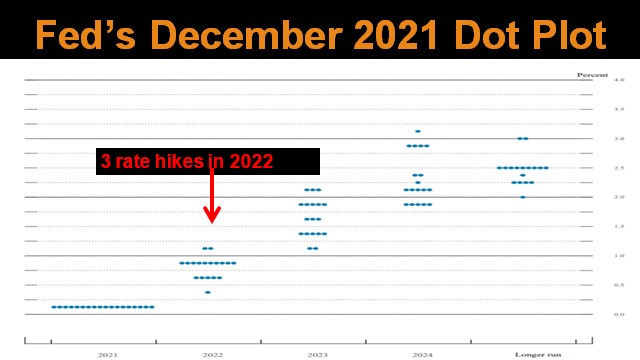

- The Fed issued its interest rate forecast, the so-called dot plot. The rate forecast indicates the Fed is likely to raise rates three times in 2022! The new dot plot is shown below.

- Finally, the Fed also issued its final forecasts of 2021 for GDP, the unemployment rate and inflation (PCE Index). The chart below is a summary of the latest forecast compared to their previous forecast.

Voting Results: No dissenting votes

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

Next Meeting: Jan. 25-26, 2022

###

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe