Economic Update Quarterly

Economic Update Quarterly

Lawry Knopp, VP-Funding & Hedging

Market Summary

The primary factors impacting markets include economic fundamentals (growth, inflation and employment), fiscal and monetary policy and COVID-19 developments.

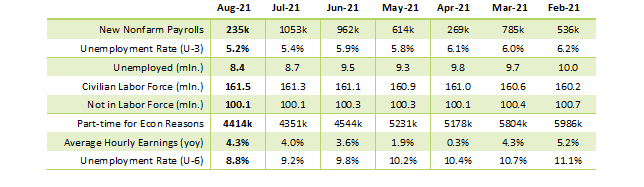

- Economic reports have been supportive of continued growth for the second half of this year, albeit at a slower pace than projections from a few months ago. Q3 and Q4 GDP growth is expected to be around 5%, as the surge in COVID-19 cases is a drag on consumer spending and housing activity remains sluggish. The economy is expected to continue losing momentum in 2022 with GDP expanding by 3%-4% for the first half of the year followed by 2.5%-3.5% growth for the second half. The employment report for August was a mixed bag with new payrolls increasing by 235,000, falling short of expectations for a gain of nearly 900,000. Meanwhile, the unemployment rate declined to 5.2% from 5.4% as the labor sector gradually improves.

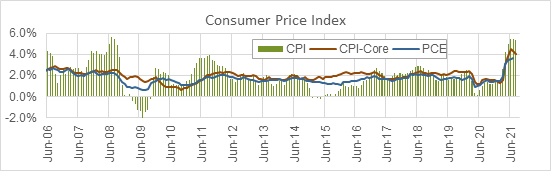

Year-over-year consumer inflation remains elevated but there are signs that pressures are easing, which may be due to price decreases for some pandemic-related items while the full impact from higher housing and wage costs have likely not been fully realized. Furthermore, supply constraints remain a reality for many businesses. The Consumer Price Index is expected to move down to the 2.5%-3.5% range next year. This may seem more manageable but at 3% that’s still about twice the current 10-year Treasury yield. Markets may find it difficult contending with persistent negative real interest rates, tighter credit spreads and high equity valuations. This implies markets believe the inflation rate will be closer to 2% than 3% over the medium-term. - Fiscal policy remains in the news as the Biden administration seeks passage of legislation that would spend $3.5 trillion over the next 10 years. The process for drafting the far-reaching social policy and climate change bill has gotten under way as key House committees begin work on their respective pieces of the law. Look for the Senate to bypass the 60-vote threshold normally used to approve major legislation and use budget reconciliation, which allows legislation to pass with a simple majority vote. The spending bill is expected to include higher personal and corporate taxes.

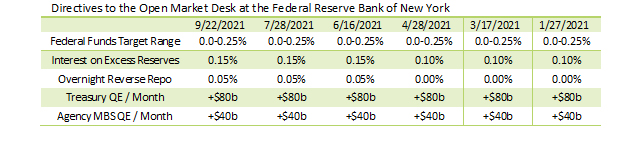

The 2-year suspension in the Federal debt ceiling expired on July 31. Treasury Secretary Janet Yellen has informed lawmakers that cash and the “extraordinary measures” taken to finance the government temporarily will be exhausted later this month. Recent sales of 4-week and 8-week T-bills have received mixed levels of demand as traders and investors await passage of legislation to increase the debt cap. Up to this point, volatility in short-term rates has been minimal. - The Federal Reserve left monetary policy rates unchanged as it wrapped up the Sept. 21-22 Federal Open Market Committee meeting. The policy statement indicated policymakers would taper its $120 billion in monthly quantitative easing bond purchases “soon” and Chairman Jerome Powell said he would need to see just one more good jobs report to convince him the economy is ready for the removal of this stimulus. The central bank then wants to be finished with its QE purchases by mid-2022, with a rate hike following possibly in late 2022 or early 2023. The FOMC is scheduled to meet in November and December. Look for an announcement on reducing QE from either meeting.

- The CDC is reporting the highly transmissible Delta variant (B.1.617.2, AY.1, AY.2, AY.3) continues to spread across the United States, albeit at a slightly slower pace. As of Sept. 29, the 7-day moving average for new cases was 106,395, down from the recent high of 160,218 on Sept. 1. Furthermore, the total number of fully vaccinated individuals 12 and older is nearly 185 million, or 65%. For persons 65 and older, nearly 84% have been fully vaccinated. Mask mandates and social distancing requirements are in effect in many regions while the effort to require vaccinations to return to work is gaining traction.

The surge in the Delta variant and reinstatement of virus mitigation requirements clouded the growth outlook for the U.S. economy and raised concern consumers may slow spending. Forecasters do not believe the spread of the virus will be a major blow to the economy as businesses and consumers have shown the ability to adapt to previous surges in the virus. However, the economy remains sensitive to the ebb and flow of the pandemic as we head into fall and winter holiday gatherings.

Interest Rates Review

| U.S. Treasury Yields |

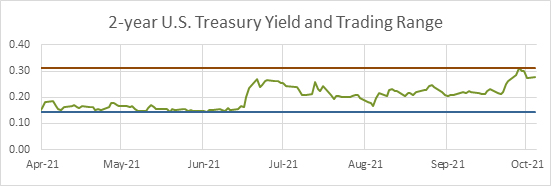

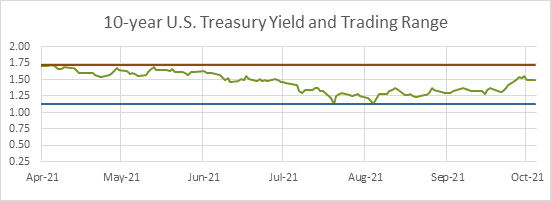

With Federal Reserve monetary policy expected to be on hold for the next 12-24 months, look for the 2-year U.S. Treasury yield to remain below 0.4% for 2021 and the first few months of 2022 with the potential for the top of the trading range to increase to 0.6% by late 2022. The current yield is near the top of the 6-month trading range of 0.14%-0.31%. As fiscal and monetary stimulus eclipse all previous policy efforts, the range for the 10-year Treasury yield is much wider at 1.14%-1.73%. If inflation expectations ease, the yield could remain near the middle of the 10-year trading range for some time. |

|

|

|

Economic Highlights

| Economic Growth |

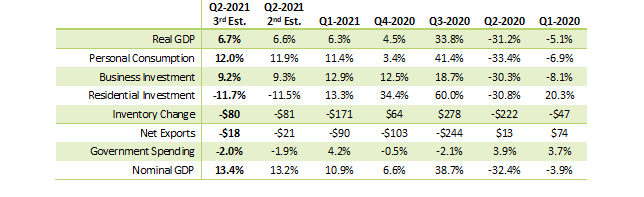

Gross Domestic Product: The final reading of Q2-2021 GDP indicated minor edits from the Second Estimate, which resulted in a 0.1 percentage point increase to 6.7% economic activity for Q2. Strong consumer and business spending was offset by weakness from the housing sector. Near the end of the month, we’ll get our first look at Q3 GDP, which is expected to show the economy was starting to lose momentum in the second half of the year. With many fiscal benefits programs ending and the delta variant causing continued uncertainty for many businesses, the rate of expansion may have slipped to the 5%-6% range for Q3. Overall, the report still suggests decent growth for the medium-term while President Biden and Congress seek to pass more fiscal stimulus spending. Look for GDP growth to average around 5% for the second half of the year with 2022 GDP around 4% |

| Consumer Inflation |

Consumer Price Index: Core CPI, which excludes volatile food and energy components, came in a touch lower-than-expected for the second month in a row in August. Public transportation prices, led by a drop in airfares, fell sharply. Vehicle prices, a source of significant upside over much of late 2020 and early 2021, were mixed with used car prices lower but new car prices higher due to continued slow production amid semiconductor shortages. Housing accounts for 40% of total CPI and just over half of Core CPI, with Owner's Equivalent Rent (OER) dominating the category. While OER was a touch cooler in August at 0.3% the trend is still accelerating moderately, up 3.5% annualized in the last three months vs. 3.3% and 2.6% in the last six and 12 months, respectively. Based on historical time lags, most of the impact from higher single-family home prices won't be felt until early 2022 CPI readings. While this is good news for the "transitory" theme suggesting most of the inflation pressures over the last year would prove one-off, this report does little to change the likely trajectory of Fed policy. Looking through the volatility of pandemic-related categories, there are plenty of indications that core CPI components will likely continue to run above the Fed's 2% target.

|

| Employment |

Payroll employment rose much less than expected as leisure and hospitality hiring were nearly flat, likely impacted by the delta variant and a slowdown in restaurant activity. Professional and business service and manufacturing jobs led gains. The number of unemployed fell by 318,000 as household employment grew by 509,000 while the labor force increased by 190,000. The result was a 0.2% decline in the unemployment rate to 5.2%. Hourly earnings rose more than expected, mostly due to the composition of the job gains skewing away from the lower-paying leisure and hospitality sector. Despite the weaker payrolls number, the report was not as bad as the headline, with modest upward revisions and difficult seasonal adjustments in public education jobs. Looking through the volatility, payroll gains have still averaged 750,000 over the last three months, the unemployment rate has dropped 0.6% to 5.2%, and average hourly earnings have accelerated to a 5.7% annualized rate.

|

| Monetary Policy |

At the conclusion of the Sept. 21-22 Federal Open Market Committee meeting, policymakers decided to keep the target range for the federal funds rate at 0.00-0.25%. Monetary policy rates are expected to be relatively unchanged for the next 12-24 months. The Fed’s dual policy mandate of stable prices and maximum sustainable employment will remain the focus for policymakers. The Fed released its Summary of Economic Projections which moderated the outlook for GDP growth for 2021 and lifted the forecast for 2022 and 2023. The unemployment rate is projected to move below 4% next year, settling in around 3.5% in 2023. Core PCE (personal consumption expenditures) inflation is expected to drop below 3% from its current 3.6% level sometime next year, moving down to the 2%-2.5% range in 2023. The shift in the “dot plot” signaled a more hawkish tone as a few more Committee members moved up their timing for the first increase in policy rates. The Committee is now evenly split between a 2022 and 2023 timeframe for lift off.

The Open Market Desk at the Federal Reserve Bank of New York was further directed to roll over at auction all principal payments from Fed holdings of Treasury securities and reinvest all principal payments from holdings of agency debt and agency MBS. This action keeps past rounds of QE in place. Total assets of the Federal Reserve now amount to $8.5 trillion. |

View on Interest Rates

Look for the Fed to keep policy rates at the current level until late 2022 or early 2023. Look for the pace of consumer inflation to slow over the coming months, coinciding with the Fed’s view that the current runup in inflation is transitory. The FOMC will continue to focus on providing support to the financial markets through purchases of Treasury and agency mortgage-backed securities at a rate of $120 billion per month and extremely low policy rates. Although, QE purchases will likely be trimmed over the coming months.

The 2-year yield will likely remain below 0.4% for the rest of 2021. As economic recovery continues, look for the 2-year yield to move about 0.4% in early 2022 and possibly reaching 0.75% by the end of 2022 as the market anticipates higher policy rates. The 10-year yield trading range is expected to be 1.2%-2% for the next two to three quarters. If the equity markets were to experience a sell off, flight-to-safety trading could push U.S. Treasury yields lower and the dollar higher. Signs of an overheating economy or accelerating inflation would likely send Treasury yields higher, which may present new and more difficult challenges for the Fed.

Northwest FCS has been able to meet customer needs through the challenges of the COVID-19 pandemic and expects to continue doing so as people deal with the dynamics of the virus. The association remains watchful for potential threats that may arise as government officials work to mitigate the effects of the virus and keep people safe.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe