Executive Summary

Drivers in the sugar beet industry include lower beet production and input cost uncertainties.

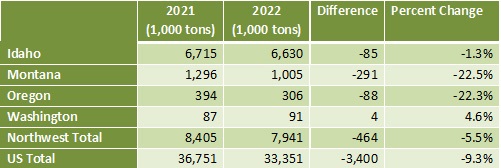

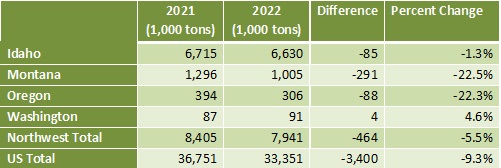

- Favorable summer weather has improved beet growth after planting delays of two to three weeks. Northwest beet production is forecasted to decline from a record 2021-22 crop of 8.4 million tons to 7.9 million tons, down 5.5% year over year.

- Montana had 10,000 fewer beet acres compared to 2021, a 23% decrease caused by contract negation setbacks and brutal weather conditions that impeded planting.

12-Month Profitability Outlook

Northwest Farm Credit’s 12-month sugar beet outlook for the 2022 crop is favorable with profitable prices, yields and sugar content. Looking ahead to 2023, uncertainty around elevated fertilizer and chemical costs will weigh on producer profitability.

Northwest Situation

After record production for the 2021-22 sugar crop, the 2022-23 Northwest crop is expected to have average yields and sugar content. Producer sentiment is more optimistic as favorable summer weather offset initial planting delays, transforming the overall crop outlook. Total beet production in the Northwest is forecasted down 5.5% year over year, due to lower yields and less acres harvested.

In Idaho, sugar beets are progressing well with little insect or disease pressure. Idaho is expected to have yields of 39 tons per acre, only 1 ton per acre less than the five-year average.

In eastern Montana, late spring rains and contract negotiations delays caused many producers to plant fewer beet acres. In Sidney, ideal planting time is mid-April, but weather delayed planting until May 10, reducing beet acres from 30,000 acres in 2021 to 18,500 acres in 2022. Reductions in planted acres also decreased harvested acres, down 23% year over year.

Growers in Sidney faced additional challenges as heavy rainfall caused sugar beets to crust (when rains disturb the topsoil creating a surface soil seal which blocks seed emergence). While there was little damage to the crop and replants were minimal, farmers had to break up the soil (crust bust) 70% of the planted acres. In June, temperatures rose to an average of 72°F and the rain subsided, kick starting more favorable weather for the growing season which allowed beet growth to catch up.

In Billings, Montana summer hailstorms damaged fields causing estimated tonnage to decline 3-4 tons per acre. Producers started harvesting in early September and even with decent weather, processors will have less beets. The Billings area is anticipating average levels of sugar content.

Sugar Beet Production

Source: Crop Production Report. Sept. 12, 2022

Cost of Production

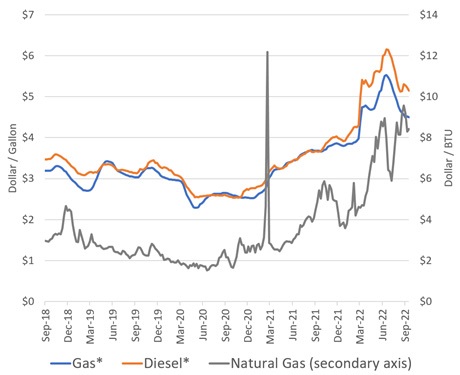

Sugar beets require significant amounts of fertilizer. The price of nitrogen fertilizer is up 114% year over year. Likewise, phosphate and potash fertilizer prices are up 68% and 101% year over year, respectively. Rising natural gas prices, up 125% year over year, have caused European fertilizer plants to stop production and two-thirds of global ammonia production has been halted. Uncertainty surrounding fertilizer prices will weigh on sugar beet profitability in 2023.

U.S. Sugar Forecasts

Source: U.S. Energy Information Administration. Sept. 23, 2022.

*West coast prices, except California

U.S. Situation

The Red River Valley is the largest sugar beet production area in the U.S., growing over 55% of all national acres. A cold, wet spring and flooding delayed beet plantings in the Red River Valley by three to four weeks. To mitigate anticipated lower yields, beet factories contracted more acres in Minnesota and North Dakota where total acreage increased 11% and 12% year over year, respectively. Increased acreage and favorable summer weather helped but were not enough to fully offset forecasted yield reductions (down 17% for Minnesota and 13% for North Dakota year over year). However, these factors did mitigate the impacts on sugar beet production. Without the additional acreage production would have fallen 2,903 short tons, raw value (STRV), a 15.5% year over year decline. The 2022-23 Minnesota and North Dakota beet crop is estimated to decline by only 1,100 STRVs, down 6.0% from last year’s crop.

Outside of the Red River Valley, other beet production areas in the U.S. are anticipating lower yields and fewer acres harvested. After the 2021-22 crop set production records it isn’t surprising that year over year yields would be lower for the new crop. Michigan, Nebraska, and Colorado all are estimated to have annual yield reductions of more than 15% year over year. While the 2022-23 national beet crop production is forecasted at 33,351 STRVs, down 9.3% from the 2021-22 crop, production estimates are comparable to the 2020-21 crop.

U.S. Sugar Forecasts

Source: World Agricultural Supply and Demand Estimates. Sept. 12, 2022. *STRV= Short Tons, Raw Value.

Mexico Sugar Forecast

Sugar production in Mexico for 2022-23 is projected to decrease 3.0% year over year. Exports to the U.S. are forecast to be 19.4% lower. The USDA determined the import quotas should be reduced in September due to higher inventory and expected declines in sugar consumption. Of the 118,000 tons of sugar not exported to the U.S. (due to changes in quota), Mexico is expected to redirect to other countries. Some sugar analysts believe this estimated reduction is too conservative and will likely increase to more than double the current estimate by the end of the marketing year. Ending stocks are unchanged as Mexico’s total supply is down 4.0% and usage is also down 4.6%.

Mexico Sugar Supply and Use and High Fructose Corn Syrup Imports

Source: World Agricultural Supply and Demand Estimates. June 10, 2022. *MTRV = Metric Ton, Raw Value

Additional Information

Northwest FCS Business Management Center

NWFCS Industry Insights

American Crystal Sugar Company

www.crystalsugar.com

American Sugar Alliance

www.sugaralliance.org

American Sugarbeet Growers Association

www.americansugarbeet.org

The Sugar Association

www.sugar.org

USDA Sugars & Sweeteners Briefing Room

www.ers.usda.gov/topics/crops/sugar-sweeteners/

Western Sugar Cooperative

www.westernsugar.com

Learn More

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit NWFCS Subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe