The Ag Globe Trotter

The Ag Globe Trotter

Dr. Dave M. Kohl

Welcome to the weekly edition of The Ag Globe Trotter by Dr. Dave Kohl.

In sports there is considerable discussion surrounding the birth of championship teams. These teams often have a nucleus of players and coaches with high football, basketball or hockey IQ. For example, the famous hockey Hall of Famer Wayne Gretzky, while physically undersized, used knowledge and mental preparation to lead his team to victory and championships. His famous saying, “A good hockey player plays where the puck is. A great hockey player plays where the puck is going to be,” is often used in business planning. From stars, bench players and coaches, the Golden State Warriors assembled a team that often displays high basketball IQ. Bridging this concept to the business of agriculture is appropriate in an era of razor-thin margins with extreme economic volatility. More agricultural lenders are prioritizing and objectively assessing management IQ in their evaluation of business risk. What are the components of high business or financial IQ?

The four cornerstones of business IQ are often observed among the upper half of profitable businesses in agriculture. These businesses are diligent in planning for all aspects of the operation. The elite businesses use their plans to prioritize their strategies. The astute group differentiates their businesses from others with the discipline of execution based on a balance of data, objectivity and their intuition or “gut feeling.” Most importantly, this elite group follows up with periodic monitoring of results so that plans and actions can be evolving as the business environment and conditions within the business organization change. These four cornerstones are then broken down into key management factors. Critical questions about these factors will stimulate conversations regarding the four cornerstones.

Management factors

The first management factor focus is the cost of production. The business manager with a high IQ knows their cost of production, but the higher-level managers know their cost of production for each enterprise. This is becoming more important as diversification of income streams and volatility become a fact of life.

Next, high-level businesses know what they stand for by identifying their core values. Structure is provided with written goals for the business and family, and personally. The goals should be further defined by their term of completion. Short-term goals are within one year and long-term goals are between three and five years. Business goals should be SMART, which means that they are specific, measurable, attainable, rewarding and reasonable, and timely.

Record-keeping systems are becoming more important in the business acumen and decision-making process. The average manager will manage a business using Schedule F tax forms with tax minimization as a priority. The elite business owner will conduct accrual analysis, realizing that there is often a wide variation in net income between cash and accrual records. If a CFO or accountant is used, the owner and management team understand the importance of documenting production, marketing, finance and labor records. They keep these records in a safe and secure place, whether they are written or electronic.

Next, a projected cash flow is developed and monitored. The difference between projected and actual results, known as variance analysis, is the report card of the business and management performance. This should be monitored throughout the year.

High-level managers will conduct sensitivity analysis based on price, cost, interest rates and production while using business intelligence from past performance and possible future trends. This provides the parameters of options and opportunities in an objective manner.

Top-level business managers often work side by side with their agriculture lender, accountant or advisory team to understand key financial and business ratios and metrics. Dashboards in key areas of the business are developed and monitored year over year so that sound decisions are being made using a balance of objectivity and intuition. Working with livestock, crop and/or financial advisors provides outside expertise in the overall decision-making process.

Whether producing a value-added product or a commodity, managers with a high business IQ develop marketing plans aligned with their cash flow and the marketing conditions. Often base hits versus hitting home runs are observed in the higher-level businesses. This means that the business conservatively earns a little profit when opportunities occur, rather than going for a one-time large profit.

A risk management plan with the necessary insurances ranging from crop, livestock, liability, long-term healthcare and disability policies that are designed to protect profits and business net worth is imperative. The key in this area is that the risk management plan is executed and updated as internal and external business conditions change.

Another element displayed by stellar managers is the correlation between business earnings and withdrawals from profits by owners and managers in the form of family living costs or dividends. Understanding this area can be imperative to growth strategies or preparing for adversity.

One attribute observed among champions is continual improvement. The stronger business has a plan for improvement with key strategies and actions.

Transition is always on any champion business or athletic teams’ radar. Injuries, changing goals and motivations of players, and retirements are a fact of life in sports. Teaching the culture to the new players is critical for an athletic team, but also for a business to ensure continuity of culture.

A strong business often has a plan for education and development. Education is a key area that is imperative in today’s fast-paced information environment. Development entails personal growth of individuals in the business.

Finally, the difference maker is the attribute of the intangible, often discussed in the book Good to Great by Jim Collins and The One Minute Manager by Ken Blanchard and Spencer Johnson. Being proactive, having a positive attitude, staying engaged and exhibiting discipline and commitment are critical elements to success in many of the aforementioned factors.

Business IQ is being proven in today’s world of tight margins. Business lenders and consultants expressed this sentiment during a recent seminar. One of the business consultants said that young producers were actually weathering the current economic cycle much better than the older, high-equity producers. After digging deeper, the difference makers were the business and financial IQ, ability, flexibility, adaptability and innovativeness of the younger generation.

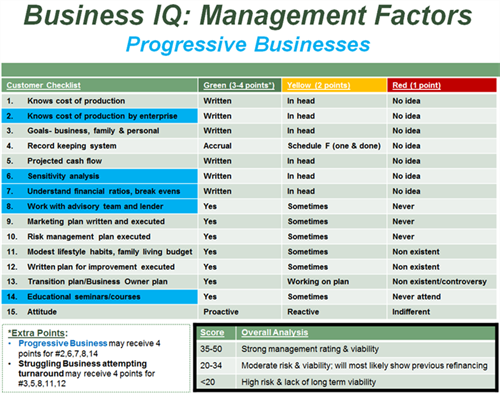

The following chart has been developed to assess your financial and business IQ. Please note that extra points are given in certain areas for high-level performers. On a humorous note, a score of one can be earned at the lowest level. Of course, in today’s environment, everybody gets a trophy. A score of 32 can be considered good, while the elite managers will score above 40. What is your business and financial IQ? Are you up for the challenge?

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe