The Wall Street Economist

The Wall Street Economist

Dr. Edmond J. Seifried

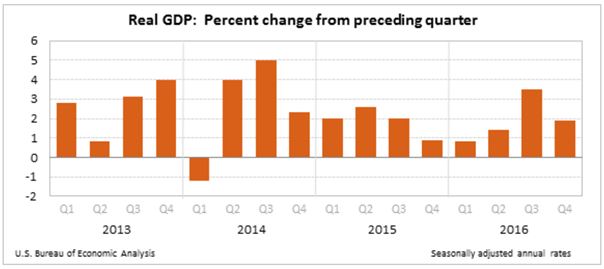

The Bureau of Economic Analysis (BEA) recently announced the Real Gross Domestic Product (GDP) for the final quarter of 2016. The results announced were not good, but were fully expected. In this so-called advanced estimate of the nation’s output of goods and services – the first of three estimates to be released over the coming months – the quarter-over-quarter growth rate dropped dramatically from 3.5% in the third quarter to 1.9% in the fourth quarter of 2016.

The BEA announced the reasons for the positive, albeit modest growth in GDP from the third to the fourth quarter. The BEA explains how some factors contributed to growth but were offset by negative growth factors. According to the BEA, the increase in real GDP in the fourth quarter reflected positive contributions from consumer spending, higher inventory investment, more housing starts, more business investment in plant and equipment, and state and local government spending. These positive contributors were partly offset by negative contributions from falling exports and federal government spending. Imports, which are a subtraction in the calculation of GDP, were higher in the quarter.

The BEA also posited the reasons why the fourth quarter performance was so much worse than the third quarter’s: “The deceleration in real GDP in the fourth quarter reflected a downturn in exports, an acceleration in imports, a deceleration in PCE, and a downturn in federal government spending that were partly offset by an upturn in residential fixed investment, an acceleration in private inventory investment, an upturn in state and local government spending, and an acceleration in nonresidential fixed investment.” The chart below captures the bad news.

A quick look at annual rates of growth in the GDP reveals similar results. While the annual growth rate of GDP in 2015 was a respectable if not tepid 2.4%, the 2016 annual rate of growth dropped significantly to 1.6%. How can this decline be explained?

The increase in real GDP in 2016 reflected positive contributions from consumer spending, increases in housing starts, higher federal, state and local government spending, and stronger exports. These gains were partly offset by negative contributions from reduced investment in plant and equipment. Imports (which are a subtraction in the calculation of GDP) increased, further limiting economic growth.

Dr. Ed Seifried is Chief Economist and Strategic Advisor at BNK Advisory Group. He is also professor of economics and business at Lafayette College in Easton, PA, and a faculty member of numerous graduate banking schools, including Stonier Graduate School of Banking and the Graduate School of Retail Bank Management. He also serves as dean of The West Virginia and Virginia Banking Management Schools. Dr. Seifried is a nationally recognized speaker and is the author of both academic and popular articles and books. He is the co-author of BNK's Art of Strategic Planning in Community Banks and The Art of Risk in Community Banks, a series for the committed bank director. He holds his doctorate in economics and business from West Virginia University.

© Northwest Farm Credit Services 2017

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe