Executive Summary

Drivers for the cattle industry include liquidations, higher feedlot placements and favorable prices.

- Widespread liquidations will create tailwinds for cattle and beef prices. Producers who were able to retain their herd will benefit from higher prices in 2023. Those who liquidated may lack the necessary herd size to capitalize on favorable prices while paying disproportionately higher prices to rebuild their herds.

- Cattle sales prices were favorable during the summer.

12-Month Profitability Outlook

Northwest FCS’ 12-month outlook for cattle suggest slightly profitable returns. Drought in major cattle producing areas has caused widespread liquidation and feedlot inventories set records twice throughout the summer. A smaller cattle herd and strong demand supports higher cattle and beef prices in 2023.

Northwest Producer Outlook

Cattle sales in the Northwest were favorable with producers receiving between $1,250 and $1,500 per head. In areas with unfavorable pasture conditions for fall grazing, producers had to ship cattle 30 to 45 days earlier than normal. Calve sales weights have been lighter because of the shortened grazing period; however, prices for these cattle remained favorable. While strong sales prices are always valued, producers need cattle prices to remain elevated to sustain profitability as cow calf margins have been squeezed by soaring production costs.

The Northwest has seen a reduction in cattle herd size. Idaho, Montana, Oregon and Washington have collectively decreased their herds by 252,000 cows in the past five years, averaging a 2.3% decrease in herd size annually. This reflects a larger national trend.

With reductions in cattle herds, it will likely take two to three years for producers to rebuild inventory. Producers rebuilding their herd will lose out on higher prices and pay more than the price they received to buy back bred heifers. A smaller national herd supports strong cattle prices in 2023. While producers will make more money on a per head basis, those who liquidate will need to sell fewer calves to build up inventories resulting in overall lower sales. The quickest way to rebuild herds is by purchasing bred heifers. Strong demand across the country will drive

Cattle sales in the Northwest were favorable with producers receiving between $1250 and $1500 per head. In areas with unfavorable pasture conditions for fall grazing, producers had to ship cattle 30 to 45 days earlier than normal. Calve sales weights have been lighter because of the shortened grazing period; however, prices for these cattle remained favorable. While strong sales prices are always valued, producers need cattle prices to remain elevated to sustain profitability as cow calf margins have been squeezed by soaring production costs.

The Northwest has seen a reduction in cattle herd size. Idaho, Montana, Oregon and Washington have collectively decreased their herds by 252,000 cows in the past five years, averaging a 2.3% decrease in herd size annually. This reflects a larger national trend.

With reductions in cattle herds, it will likely take two to three years for producers to rebuild inventory. Producers rebuilding their herd will lose out on higher prices and pay more than the price they received to buy back bred heifers. A smaller national herd supports strong cattle prices in 2023. While producers will make more money on a per head basis, those who liquidate will need to sell fewer calves to build up inventories resulting in overall lower sales. The quickest way to rebuild herds is by purchasing bred heifers. Strong demand across the country will drive bred heifer prices up. Producers may pay upwards of double the price they received when they sold cattle during the droughts in 2021.

Pasture conditions varied in the Northwest depending on rainfall and access to irrigation water. For those with irrigation or water, pasture conditions look good. Where insufficient rain was received, producers have turned cattle out to graze on grass-hay fields due to shortage of other grasses. Reductions in national cattle herds will soften domestic demand for feeder quality hay in the near term. Northwest producers have experienced some relief with lower hay prices, although overall trade has been limited.

In Montana, drought lingered with eastern Montana facing 90°F highs into the last week of September. Pasture conditions suffered from prolonged heat and grasshoppers. By mid-September, 48% of Montana’s pastures are in poor or very poor condition. Compared to the widespread drought in 2021, Montana pasture conditions have improved with a 50% yearly reduction in acres facing moderate drought or greater. No matter the improvement, multiple years of drought have severely impacted pasture ground. Producers lacking good pasture conditions for fall grazing will need to ship calves earlier than normal.

In Oregon, pastures are also in less-than-ideal condition with 48% in poor or very poor condition, although this is largely region dependent. Eastern Oregon has favorable grass and hay production while Central Oregon is experiencing their second consecutive year of extreme drought. Those without water are looking to ship cows right away and hoping for better winter weather conditions to replenish pastures.

Beef Market Fundamentals

Demand

Cattle markets have been favorable with strong beef demand and sales unaffected by rising retail prices. Even with noticeable increases in meat prices, up 3.4% year over year, consumers have not cut back on beef consumption. Record beef exports in July were unaffected by the strengthening U.S. dollar.

Declines in the national cattle herd will place further upward pressure on prices. Beef prices are forecasted to increase by 9.4% in 2023. So far, beef sales have been unaffected by price increases. However, declines in consumer purchases, record low consumer sentiment, and potential for a recession could cause headwinds for domestic beef demand. The silver lining is estimated reductions in beef production are set to outweigh cutbacks in beef consumption. The USDA forecasts beef consumption in 2023 will reach its lowest level since 2015. Even the highest projection of a 5-lbs. per person cutback would be less than the expected beef supply reduction.

Beyond domestic demand, July had record beef exports fueled by growth in Asian markets and strong international demand. In the third quarter, the Livestock Marketing Information Center projects that U.S. beef exports will be 915 million lbs. For the fourth quarter of 2022, U.S. beef exports are projected at 860 million lbs. If these projections hold, both will set quarterly export records amid the U.S. dollar reaching 20-year highs.

Total beef exports for the first six months of 2022 increased by 133% from last year. China led export growth purchasing 373.5 million lbs. of beef, a 91.6 million increase from the same period in 2021. Growth in the Chinese market over the last two years has been accelerated by the U.S.-China Trade Agreement. Exports to Japan and South Korea also up 6.2% and 12.6% respectively year over year.

Demand is working in favor of cattle producers. Consumer demand has been strong, unaffected by higher prices. The U.S. had record exports in 2022 and record trade will likely remain despite a strengthening dollar. Smaller cattle supply will be the limiting factor in 2023, supporting higher beef prices while constraining domestic beef consumption and exports.

Supply

Supply is tightening due to increases in cattle liquidation from poor pasture and forage conditions. Cattle in feedlots on August 1 reached 11.2 million head. This is the second highest reported monthly number of cattle waiting for slaughter in 25 years. The record for the most cattle in feedlots was set in June of this year at 11.8 million head. The final week of August set a record for the most cattle slaughtered in a week. U.S. beef production forecasts for 2022 have been raised on higher feedlot inventories to 28 billion lbs., up 500 million lbs. from 2021.

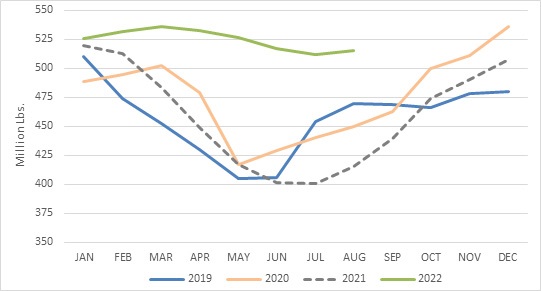

Beef in cold storage set a record at 515.6 million lbs., up 24% year over year. For the Pacific region, boneless beef and beef cuts in cold storage rose 27% and 19%, respectively, from August 2022. With a record number of cattle on feed, cold storage stocks will continue to rise throughout the end of the year. In 2023, the small domestic herd will require greater reliance on cold storage inventories to meet demand.

Total Frozen Beef in Cold Storage, 2019-2022

Source: Cold Storage Report. Sept. 22, 2022

Expensive hay prices and poor forage conditions have forced many producers to liquidate. Of the five largest cattle producing states (Texas, Oklahoma, Missouri, Nebraska and South Dakota respectively), four face significant droughts that depleted hay production. South Dakota was the one state with an annual increase in hay production after recovering from drought in 2021. The Southern Plains had the greatest deterioration with more than 50% of their pastures in poor or very poor conditions. Feedlots in this region have increased slaughter rates by 31% year over year. The last time the Southern Plains had major drought was 2011. Compared to 2011, this region now has 0.4 million fewer cows and saw a modest increase in cattle slaughtered.

Many states, especially in the Southern Plains region, have liquidated their cattle herds due to higher feed costs and difficulties securing hay. The reduction in the national cattle herd will likely take two to three years to rebuild.

Increases in national cattle in feedlots will reduce cattle supplies and beef production will decline in 2023. A smaller national herd will support higher beef prices. Producers that were able to retain cattle will benefit from higher prices and lower production cost (softening hay prices) resulting in greater earnings.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

Additional Information

Northwest FCS Business Management Center

www.northwestfcs.com/Resources/Industry Insights

Beef Magazine

https://www.beefmagazine.com

Cattle Fax

www.cattlefax.com

Livestock Marketing Information Center

https://www.lmic.info/

USDA Economic Research Service

www.ers.usda.gov

Western Livestock Journal

www.wlj.net

Learn More

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe