Economic Update Quarterly

Economic Update Quarterly

Lawry Knopp, VP-Funding & Hedging

- Market hopes of more fiscal stimulus and availability of a vaccine in 2020 have been realized with the recent passage of a $900 billion COVID-19 relief spending bill and multiple pharmaceutical companies receiving FDA approval to begin administering COVID-19 vaccines. These developments have improved the outlook for continued economic growth in 2021 and fueled the runup in the major U.S. equity indexes to record highs, while longer term interest rates have moved higher. Look for oil prices to trend higher on the improved outlook while the dollar continues to slide on weaker demand for the safer assets.

- In early December, the European Central Bank increased its emergency bond-buying program, which pushed the ECB’s monetary stimulus program in 2020 to over 3 trillion euros. Total assets held by the ECB now top 7 trillion euros. There is fear that the eurozone economy contracted during Q4-2020 on new restrictions aimed at controlling COVID-19 and the prospect for 2021 growth is weaker than expected. Globally, total assets for the major central banks is around $28 trillion.

- Brexit appears to be headed for approval as Britain seeks to retain sovereign control over its laws and regulations, while establishing a new set of processes for trade and cooperation with the European Union. The agreement removes constraints of the EU from U.K. law making, policy and regulations.

Interest Rates Review

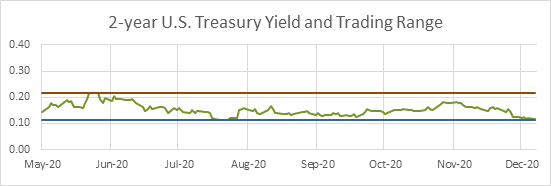

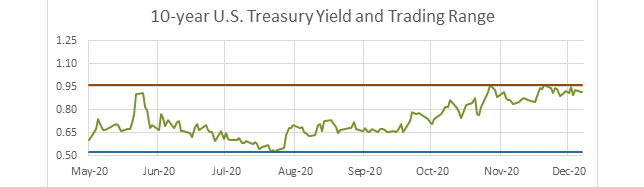

| U.S. Treasury Yields | With Federal Reserve monetary policy expected to be on hold for the next two to three years, look for the 2-year U.S. Treasury yield to remain below 0.35% for most of 2021. The yield is near the low-end of its recent trading range of 0.11-0.23%. On Dec. 4, 2020, the 10-year yield rose to 0.97%, which expanded its trading range to 0.51-0.97%. Look for the 10-year trading range to increase by 25 basis points during the first half of 2021 and potentially another 25 basis points for the second half of the year as inflation becomes a concern. A year ago, the 10-year was yielding 1.55%. |

| |

|

Economic Highlights

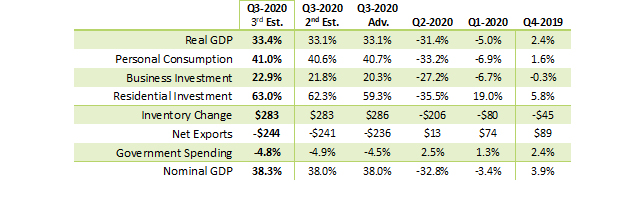

| Economic Growth | Gross Domestic Product: The economy experienced record growth during Q3 following the greatest decline in Q2. Consumer spending led gains as lockdowns were eased and the full impact of over $2 trillion in fiscal stimulus, including additional unemployment benefits and paycheck protection legislation, greatly benefited consumers. The Third Estimate of Q3-GDP indicated growth was slightly better than initially reported.

Markets were buoyed by the passage of a second fiscal relief package totaling $900 billion, which included a one-time $600 direct payment to Americans. The Trump administration believed payment proposed by the legislation should be increased to $2,000. In last-minute legislation, the House voted to approve sending $2,000 payments to Americans the day after President Trump signed the COVID-19 relief bill into law. However, the $2,000 payment legislation may have difficulty getting passed by the Senate. Passage of the additional COVID-19 relief spending should provide a boost to Q1-2021 GDP, now projected to be 2-4%. Estimates for Q2-2021 GDP growth range from 5-7% with GDP growth for the second half of 2021 ranging from 3-5%. Housing and business spending should continue to be supportive of economic activity. Efforts to reopen businesses, to rejuvenate job growth, would also be significantly beneficial to the economy. Looking into 2022, we may see the pace of economic activity slow as fiscal spending tailwinds start to dissipate. The impact of the coronavirus on world populations and economies has been devastating. Furthermore, the extreme monetary policy measures and fiscal spending is a growing concern going forward as markets and financial systems contend with unprecedented levels of debt and currency debasement. |

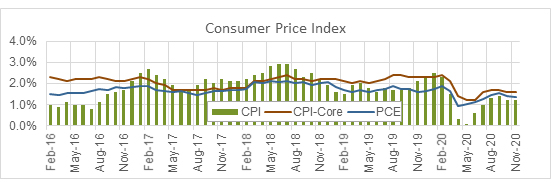

| Consumer Inflation | The year-over-year consumer price index remains below pre-COVID-19 levels. For November, overall prices were up 1.2% compared to a year ago with core inflation up 1.6%. Core inflation excludes volatile food and energy components. Higher prices for food (+3.7%) and used vehicles (+10.9%) are being offset by lower prices for gas (-19.3%), apparel (-5.2%) and transportation (-3.4%), which includes airfares. While prices for services are rising at a 1.7% rate, prior to the COVID-19 outbreak, services were running closer to 3%. Look for inflation to gradually trend higher to around 2.5% by mid-2021, as low readings from the start of the pandemic fall out of the year-over-year average calculation and fiscal spending spurs economic growth on stronger consumer spending.

|

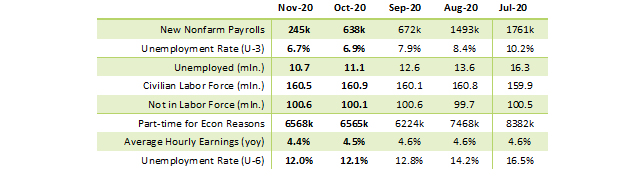

| Employment | U.S. unemployment continued to improve in November, while job growth was modest. The unemployment rate declined 0.2% to 6.7% as household employment fell by 74,000 and the labor force shrank by 400,000. While year-over-year (yoy) average hourly earnings remain strong, recent monthly gains have been modest with the increase over the past three months averaging 1.8%. Look for the jobless rate to gradually improve, working its way down to around 6% by this time next year. Growth in nonfarm payrolls continue to moderate and bears watching as only 12 million of the 22 million jobs lost in the initial shutdowns from March to April have been recovered thus far.

|

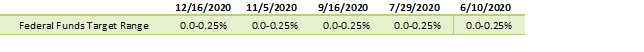

| Monetary Policy | At the Dec. 16 Federal Open Market Committee meeting, policymakers decided to keep the target range for the federal funds rate at 0.0%-0.25%. Monetary policy rates are expected to be relatively unchanged for the next couple years as the Federal Reserve operates under its new “flexible average inflation targeting” (FAIT) regime. The Fed’s dual policy mandate of stable prices and maximum sustainable employment will remain the focus for policymakers. The FOMC “will aim to achieve inflation moderately above 2% for some time so that inflation averages 2% over time,” and inflation expectations are well anchored at 2%. The FOMC reiterated its commitment to quantitative easing by saying holdings of Treasury securities will be increased by $80 billion per month and agency mortgage-backed securities by $40 billion per month until “substantial progress has been made toward the Committee’s maximum employment and price stability goals.” Scheduled changes to the make-up of the committee are expected to be more supportive of accommodative monetary policy. The FOMC consists of 12 members--the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York, currently Jerome Powell; and four of the remaining 11 Reserve Bank presidents, who serve one-year terms on a rotating basis. The four Fed presidents rotating on to the committee for 2021 are viewed as being more “dovish” or less likely to support tightening monetary policy, compared to the four presidents that will roll off the committee. In response to the start of the COVID-19 outbreak in February and March, the FOMC dropped the federal funds rate range by 150 basis points in March with two rate cuts. The next FOMC meeting is Jan. 26-27.

|

View on Interest Rates

Look for the Fed to keep policy rates at the current level for the next two to three years, provided inflation remains within the Fed’s new strategic framework. Their efforts will continue to focus on providing support to the financial markets through purchases of both public and private debt and loan guarantees. Due to the Fed’s level of quantitative easing, longer term rates are expected to remain extremely low.

The 2-year yield will likely remain below 0.35% for most of 2021. The 10-year yield trading range is expected to be 0.50%-1.25% for the next two to three quarters. Recent news of an agreement by Congress and President Trump on fiscal stimulus spending prior to year-end and a vaccine in early 2021 has pushed longer term interest rates higher. Nevertheless, the recent surge in cases added greater uncertainty to the outlook, as increased restrictions are being implemented on a state-by-state basis. If the outlook for recovery becomes less certain, credit, lending and equity markets could experience another round of extreme volatility as the economic narrative turns toward discussion of a double-dip recession.

Impact to Northwest FCS

Market volatility has subsided significantly over the past several months as the U.S. economy and markets seek a return to normal operations. The threat to the economy remains real, but market participants have been able to acclimate to working from home and other remote operation protocols. Northwest FCS has been able to meet customer needs through the challenges of the outbreak and expects to continue doing so as people deal with the dynamics of COVID-19. The Association remains watchful for potential threats that may arise as government officials work to mitigate the effects of COVID-19 and keep people safe.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe