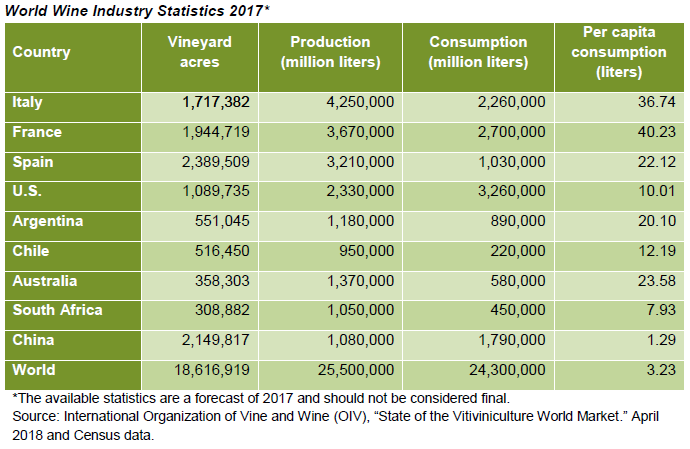

Traditional 'Old World' wine-growing regions of Europe dominate world wine production. Old World wine regions accounted for over half of world wine production just five years ago. However, reductions in world acreage, led by Europe, have reduced the Old World share of wine production to around 45 percent.

Growth in global wine production and consumption is fueled by 'New World' countries. The United States, Argentina, Chile, Australia, South Africa and China lead New World production. Still, these countries contribute only 30 percent of world production.

US Overview

The U.S. became the world's largest wine consumer by value and volume in 2013. In 2016, Americans consumed just under 400 million cases. Although Americans do not drink as much wine per capita as Europeans, consumption has risen to an all-time high.

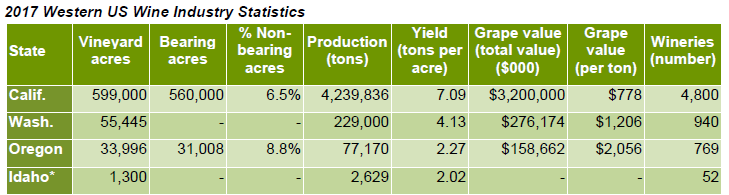

Producing approximately 9 percent of the world's wine, the U.S. ranks fourth behind Italy, France and Spain. California accounts for approximately 85 percent of U.S. wine production with a crush of 4.2 million tons in 2017. According to the Wine Institute, California accounts for 60 percent of bottled wine sold in the U.S. and supplies 90 percent of all exported U.S. wine.

The next largest wine-producing region in the U.S. is the Pacific Northwest. Concentrated mainly in Washington, Oregon and Idaho, the region has almost 90,000 acres of wine grapes and over 1,700 wineries accounting for approximately 7 percent of U.S. wine production.

*2016 Sources: California: USDA NASS Grape Crush Report,USDA NASS Grape Acreage Report;, Washington: Washington Vineyard Acreage Report and Washington State Wine Grape Crush ReportOregon: Southern Oregon University Oregon Vineyard and Winery Census Report; Idaho: Idaho Wine Commission, Wine Grape Fact Sheet.

Pacific Northwest Perspective

Washington vineyards

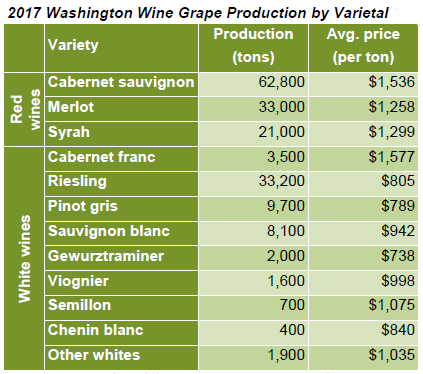

Washington ranks second among the states in U.S. wine production. It has 14 'appellations,' or American Viticulture Areas (AVAs). Most plantings lie east of the Cascade Mountains. The state's four most abundant varietals - cabernet sauvignon, riesling, chardonnay and merlot - account for more than 75 percent of total acreage. Cabernet is the main variety grown in Washington; most other reds are used in blends that are increasingly popular.

Over 350 wine-grape growers operate in the state; nearly 70 percent of the vineyards grow grapes under contract for Ste. Michele Wine Estates.

Washington wineries

Washington, now boasting over 900 wineries, has gained fame for producing moderately priced, high quality wines. As a percentage, Washington wines receive more scores of 90 or above from Wine Spectator than any other region, including France and California.

Walla Walla Valley and Woodinville have been heavy traffic and destination hotbeds for Washington wineries. Boutique wineries have transformed Walla Walla into a destination town, while Woodinville is home to Ste. Michelle. Woodinville capitalizes on direct-to-consumer sales due to its proximity to the state's largest and most affluent metropolitan population center of Seattle-Bellevue-Tacoma.

Among all the state's wineries, three dominate the industry's volume: Ste. Michelle Wine Estates, Precept Wines and Constellation.

Ste. Michelle Wine Estates accounts for over 70 percent of Washington's annual production of around 10 million cases. Its largest brands are Chateau Ste. Michelle, 14 Hands and Columbia Crest. 14 Hands and Columbia Crest target the $7 to $14 per-bottle range. The Chateau Ste. Michelle brand produces 2.8 million cases and targets prices between $15 and $40 per bottle. Over the last few years, Ste. Michelle has diversified its holdings by purchasing Erath Vineyards in Oregon and Stag's Leap in California's Napa Valley.

Precept Wines in Seattle, producing about 1.8 million cases of wine a year, is Washington's second-largest wine company selling over 30 brands with a focus on prices between $7 and $15 per bottle. Constellation, Washington's third-largest wine company, produces 1 million cases.

Ste. Michelle, Precept and Constellation combined produce more than 12 million cases. The remaining wineries in Washington produce less than a million cases a year in total.

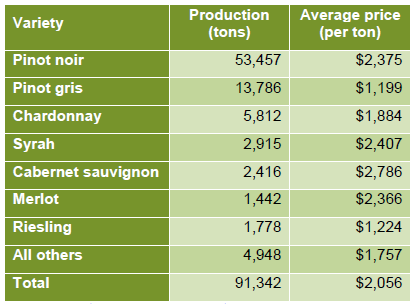

Oregon vineyards

Oregon currently has 18 AVAs; about half are sub-AVAs (wine growing region within a region). Unlike Washington, most of Oregon's vineyards are cultivated west of the Cascades. Western Oregon's climate favors cooler-season grapes such as pinot noir and pinot gris. Notably, 58 percent of Oregon's grape production is pinot noir. Due to the state's cooler climate, particularly in the Willamette Valley where about 75 percent of Oregon's grapes are grown, grape yields are much lower than those in other Western states.

Source: Southern Oregon University 2018 Oregon Vineyard and Winery Census Report

Oregon wineries

The Oregon wine industry is relatively young, with the first pinot noir vineyards planted just over 50 years ago. Oregon's pinot noirs are recognized for high quality and demand for the state's wine has grown over the last decade. Currently, the state is home to 769 wine companies and most are relatively small.

Many Oregon wine producers enjoy the location advantage of being near large population centers, which allows for a greater volume of direct sales. Because many Oregon wineries are small and have a boutique-quality focus, the prevailing prices of these wines are higher than national averages.

Driven by land costs, supply and portfolio diversity, Oregon has seen increased interest from out-of-state wine businesses since 2013. In August 2013, France-based Maison Louis Jadot purchased an Oregon vineyard in Newberg. Jackson Family Wines purchased 1,350 acres in two Willamette Valley vineyards and opened a tasting room during spring 2014. In 2016, the company extended its investment in Oregon vineyards by purchasing prestigious wine companies Penner-Ash and WillaKenzie.

Idaho vineyards

According to the Idaho Wine Commission, Idaho's vineyards encompass an estimated 1,300 planted acres. The state's wine output consists mainly of grape varietals that can withstand comparatively harsh winter-weather conditions, as most of the growing areas are at high elevations. Idaho's leading varietals include chardonnay, riesling and cabernet sauvignon.

Idaho's wine industry is the newest in the Northwest. In 2007, Idaho's first AVA, Snake River Valley, was approved. The Eagle Foothills AVA, authorized in 2015, lies within the Snake River Valley and the newest AVA, approved in May 2016, is the Lewis-Clark Valley.

Idaho wineries

Idaho has 52 wineries that produced almost 160,000 cases in 2016. Ste. Chapelle Winery and Sawtooth Estate Winery, both owned by Precept, make up a large portion of the state's production. Most of Idaho's wineries and vineyards are in the Snake River Valley within an hour's drive of Boise. The remaining 50 are independently owned boutique wineries that rely primarily upon tasting-room sales and local distribution to market their products.

Value Chain

In the vineyard

Start-up costs are high in the wine/vineyard industry. New vines are supplied primarily by nurseries in California or Washington; once in the ground, the vines become fully productive in about two to three years. In year one, the grower establishes vine root systems, irrigation and trellises. In year two, the irrigation and trellis systems are finished, and training of the vines begins. By year three, most vines can produce a harvestable crop.

Parts of the Northwest are especially susceptible to freeze, which can severely damage vines that must be cut back or removed. Rain can prolong harvest, although most grape varieties are not damaged by rain. Pests, mold/mildew and other diseases also threaten vines and grapes and must be constantly managed. Red Blotch, a disease that turns leaves red and reduces sugar accumulation in berries, has been pervasive in California vineyards, and is now being reported in Oregon. Research is currently in process, but the origin or how the disease is transferred is unclear.

Harvest

Vineyard managers measure Brix, the sugar level in grapes, to determine harvest timing. Harvest typically begins around August or September for white grapes, which are harvested before reds. Cabernet is the last grape harvested and is typically picked by October.

Grapes are harvested mechanically or by hand. For mechanically harvested grapes, machines hover over the vines, shaking them until the grapes fall. A conveyer belt on the bottom of the machine collects the grape clusters into a bin and transports the harvest to a storage cellar or directly to a crush facility. Harvesting by hand is more expensive, requiring more labor and time. Hand harvesting is not typically an option for bottles priced under $20. Washington vineyards are almost solely machine harvested, while in Oregon hand harvesting is more common.

Labor shortages, increasing wages and technological advancements will drive more vineyard owners to invest in machine harvesters, de-stemmers and precision pruners. There is a long-standing belief that hand harvesting leads to better-quality wines. However, new optical-sorting machines on the harvesters or at the crush facility are more advanced and efficient at removing materials other than grapes (MOG).

Wineries

Once grapes are harvested, they are sent to the winery for crush, aging and bottling. As grapes are crushed, the fermenting stage begins. Grapes are typically fermented and aged in large steel tanks or oak barrels; sometimes oak chips are added to steel tanks to impart some oak flavors more cost effectively.

To make white wine, grapes are pressed to remove skins before fermentation. Grape skins are left on for red wines and there is a period with skin contact, also known as maceration or cold soaking. Winemakers adjust the maceration time to change flavors and color. When the maceration time is complete, the red wine is pressed to remove skins.

Once fermented, wines are transferred to bottles where they are aged so the flavors can fully develop. White wines age for only a couple of months, but reds need longer. Higher-end wines can age for several years before going to market.

Marketing channels

A three-tier system was designed to track alcohol movement to minimize illegal production and sales. Under this system, a winery sells to a distributor, which in turn must sell to a retailer. With this system wineries can work with a few distributors to get their wines on many different shelves and wine lists instead of having to work with numerous retail shops and restaurants.

Consolidation in the number of distributors has been significant over the past two decades. The Stonebridge Research Group reported that in 1998 there were 7,000 distributors and 2,000 wineries in the U.S. By 2008, there were an estimated 500 to 700 distributors and 5,000 wineries. Since then, the consolidation trend has continued.

Due to tighter margins, individual distributors now carry more brands but devote less time selling each brand. Because a winery with a broad product base can more effectively serve a distributor's needs than 10 different small wineries, the large winery becomes an attractive "one-stop shop." With distributors' focus on efficiently moving product, smaller wineries often find their product is a lower priority, so smaller brands are more difficult to find through retail outlets.

Attracting a distributor and getting placements in out-of-state restaurants and retailers is increasingly difficult, especially for small wineries. Out of necessity, small wineries are taking control of their marketing and focusing on the direct-to-consumer (DtC) channels. States are increasingly opening up DtC shipments to out-of-state wineries, thus expanding the DtC market.

Although the wine industry's distribution system is being modified, distributors largely control wine sales. Over 95 percent of U.S. wine sales are through distributors, either off premise (retail) or on premise (restaurants). DtC accounts for less than 5 percent of total U.S. wine sales. While still a small portion, DtC sales have shown double-digit growth for the last several years.

Drivers

Wine consumption

Global wine consumption, largely flat since 2009, appears to have stabilized near 240 million hectoliters (6.34 billion gallons) after trending steadily upward through 2007. A slow global economic recovery and declining consumption in the Old World wine-growing regions of Europe have led to anemic growth in world wine consumption. Still, European nations have the highest per capita wine consumption levels in the world, although consumption growth is increasing in New World wine consumers. U.S. wine consumption is at an all-time high but has been leveling off the last few years.

Economic health

Economic weakness during the Great Recession resulted in reduced consumption, trading down to lower prices and less spontaneous wine buying by consumers. According to a Nielsen Company survey published in May 2009, 24 percent of wine consumers opted for a cheaper bottle when ordering drinks at restaurants and bars. Consumers also ordered fewer drinks in restaurants or shifted to consumption at home. As the health of the U.S. economy has improved, so has consumer confidence, which impacts wine demand.

U.S. wine sales value have been growing around 2 to 3 percent per year for the past several years. Premium wines, between $10 and $20 a bottle, are responsible for much of the growth in wine sales. Ultra-premium wines, over $20 a bottle, have also seen significant growth. Consumers are trading up and spending more on wines, a trend known as premiumization.

Consumer tastes and preferences

According to the U.S. Census Bureau, millennials outnumbered boomers for the first time in 2016. A study by the Wine Market Council revealed that millennials, now all of drinking age, make up the largest percentage of the wine-drinking population at 38 percent.2 However, baby boomers still consume the largest volume.

Millennial wine drinkers are more likely to spend over $20 a bottle, contributing to the trend of premiumization post the Great Recession. According to the Wine Market Council study, 17 percent of millennials purchased a bottle priced $20 dollars or more in the past month compared to only 10 percent of all drinkers and 5 percent for baby boomers.3 However, more recently, the wine industry has seen challenges competing for millennials' spending. Millennials have more options with the rise of craft beer, spirits and cannabis. Marketing to millennials is largely understood to be centered around experience-oriented branding with alternative packaging suiting their lifestyles. This contrasts with prestige and family heritage branding that had appealed to previous generations.

Consumer preferences for varietals constantly change. A few years ago, cabernets were the hot item. Currently, red blends and rosés are experiencing explosive growth. Although difficult, staying on top of varietal preferences is imperative to match varieties in the vineyard to consumer preferences. This requires forward thinking, given that it takes three years for a vine to produce grapes and another year or more to make wine.

Appendix

Best Practices

The following summarize best practices common among successful vineyard and winery operations. For this discussion, it is accepted that most successful operations employ best industry practices in production to maximize product quality and economic return. Accordingly, the following discussion is confined to marketing and finance.

Marketing

Successful vineyard owners:

- Carefully align their long-term strategic production goals with the practical needs of the winery and the general marketplace where that fruit will be marketed.

- Develop market alliances before the vineyard is designed and planted.

- Thoroughly consider critical factors around vineyard establishment (trellis type, irrigation system, plant spacing, elevation, row direction, soil type, slope orientation, rootstock, clones, AVA, site selection, etc.) that can profoundly impact quality, production and marketing throughout the life of the vineyard.

- Have a vineyard branding strategy and create additional value in the vineyard asset through effective marketing of grapes to reputable wineries.

- Broaden marketing to multiple wineries and strive to produce high quality grapes that will merit vineyard-designated wines.

- Use long-term contracts with wineries to minimize marketing risk.

- Partner with reputable vineyard management companies that can help maximize fruit quality and raise the overall profile of the vineyard in the marketplace.

Successful winery owners:

- Develop strong branding and marketing strategies.

- Craft a story around their brand that is authentic and durable in the marketplace, and that is further enhanced by the personality and energy of the owners.

- Genuinely enjoy people and marketing, and don't tire of telling their story repeatedly - an essential requirement of a winery owner.

- Have a distinct channel strategy and effectively develop all three traditional marketing channels (retail, wholesale and distributor).

- Align themselves with reputable and financially sound brokers and distributors.

- Closely participate in the marketing process in all channels.

- Produce high quality wines, differentiating their brand not with the occasional high score or good review, but with consistently strong recognition year after year.

- Develop wines at multiple price points that will accommodate changes in market demand and normal variations in quality from vintage to vintage.

- Consider replacing wine brokerage relationships with in-house sales staff to gain better representation of the wines in the marketplace.

Finance

Successful vineyard owners:

- Resist the notion that appreciation is guaranteed over time on a land and vineyard investment (a common investor motive), and carefully manage vineyard costs to generate annual cash returns.

- Use long-term contracts to limit downside risk.

- Persistently challenge conventional vineyard production practices that add cost without materially improving grape quality.

- Use crop insurance and other risk-management tools to minimize income volatility.

Successful winery owners:

- Align with accounting firms that have a solid understanding of the unique accounting characteristics of the wine industry.

- Develop high quality accounting systems that provide internal and external audiences with a clear understanding of accrual earnings and balance sheet health.

- Develop clear financial performance metrics that allow them to compare their operation to industry benchmarks.

- Are smart about deploying capital and focus capital resources, if limited, first on inventory and brand building, and then on development of hard assets such as land, vineyard development and winery facilities.

- Maximize use of their winery capacity with their own production, or market their unused capacity by sharing space with another winery.

- Maintain health in their balance sheet, particularly liquidity, recognizing that the wine industry is highly cyclical.

In summary, much of financial management is about preparing the company's balance sheet to withstand the inevitable next down cycle. When the industry is in distress, wineries can expect lower margins with pressure on quality and price. Growers can expect downward pressure on grape prices with increasing expectations for quality and slowing of new vineyard development. Meanwhile, consumers will enjoy a period of great bargains.

Beyond this period, a new phase will develop where supply and demand will rationalize, and prices and general market conditions will begin to once again tilt in favor of vineyard and winery owners. Owners who have positioned their operation to survive adversity will be ready to take advantage of opportunities in a recovering market.

Glossary

American Viticultural Area (AVA) or appellations: geographical wine-grape growing regions in the U.S. Established at the request of wineries or other petitioners, the Alcohol and Tobacco Tax and Trade Bureau designates the boundaries.

Boutique wineries: small, artisan and sometimes family-owned wineries.

Brix: a scale system used to measure the degree of sugar content of grapes and wine. Each degree is one gram of sugar per 100 grams of grape juice; table wine is usually between 20 to 25 Brix.

Crush facility: processing facility where grapes are crushed to start the wine-making process.

Direct to Consumer (DtC) and direct sales: marketing and selling directly to consumers, bypassing distributors and third-party retail locations. In the wine world this is often done through wine clubs, tasting rooms and other direct communication with the consumer.

Distributor: an agent who supplies goods to stores and other businesses.

Fermentation: chemical breakdown of a substance by bacteria, yeasts or other microorganisms; the process for wine converts sugars to ethyl alcohol.

Maceration: process of soaking crushed grapes, seeds and stems in a wine to extract color, aroma and tannins.

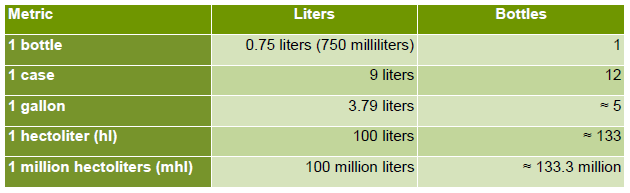

Measurements: The following table shows frequently used metrics in terms of liters and bottles.

New World wine: wines from countries or regions where winemaking was imported during and after the age of exploration; typically refers to the regions outside the traditional wine-growing areas of Europe.

Oak barrels: wooden containers used to age and store wine. The most common oak barrels are either French oak or American oak. American oak tends to be more intensely flavored with more sweet and vanilla overtones since the grain is looser. French oak, which has a tighter grain, generates a sensation of light sweetness with fruity flavors. The most common size of a barrel holds almost 60 gallons. Oak barrels are the most expensive storage method and can be used only a couple of times before the flavoring effects wear off.

Old World wine: wines from countries or regions where winemaking first originated, mostly refers to Europe and regions around the Mediterranean basin.

Pre-productive: when a plant is young and does not yet bear fruit

Steel tanks: containers used to ferment and store wine. Stainless steel tanks vary in size from a couple of gallons for home brewing up to 400,000 gallons (for reference, 800 gallons is about 4,000 bottles of wine). Steel tanks are ideal for temperature control during fermentation. They have a chamber surrounding the tank that holds coolant, which the winemaker can adjust.

Sub-AVA: An AVA within a larger AVA; see AVA definition.

Tannin: naturally occurring polyphenol found in plants, seeds, bark, wood, leaves and fruit. In wine, it is the textural element that makes wine taste dry.

Tasting room: part of a winery or brewery typically located on the premises. It is primarily used by guests to sample products.

Trellis system: a frame used to support climbing plants; helps to train the vine and canopy into an ideal shape for fruit growth, fruit ripening and harvesting.

Varietals: the types of grape used in winemaking.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe