Executive Summary

Drivers for crop inputs include volatile energy markets, elevated fertilizer prices and generally improving logistics conditions.

Energy

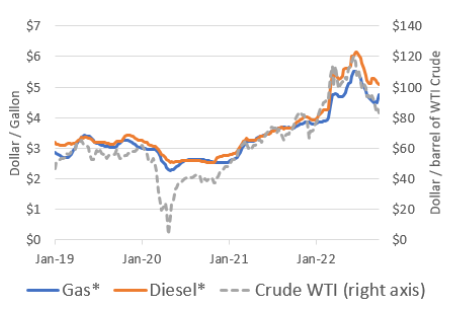

Crude Oil and Refined Products – Crude oil prices were volatile during the third quarter of 2022, with West Texas Intermediate (WTI) falling from June highs of $121 per barrel to $77 per barrel as of Sept. 26, due to:

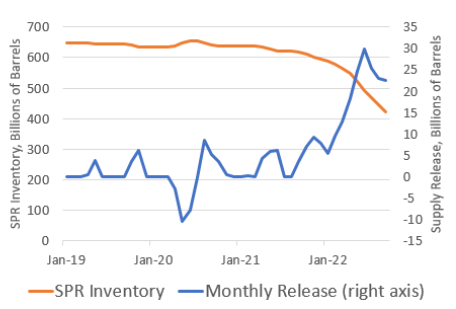

- Strategic Petroleum Reserve (SPR) supply. The Biden Administration authorized SPR sales starting November 2021. Withdrawals for the third quarter averaged 0.86 million barrels per day (or 4.5% of U.S. daily consumption). Sales are expected to end in November 2022, at which point inventories will be nearly half their 20-year average. These levels were last seen in 1983.

- Strengthening U.S. dollar. Crude oil is primarily traded in U.S. dollars, so prices in the U.S. generally decrease as the dollar strengthens. The DXY Index, which measures the value of the U.S. dollar relative to a group of currencies, has increased 6.3% over the last quarter.

- Slowing economic growth. The two largest oil consumers face headwinds. Persistently high inflation has eroded consumer wealth in the U.S. and China faces a rapidly deteriorating property market and continued COVID-19-related lockdowns. Fears of a global recession are limiting demand from commodity investors.

- Exports out of Russia. Europe’s partial ban on Russian oil imports in June did not impact global markets as expected because supplies were diverted to China and India, the second and third largest oil consumers. U.S. and European policy responses to the war in Ukraine are constantly evolving and unfortunately, it’s difficult to predict their net impacts.

In the U.S., crude oil inventories remain tight and production, while 60% above its 20-year average, is 8% below November 2020 peak levels. Refinery capacity is also down from 2020 by 5.7% and will likely hold flat in 2023. Capacity utilization of refineries is near 100%.

As winter approaches and withdrawals from the Strategic Petroleum Reserve end, prices should find a floor and gradually increase even if economic conditions worsen. Much will also depend on the strength of the dollar.

WTI Crude, Retail Gas and Retail Diesel Prices

Strategic Petroleum Reserve Inventory and Withdrawal

Source: U.S. Energy Information Administration. *West Coast prices. Data as of Sept. 23, 2022.

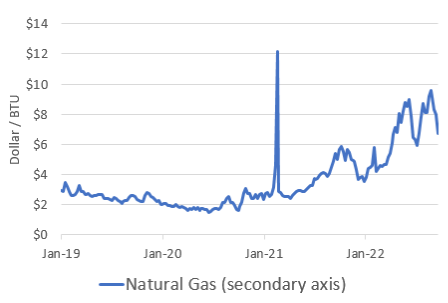

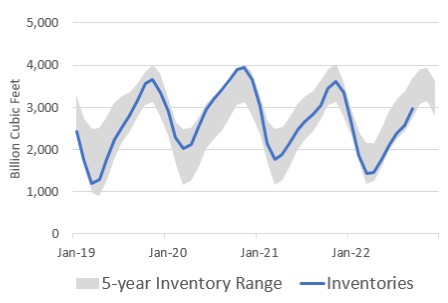

Natural Gas – Natural gas prices were volatile this quarter. A fire at a Liquified Natural Gas export facility in Freeport, Texas (the second largest in the U.S.) reduced access to export markets and increased domestic supplies. Prices dropped briefly, but soon rose as the southern U.S. experienced an intense heat wave. Inventories are low headed into peak demand season but a recent uptick in mid-September helped to soften prices. The Freeport facility is expected to ramp up later this year, increasing access to and competition from international markets. Prices are likely to find a floor soon.

Natural Gas Prices

Natural Gas Inventories

Source: U.S. Energy Information Administration. Data as of Sept. 26, 2022.

Chemicals

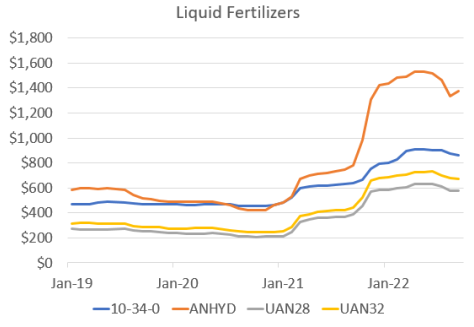

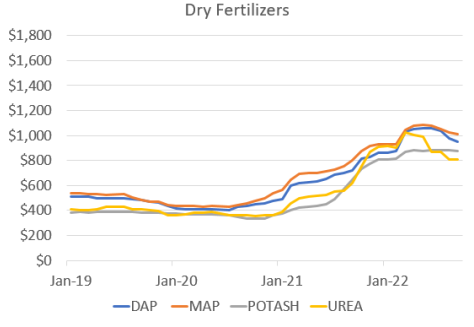

Fertilizers – Fertilizer prices experienced some relief in July and August; however, they remain elevated and may increase as producers plan for next season, especially if natural gas prices rise. Many fertilizer manufacturing plants remain closed in Europe and this will continue to drive uncertainty and a supply and demand imbalance in global markets. Hurricane Ian hit central Florida hard and eleven counties face power outages of 60% of more. This region includes about half of phosphate fertilizer production capacity in the U.S. Early indications suggest plants were not damaged; however, some are concerned about possible breaches (none currently identified) in their open-air wastewater ponds (which contain many carcinogens). Expect fertilizer delivery delays and/or shortages out of this region given the immense impact to its infrastructure and supply chain.

Retail Fertilizer Prices, $/ton

Source: DTN Retail Fertilizer Trends. Data as of Sept. 28, 2022.

Logistics

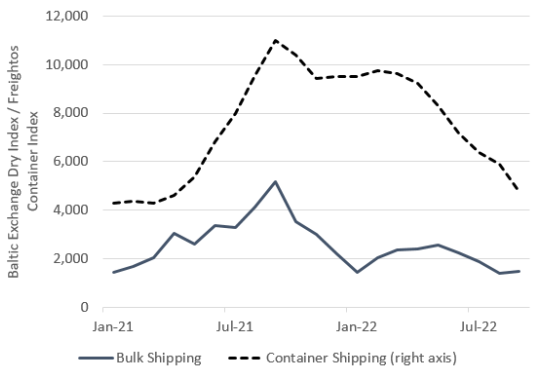

Container Shipping – Container shipping rates, particularly from East Asia/China to North America, are falling rapidly and approximately 60% below their September 2021 peak, but remain substantially above pre-pandemic levels. Rising inflation and recession fears led to lower goods demand. China’s Golden Week, in which most manufacturers shut down, begins October 1 and may push rates further down.

Dry Bulk Shipping – Dry bulk shipping rates (used for wheat, corn, industrial materials and coal) have been volatile, but remain 140% above their five-year average. Lower grain exports out of Ukraine and lockdowns in China have dampened demand, while Europe’s renewed interest in coal provides support. As with container rates, the outlook is uncertain and will depend on agriculture yields (primarily wheat and corn), industrial production (coal and steel) and macroeconomic conditions.

Container and Dry Bulk Shipping Costs

Source: Freightos, Investing.com. Data as of Sept. 29, 2022

Seaports - West Coast port congestion is improving as demand for goods falls and shippers spread deliveries to gulf and East Coast ports. Contract negotiations between the Pacific Maritime Association and International Longshore and Warehouse Union are ongoing and may extend to 2023. ILWU members are working without a contract, meaning companies do not have a mechanism to resolve conflicts at a time when labor disputes across the U.S. are rising. It’s generally thought that cargo movement will not be impacted through this process.

Trucking - Freight rates declined 9.5% in May, but remain up 31% year over year. While still early, this may signal a top in the current rate cycle. Lower goods demand due to inflation and reduced supply from coronavirus-related lockdowns in China may reduce trucking volumes.

Rail - On September 15, an emergency board brokered an agreement avoiding a national rail strike by mere hours. Contract negations between rail companies and railroad unions representing over 100,000 workers reached a temporarily resolve while negotiations remain ongoing. Rail plays a vital role for agricultural infrastructure, especially during harvest. If rail workers had gone on strike, it would cost an estimated $2 billion per day in economic slowdown with large implications for agriculture.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

Additional Information

Northwest FCS Business Management Center

www.northwestfcs.com/Resources/Industry-Insights

CoBank Knowledge Exchange

www.cobank.com/Knowledge-Exchange/

Learn More

For more information or to share your thoughts and opinions, contact the Northwest FCS Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe