Executive Summary

Drivers for the wine/vineyard industry include a large wine grape crop that is behind on maturity, softening wine sales volumes offset by rising values and improving packaging material availability.

- Northwest wine grape crop is large, but behind in maturity by two weeks on average.

- Wine sales continue to increase in value but decrease in volume.

- There are early indications that inflation may start to impact consumer behavior.

Input costs remain elevated, but availability of glass bottles, labels and other materials have improved.

12-Month Profitability Outlook

Northwest FCS’ 12-month outlook calls for profits for both vineyards and wineries. Wine grapes are healthier than previously expected but two weeks behind on maturity. In response, growers will delay harvest, presenting a potential risk if cold weather arrives early. Rising sales values have offset declining volumes. Early signs indicate persistently high inflation that may begin to impact consumer behavior. Input costs remain elevated and packing material shortages have started to ease.

Supply

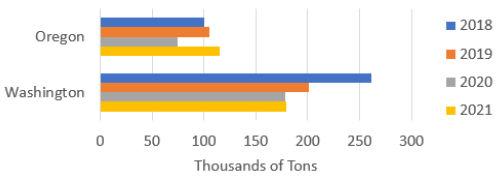

Source: University of Oregon Wine and Grape Report, Washington Wine Grape Production

Glass bottle and label shortages appear to be easing and while input costs remain significantly above pre-pandemic levels, their growth is moderating. Wine inventories remain tight in Oregon and average in Washington.

Oregon is increasingly viewed as a growth opportunity for investors due to its premium Pinot Noir wines. Ste. Michelle Wine Estates (itself recently acquired by Sycamore Partners) recently acquired A to Z Wineworks and its sister label Rex Hill, making them the state’s largest wine company.

Demand

Wine grape demand is favorable and the region should be able to absorb a large crop without significantly depressing prices.

According to Wine Vines Analytics, domestic wine sales, including bulk, are up 11% on the year, with off-premise (retail) purchases down 2%, Direct-to-Consumer down 8% and on-premise (restaurant) sales up 49%. Overall, the industry is seeing increasing sales value but slightly declining volumes. Inflation is reducing consumer wealth and sentiment, and there are emerging signs of changing behavior. Recent survey data suggest 1) there is a negative correlation between rising restaurant check costs and customer interest in returning to the same restaurant and 2) consumers are likely to cut back on visits to bars and restaurants due to inflation (many have already cut back). While still strong, tasting room visitations from May to July are below 2021 levels and on-premise sales haven’t rebounded as strongly as initially expected.

International

Europe is experiencing intense drought and early harvests. In Italy, estimates are for a 10% yield decrease from 2021. In France, estimates are for an above average yield, with good quality. Drought conditions are acute in Alsace (which produces white still wines), Languedoc-Roussillon (primarily red blends), Burgundy (Pinot Noir and Chardonnay) and Bordeaux (Merlot, Cabernet Sauvignon and other reds).

The Southern Hemisphere had mixed 2022 crops. In Chile, drought and late frosts reportedly lowered yields by 7% to 22% depending on the region, but quality is high. Australian yields came in 2% below their 10-year average due to weather conditions as well as wineries reaching production capacity. New Zealand’s yield was up 44% from 2021, during which it suffered a 20% drop due to a cool spring and late frost, providing much needed supply to wineries.

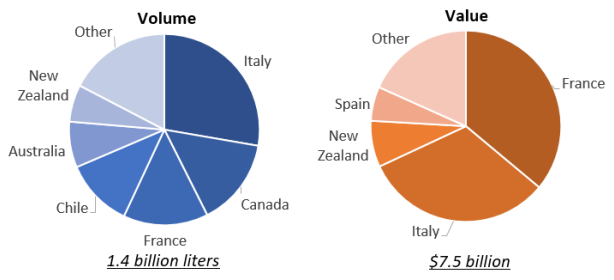

Source: U.S. Census Bureau

Historically, the dollar’s value is weakly correlated to wine imports. Thus, while the dollar strengthened over the past year against most currencies, this alone shouldn’t significantly impact U.S. markets. With that said, global trends may lead to a supply and demand imbalance. Europe has soaring energy costs, which will reduce consumer wealth. China is facing significant headwinds that may impact consumer spending, including a housing crisis, strict COVID-19 related lockdowns and fraying trade relations with Australia and New Zealand, two important wine producers. These circumstances may reduce global wine demand, incentivizing producers to seek out different markets including the U.S.

Profitability

Crop quality will largely drive vineyard profitability as grape demand is strong. Since grape maturity is behind two weeks, much will depend on the weather as growers push harvest out. An early season frost or heavy rain could greatly impact mid- to late-season varieties, at which point crop insurance will play an important role. If all goes well, the region is poised to have a large, good quality crop with favorable pricing.

Winery profitability will depend on this season’s crop, especially in Oregon where inventories remain tight. Competition from international suppliers may get more acute as weakening demand in Europe and China combines with a strong U.S. dollar. While not a pressing issue yet, persistent inflation may gradually influence wine consumption. Fortunately, material shortages are easing and softening sales volumes are counterbalanced by rising values.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

Additional Information

Northwest FCS Business Management Center

NWFCS Industry Insights

Idaho Wines

https://wine.idaho.gov/

Oregon Wine Center

www.oregonwine.org

ShipCompliant

www.shipcompliant.com

Turrentine Brokerage

www.turrentinebrokerage.com

U.S. Drought Monitor

www.droughtmonitor.unl.edu

USDA National Agricultural Statistics Service

www.nass.usda.gov

Washington State Wine Commission

www.washingtonwine.org

Wine America

www.wineamerica.org

Wine Business

www.winebusiness.com

Winegrape Growers of America

www.winegrapegrowersofamerica.org

Wine Institute – The Voice for California Wine

www.wineinstitute.org/resources/statistics

Wine Market Council

www.winemarketcouncil.com

Learn More

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe