Executive Summary

Drivers for the pear industry include a 2022-23 crop with good quality and size profile, stable demand and prices, persistently high input costs and rising inflation

- The first 2022-23 season crop estimate was 16.2 million boxes, which is near the five-year average.

- Early reports suggest crop quality is strong and while the average fruit size is slightly down, the range of sizes available (crop profile) is favorable.

- High input costs continue to pressure margins and consumer preferences may change due to inflation.

12-Month Profitability Outlook

Northwest FCS’ 12-month profitability outlook anticipates slight profits for growers. The 2022-23 crop estimate came in similar to last season and early reports suggest good quality and a favorable, albeit slightly smaller than average, size profile. Marketing strategies continue to evolve to meet changing consumer preferences. Input costs remain significantly above prepandemic levels and are pressuring margins. Inflation is eroding consumer wealth and may impact spending habits.

Supply

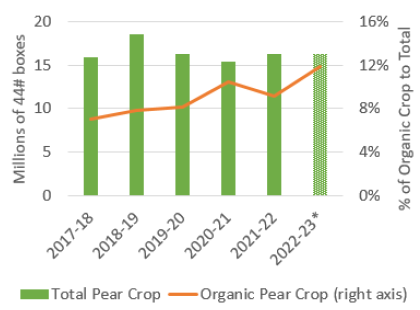

According to the Fresh Pear Committee’s final crop report, 2021-22 crop production came in at 16.3 million 44- pound boxes, which is within the five-year range (see chart below).

2022-23 Crop

The Fresh Pear Committee’s August forecast puts the 2022-23 crop at 16.2 million boxes, nearly identical to last season. Gains in Anjous should mostly offset declines in Bosc, Green Bartlett and Comice varieties. Crop quality is reportedly favorable, with a wide range of sizes expected, but growth is behind 10 – 14 days due to the prolonged cool and wet spring. As of mid-September, harvest is well underway primarily with Green Bartletts and Starkrimsons from the Wenatchee and Mid-Columbia growing regions. Organic pear production is estimated at 1.9 million boxes, 37% above its five-year average. Input cost increases have tapered, but remain significantly above pre-pandemic levels. California has largely shipped their crop and there is little risk of overlap with the Northwest.

*Estimate

Source: Fresh Pear Committee Final Crop Report and August Estimate.

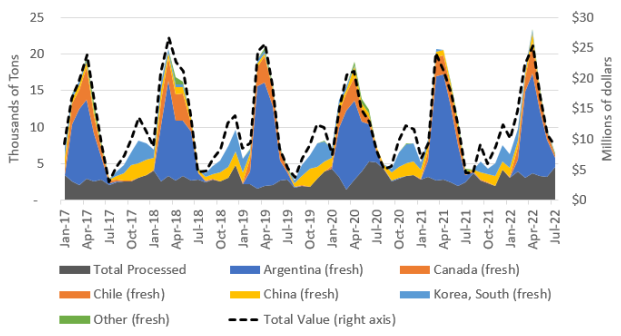

Fresh pear imports are dominated by Argentina and peaked in April at roughly their five-year average. Imports from South Korea and China should begin in September.

Pear Imports by Country

Source: Census Bureau.

Demand

Demand for pears should remain stable through 2023 and with a wide range of fruit sizes available, growers and shippers will be able to meet fresh, processed and export market demand. The Pear Bureau reports that the industry continues to expand conditioning programs, the process of using ethylene (a naturally occurring molecule released by fruit) to the improve the texture and flavor of pears prior to market deliveries. Market strategies will emphasize developing in-person relationships with retailers, digital marketing, and better display placements at stores. QR codes with links to short, informative videos are increasingly used to educate consumers.

Persistently high inflation continues to erode consumer wealth and people may begin to choose less expensive varieties and/or alternative fruits. This will present a challenge to the industry even though pears are increasingly viewed as a staple food item.

International Demand

Shipments to Canada and Mexico, which collectively made up 90% of exports during the 2021-22 season, are off to a strong start. The dollar has strengthened significantly against most currencies over the last year, but has been relatively steady against the Mexican Peso. While U.S. pears in this market should not experience significant prices increases, fruit from other countries may become more cost competitive.

Pricing and Profitability

The 2022-23 season should see stable domestic and international demand, favorable prices and a crop with strong quality and size profile. Input costs remain significantly above pre-pandemic levels, pressuring margins, and inflation is eroding consumer wealth, which may lead to more cost selective fruit purchases. Expect a wide range of profitability among producers, with the average at slightly profitable levels.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

Additional Information

Northwest FCS Business Management Center

www.northwestfcs.com/Resources/Industry-Insights

USA Pears

www.usapears.org

USDA Agricultural Marketing Service

www.ams.usda.gov

USDA National Agricultural Statistics Service

www.nass.usda.gov

Washington State Tree Fruit Association

www.wstfa.org

Learn More

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe