Executive Summary

Drivers for the fisheries industry include strong market and resource conditions and rising input costs.

- Prices across all fish types are strong, especially pollock.

- Harvest levels and fish sizes across active fisheries are strong to stable.

- Snow and king crab survey estimates show low abundance of mature males and females.

- Rising input costs are starting to pressure margins and increase the cost to repair and build vessels.

12-Month Profitability Outlook

Northwest FCS’ 12-month outlook foresees fisheries being profitable. Solid harvest levels are being met with strong market demand and pricing across nearly all fisheries except snow and king crab. The season’s salmon run was successful, and Bristol Bay experienced a record catch. While not a major concern yet, rising input costs are starting to pressure margins and raise the cost to repair and build vessels.

Salmon

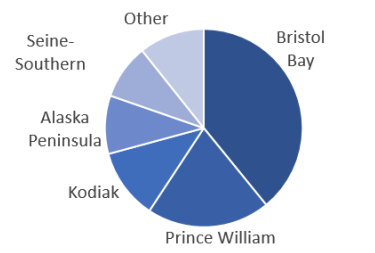

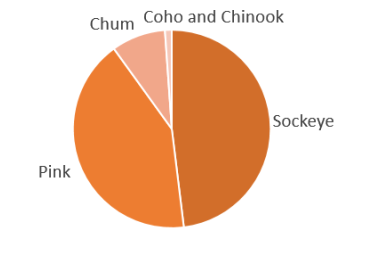

The preliminary salmon harvest estimate is 152.8 million fish, slightly below the forecast 161 million but still strong for an even year (which generally experiences smaller catches) and 11% above the five-year average. Bristol Bay experienced a record season with a 60.5 million fish catch. The sharp influx briefly led to warehousing and transportation bottlenecks in July, but they have since resolved. Despite marketing efforts to promote fresh fish sales at retail stores, the majority will end up processed into frozen and canned products. A large catch is coinciding with strong demand and prices.

Salmon Harvest by Fishery

Salmon Harvest by Species

Source: Alaska Department of Fish and Game, as of September 21, 2022

Alaskan Pollock

Demand for U.S. pollock is strong largely due to pandemic induced changes to consumer behavior, USDA’s purchase of 17.6 million tons to support food banks, lower Russian supply (resulting from sanctions and efforts to modernize their trawler fleet and supply domestic markets) and increased use as imitation crab (response to record high crab prices in 2021 and early 2022). Producers are processing fish for high-value products and consequently, surimi production is decreasing despite strong demand. Favorable market conditions are coinciding with robust fish sizes and allowing for greater price premiums. Gulf of Alaska fall fisheries remain open through November 1.

Halibut and Sablefish

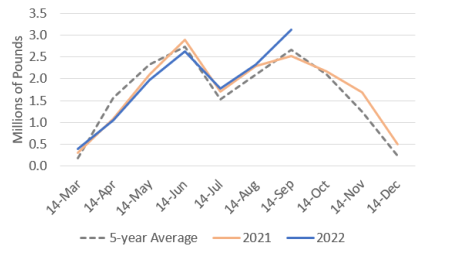

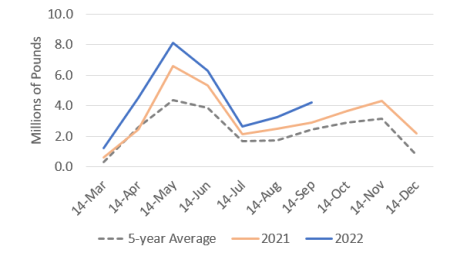

As of September 21, halibut and sablefish fisheries are 69% and 56% through their respective 2022 total allowable catches (TAC), both of which were increased significantly from 2021. Prices and fish size are favorable.

Halibut Landings, Season to Date

Sablefish Landings, Season to Date

Source: NOAA Fisheries Catch and Landings Reports in Alaska

Alaskan Crab

Recent National Oceanic and Atmospheric Administration Fisheries’ survey data showed the following:

- Snow Crab – Mature male and female estimates are down 22% and 33% from 2021 levels, but significant increases in immature populations were observed.

- Bristol Bay King Crab - Male and female populations increased from 2021 levels but remain historically low across all size classes.

Other Market Considerations

Input costs continue to rise across the industry and while not a major concern yet, they are starting to impact margins and increase the cost to maintain and repair vessels. The price of new vessels is also increasing rapidly and incentivizing fishermen to keep older ships in service longer than expected.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

Additional Information

www.northwestfcs.com/Resources/Industry-Insights

Learn More

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe