Executive Summary

Drivers for the corn industry includes drought, a smaller national crop, and lagging trade.

- Drought in the Corn Belt caused forecasted production to fall by 1,160 million bushels, a 7.7% reduction in the 2022-23 crop.

- A strengthening U.S. dollar has weakened U.S.’s global corn export competition and the 2022-23 exports were down by 100 million bushels.

Supply/Demand

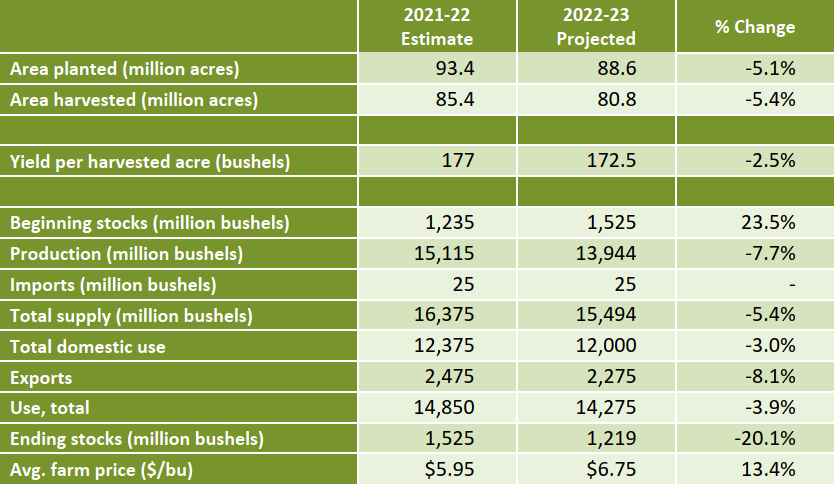

Severe drought across the Corn Belt stressed the 2022-23 crop, and production declined to 13,944 million bushels, a 415-million-bushel reduction since August. The sudden and substantial monthly decrease comes as national yields fell to 172.5 bushels per acre (down 2.9 bushel per acre since August’s forecast). Worsening yields and fewer harvested acres will lead to a 7.7% year over year reduction in the corn crop.

The Northwest is a small corn production area with most corn grown for local feed use. Higher nitrogen fertilizer prices, water concerns, and a multitude of competing, profitable crops reduced corn acres planted in the Northwest. For Idaho and Washington, the USDA forecasts corn production at 36.7 million bushels, down 28.7 million bushels compared to 2021. Lower corn silage production puts pressure on dairies, reducing options for affordable feed alternatives.

Pricing

Corn prices will remain elevated for the 2022-23 crop. December corn futures settled on Sept. 23, 2022 at $6.77 per bushel, up 34% year over year. Cash prices for the new crop are 40% higher than a year ago. The USDA’s average corn price for the 2022-23 crop is projected at $6.75, up $0.80 from the 2021-22 season average price. The shrinking crop and wavering crop conditions will provide tailwinds for corn prices.

Exports

The 2022-23 corn crop will face steep global competition. The U.S. dollar climbed to a 20 year high. A strong dollar hinders exports, making the relative price of U.S. corn higher than other corn exporting countries. Specifically, U.S. corn will face harsh competition from South American exporters who set export records in August.

U.S. corn exports sales hinge on the strength of the dollar. On Sept. 21, 2022, the Federal Reserve raised the federal funds rate by 75 basis points. In response, weekly corn export sales decreased by 400,000 tons, a 68% weekly decline.

A study on U.S. agricultural trade found that for each percent the U.S. dollar appreciates relative to other major exporter currencies, exports decrease by 0.5%. With the U.S. dollar appreciating more than the Brazilian Real and Argentine Peso, South American corn will have a price advantage, taking a larger share of global exports.

Within the first two weeks of the new crop marketing year, corn sales have plummeted. During the first week of September, corn sales grossed 583,000 tons. For the second week of September, sales fell by 69% to 182,300 tons. China has been the leader in early corn sales since 2020, but so far Chinese early corn purchases are weak. The USDA forecasts wanning exports to China with sales of 18 million tons for the 2022-23 corn crop, down more than 10 million tons from 2021. Total corn exports are projected to be $19.1 billion, $100 million less in sales than the previous year.

U.S. Corn Supply and Use

Source: World Agricultural Supply and Demand Estimates. Sept. 12, 2022

International

The WASDE reduced the world production estimates to 1.17 billion tons of corn (47 million tons lower than 2021-22 crop). Global corn remains bullish with trade, domestic feed use, and lower ending stocks. Losses from drought in the U.S. and European Union offset other regions’ production gains.

Europe’s corn crop is estimated to be 58.8 million tons. However, heatwaves continued in August diminishing corn quality to less than half the expected level. Between August and September, yields plummeted, and production estimates were lowered by 1.2 million tons. The European Union will rely on greater imports from Brazil due to lower production and issues securing corn from their historic exporter, Ukraine.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

Additional Information

Northwest FCS Business Management Center

www.northwestfcs.com/Resources/Industry-Insights

CoBank Knowledge Exchange

www.cobank.com/Knowledge-Exchange

Farmdoc Daily

https://farmdocdaily.illinois.edu/2021/12/2022-updated-crop-budgets.html

USDA Economic Research Service

www.ers.usda.gov/topics/crops/corn.aspx

USDA World Agricultural Supply and Demand Estimates

www.usda.gov/oce/commodity/wasde

Learn More

For more information or to share your thoughts and opinions, contact the Northwest FCS Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe