Meeting Date: Dec. 13-14, 2022

Federal Open Market Committee (FOMC) Meeting Results

FOMC meeting highlights:

1. The Fed increased its Target Fed Funds rate by 0.5%. The new Fed Funds Target range is now 4.25-4.50%.

2. Similar to the Nov. 1-2, 2022 meeting, this meeting’s vote was unanimous!

3. The FOMC, which began to shrink its securities portfolio on June 1, 2022, announced it will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that it announced at the May 2022 FOMC meeting.

4. The Committee emphasized that it is strongly committed to returning inflation to its 2% objective.

Economic Highlights:

Economic activity continue to weaken, and inflation remains too high!

• “Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low.

• Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

• Russia's war against Ukraine is causing tremendous human and economic hardship. The war and related events are contributing to upward pressure on inflation and are weighing on global economic activity.

• The Committee is highly attentive to inflation risks."

Announcements:

Fed funds rate increased. Fed funds range raised by 0.50% to a new range of 4.25% to 4.50%, and balance sheet reductions continue.

• “The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run.

• In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4.25% to 4.5%.

• The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.

• In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial

developments.

• In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued

in May.

• The Committee is strongly committed to returning inflation to its 2% objective.”

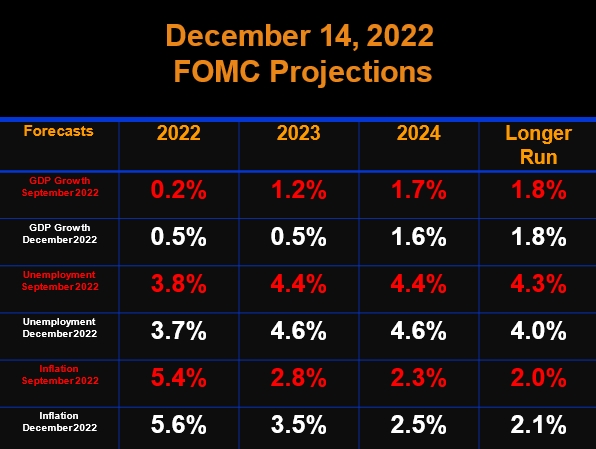

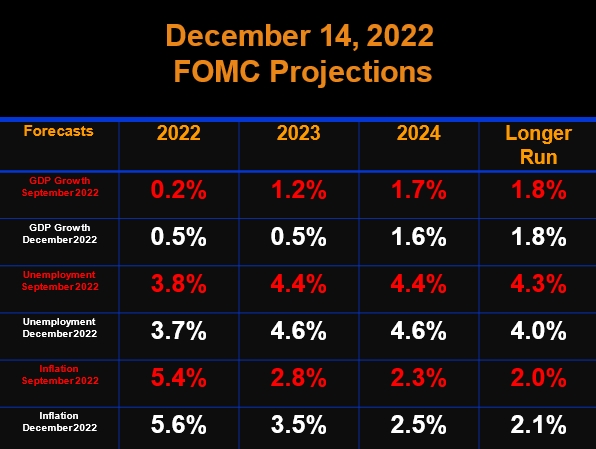

Fed’s New Economic Projections:

The FOMC’s most recent Economic Projections have changed. See the changes in the chart below.

Voting Results: No dissenting votes

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lael Brainard; James Bullard; Susan M. Collins; Lisa D. Cook; Esther L. George; Philip N. Jefferson; Loretta J. Mester;

and Christopher J. Waller.

Next Meeting: Jan. 31 - Feb. 1, 2023