Economic Update Quarterly

Economic Update Quarterly

Lawry Knopp, VP-Funding & Hedging

- Longer-term U.S. Treasury yields are up nearly 100 basis points over the past six months, while the major U.S. equity indexes have set multiple record highs. With the Federal government adding $2.8 trillion in fiscal spending to the economy over the last five months and planning to add an additional $2-3 trillion more, the growth outlook has improved significantly. Furthermore, there has been a significant decline in the number of COVID-19 cases since January, eased restrictions, increased mobility and progress on vaccinations, all of which are providing a boost to the growth outlook. GDP growth for 2021 is expected to be around 6%, which would be the strongest reading since 1984. However, the economic boom will likely be temporary as the effects of government spending start to fade in 2022 and 2023. In addition, the largest tax increase in nearly 40 years is expected to be implemented in 2022.

- Short-term interest rates have remained very low, as Federal Reserve officials have said monetary policy rates and other measures will continue despite projections for a runup in inflation. Policymakers view the expected increase in inflation as transitory and further believe the massive increase in government spending is necessary for the economy to achieve full employment within a couple of years. Look for the Fed to maintain policy rates at current low levels and continued quantitative easing purchases for the next 18-24 months as the central bank works to support stronger economic growth, full employment and sustained inflation of 2%-2.5%.

- Businesses made the transition to working from home and other remote operation protocols. As more people are vaccinated, employees returning to the office may bring new challenges and disruptions.

Interest Rates Review

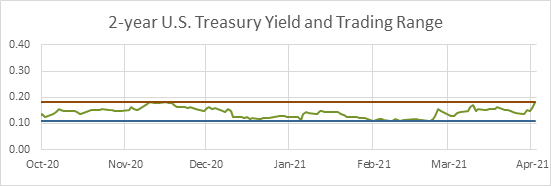

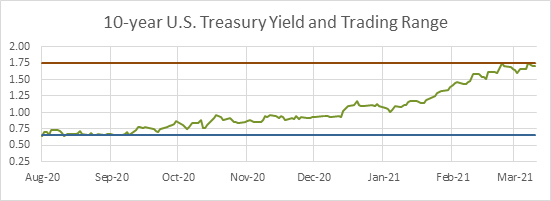

| U.S. Treasury Yields | With Federal Reserve monetary policy expected to be on hold for the next 18-24 months, look for the 2-year U.S. Treasury yield to remain below 0.40% for 2021 with the potential for the top of the trading range to increase to 0.50% during 2022. The current yield is near the top of the six-month trading range of 0.11%-0.18%. As fiscal and monetary stimulus eclipse all previous policy efforts, the range for the 10-year Treasury yield is much wider at 0.65%-1.75%. Look for the 10-year trading range to trend higher with the upper bound potentially breaking above 2% later this year on the prospect for stronger economic growth and higher inflation. |

| |

|

Economic Highlights

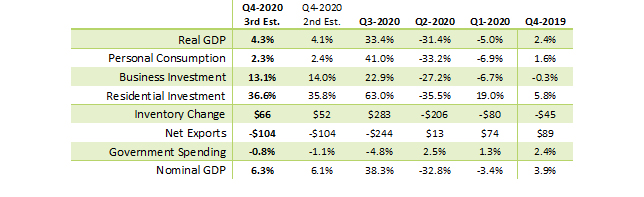

| Economic Growth | Gross Domestic Product: The third estimate revised the Q4-2020 GDP higher by an increase in inventories late in the quarter, while consumption growth was a touch slower. Manufacturing and housing continued to lead the recovery. However, it may be difficult for these two sectors to sustain the rate of growth, which means it will be critical for consumer spending to accelerate in the coming months. Net exports and government spending were a modest drag. Overall, the report suggests solid growth for the medium-term with risks to the economy being modest as the government remains committed to more fiscal stimulus.

With $2.8 trillion in fiscal spending already in the pipeline look for Q1-2021 GDP to be around 5% and nearly 10% for Q2-2021. The Biden Administration is expected to propose $2-3 trillion in additional spending focused on infrastructure, climate change and support for social programs. Provided the additional spending is passed by Congress later this year, look for 2022 to experience 4%-6% economic growth. Experts are also expecting President Biden to approve the largest tax increase in decades, which will likely include increases in corporate and personal taxes, and new social taxes. Growth in 2023 may slow as fiscal policy tailwinds start to fade and headwinds form. |

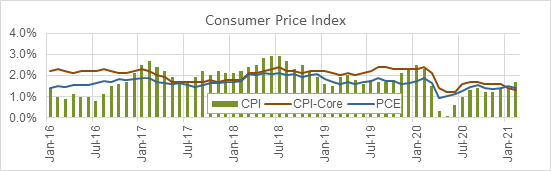

| Consumer Inflation | Consumer Price Index: Consumer inflation for February rose by 0.4% month-over-month while core consumer price inflation increased 0.1%. There was a modest increase in food prices, up 0.2% while gas prices continued to climb, up 6.4%. Compared to a year ago, overall inflation is up 1.7% with food prices up 3.6% and gas prices up 1.5%. Core inflation, which excludes food and gas components, is higher by 1.3%. Housing and other costs have yet to register much of an increase with the services subindex up 1.3% year-over-year. While there have been pockets of inflation related to shifting demand during the pandemic, the trend shown in the chart below indicates inflation has been limited.

|

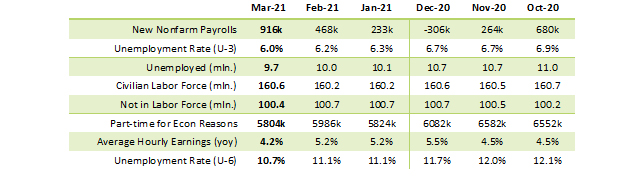

| Employment | U.S. employment improved as nonfarm payrolls for March expanded by 916,000. The unemployment rate fell 0.2% to 6% as household employment expanded more than the labor force. Year-over-year (yoy) average hourly earnings remain strong but will likely trend lower as more states ease COVID-19 mitigation restrictions and leisure and hospitality workers return to work. Look for the jobless rate to gradually improve in 2021, potentially trending down to 5.2% by year-end.

|

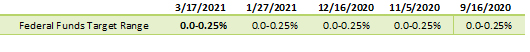

| Monetary Policy | At the conclusion of the March 17th Federal Open Market Committee meeting, policymakers decided to keep the target range for the federal funds rate at 0.0%-0.25%. Monetary policy rates are expected to be relatively unchanged for the next 18-24 months as the Fed operates under its new “flexible average inflation targeting” (FAIT) regime. The Fed’s dual policy mandate of stable prices and maximum sustainable employment will remain the focus for policymakers. The Fed lifted its forecasts for growth and inflation and lowered the projections for unemployment. The market was intrigued with the “dot plot” graph, which showed several committee members moved up their timing for the first increase in policy rates, which Fed Chair Jerome Powell subsequently downplayed indicating the dots were forecasts only. Chair Powell continued to signal that monetary policy would remain accommodative until inflation is consistently above 2%.

|

View on Interest Rates

Look for the Fed to keep policy rates at the current level until 2023, provided inflation remains within the Fed’s new strategic framework. The expected increase in inflation over the next several months will likely be tolerated if it falls within the Fed’s new average inflation targeting regime and policymakers believe the uptick is temporary. The FOMC will continue to focus on providing support to the financial markets through purchases of Treasury and agency mortgage-backed securities at a rate of $120 billion per month. If longer-term Treasury yields continue to move higher, this may present new and more difficult challenges to the Fed’s desire for yields to remain low.

The 2-year yield will likely remain below 0.40% for most of 2021. The 10-year yield trading range is expected to be 1.20%-2.20% for the next two to three quarters. If the equity markets were to experience a sell off, flight-to-safety trading could push U.S. Treasury yields lower and the dollar higher.

Market volatility has subsided over the past several months as the U.S. economy and markets seek a return to normal operations. The threat to the economy has subsided as the Federal government pumps substantial amounts of fiscal stimulus into the economy. Northwest FCS has been able to meet customer needs through the challenges of the outbreak and expects to continue doing so as people deal with the dynamics of the virus. The association remains watchful for potential threats that may arise as government officials work to mitigate the effects of the virus and keep people safe.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe