Northwest FCS News

Federal Open Market Committee (FOMC) Meeting Results

FOMC Hightlights

Fed pledges to use full range of tools to assist the economy. Fed does not change rates - keeps interest rate range at 0.0% - 0.25%.

Fed claims that progress on Covid vaccinations have helped, and the economy is much stronger because of it.

The Federal Reserve announced that it would be ready to reduce the purchases of security soon. However, it will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals.

Fed claims recent inflation is transitory!

- “With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen.

- The sectors most adversely affected by the pandemic have improved in recent months, but the rise in COVID-19 cases has slowed their recovery.

- Inflation is elevated, largely reflecting transitory factors.

- Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

- • The path of the economy continues to depend on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy but risks to the economic outlook remain.”

- “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.

- With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent.

- The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.

- The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.

- Last December, the Committee indicated that it would continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward its maximum employment and price stability goals.

- Since then, the economy has made progress toward these goals. If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.

- These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

- In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook.

- The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals.

- The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

- The Board of Governors of the Federal Reserve System voted unanimously to maintain the interest rate paid on reserve balances at 0.15 percent, effective September 23, 2021.

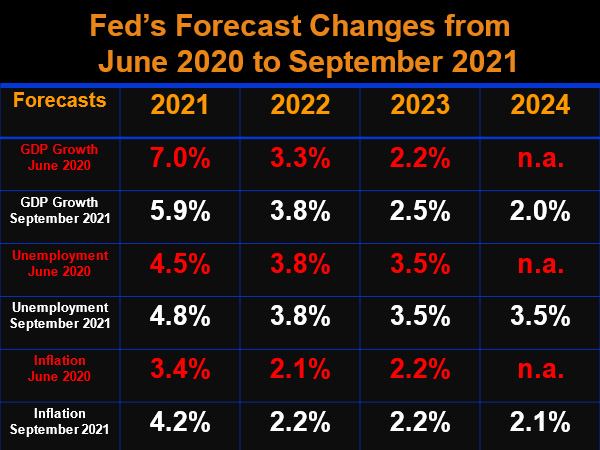

The FOMC’s most recent Economic Projections have changed.

- The new Fed forecast indicates that GDP growth in 2021 will be lower than previously forecasted. The new growth rate is forecasted to be 5.9% compared to the earlier forecast of 7.0%.

- The new unemployment forecast shows that unemployment will remain elevated through 2022 but return to the pre-pandemic rate of 3.5% by 2023.

- The biggest change in the new forecast is on the inflation front. The latest forecast shows over-all Personal Consumption Expenditure (PCE) Index increasing in 2021 to 4.2% compared to the earlier forecast of 3.4%.

- More importantly, The Fed’s newest forecast shows the inflation rate in 2022 to be 2.2% up modestly from the previous forecast of 2.1%. Fed officials have said all along that they believe the current inflation is only transitory, and their 2022 and 2023 forecasts on inflation reflects that view.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

###

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe