Executive Summary

Drivers for the soybean industry include a smaller domestic crop, weakening prices, and pressure from South America.

- Soybean production declined to 4.38 billion bushels for the 2022-23 crop.

Argentina incentivized mass soybean sales and softened global soybean prices from record highs. South America is gearing up for a record crop. Despite these headwinds, U.S. soybeans will remain profitable.

Supply/Demand

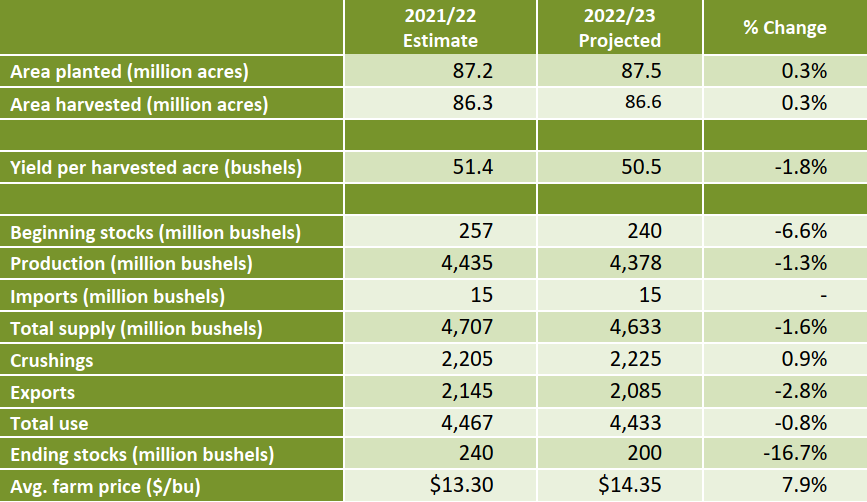

U.S. soybean harvest started Sept. 18 with 55% of the soybean crop in good or excellent condition. The USDA estimates the 2022-23 crop to be 4.38 billion bushels, down 1.3% from the 2021-22 crop. Ending stocks declined year over year based on lower beginning stocks, yields and production.

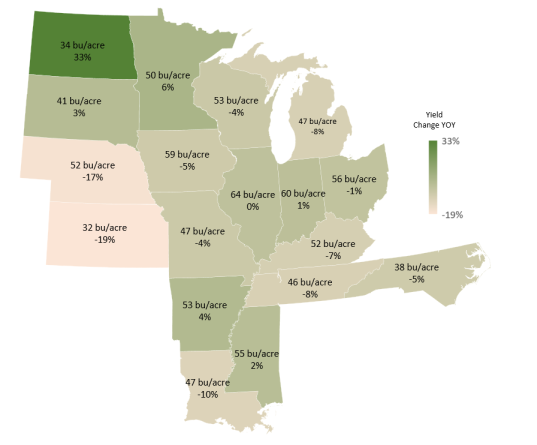

U.S. soybean production was reduced due to losses in the Eastern Corn Belt and Central Plains. Both regions experienced multiple headwinds of late planting followed by excessive heat with little rain. Only two of the major corn growing regions, the Delta and Northern Plains, had modest annual production increases (25 and 2 million bushels, respectively). The USDA projects national soybean yields of 50.5 bushels per acre, down 1.8% from 2021.

U.S. Soybean* Yields and 2021 vs 2022 Year over Year Change

U.S. Soybean* Production (in million bushels) and 2021 vs 2022 Year Over Year Change

-and-2021-vs-2022-year-over-year-change.png?sfvrsn=eddebff0_1)

*Selected 18 states account for 96% of soybean production in 2021.

Source: World Agricultural Supply and Demand Estimates. Sept. 12, 2022.

Prices

Soybean prices are softening. The USDA’s forecasts the 2022-23 crop average price at $14.35 per bushel, $0.35 per bushel lower than July’s forecast. November soybean futures have been volatile, reaching highs of $15.82 per bushel in early June before falling more than $2.30 at the end of July. Futures prices have settled in the $13.75 to high $14 range since August.

International

The government of Argentina raised soybean exchange rates to 200 Argentina peso per U.S. dollar, a 60 peso per U.S. dollar increase. Their goal was to incentive farmers to sell soybeans in storage and replenish Argentina’s foreign currency reserves. The policy worked. Within the first week, Argentina’s soybean sales grew 7x to 2.1 million tons of soybeans (4.7% of the 2021-22 crop sold in a week).

Additional Information

Northwest FCS Business Management Center

www.northwestfcs.com/ag-industries/industry-insights

CoBank Knowledge Exchange

www.cobank.com/Knowledge-Exchange

Agricultural Marketing Resource Center

www.agmrc.org

Energy Information Administration

www.eia.doe.gov

The National Biodiesel Board

www.biodiesel.org

USDA Economic Research Service

www.ers.usda.gov/topics/crops/soybeans-oil-crops

USDA World Agricultural Supply and Demand Estimates

www.usda.gov/oce/commodity/wasde

Learn More

For more information or to share your thoughts and opinions, contact the Northwest FCS Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe