Executive Summary

Drivers for the potato industry include harvest delays, elevated prices for open potatoes and rising input costs.

- The 2022-23 Northwest crop will be smaller than 2021-22 but has significant quality improvements. Potatoes were three to four weeks behind normal development and where possible, harvest was delayed so potatoes could grow larger.

- Processors were experiencing potato shortages and needed the new crop to continue operating their plants, growers able to harvest early were awarded with higher open prices.

- Contracted growers’ profits were negatively impacted by lower yields and quality concerns.

12-Month Profitability Outlook

Northwest FCS’ 12-month profitability outlook suggests slightly profitable returns for contracted potatoes and profitable returns for uncontracted potatoes. For contracted growers, profits were negatively impacted by lower-than-normal yields and higher bruising. Uncontracted growers were able to offset production and quality challenges with high open market pricing and a solid price floor as processors were actively buying open market products.

Northwest Situation

The combination of a smaller 2021-22 crop and late plantings for the 2022-23 crop culminated in a gap for processors who did not have enough potatoes to operate fry plants. In a normal year, there is a small, but manageable window where processors use the remaining crop in storage and transition to the new crop without disruptions. For 2022, potato harvest was delayed three to four weeks due to the late planting start. Harvest delays combined with the short 2021 crop, down 29 million tons (6.7%) from the five-year average, meant processors lacked the necessary potatoes in storage to last until the start of harvest for the new crop.

To minimize the time factories were offline, open potato growers were given substantial monetary incentives to harvest potatoes early. Weighted average prices for fresh russet table potatoes in Idaho and the Columbia Basin were more than double prices at the same time in 2021. Grower returns on Sept. 14, 2022 in Idaho were $25.36 per cwt, up 76.1% year over year. Similarly in the Columbia Basin, returns were up 82.4% to $22.85 per cwt. Fresh growers offset production and quality challenges (smaller size profiles and more bruising) with high open market prices.

While early harvest has benefitted processors by filling their processing lines and awards fresh growers with higher prices, it makes a short crop, shorter. Early harvest is a near term solution, but if overused, could create long term cyclical potato production challenges. Ideally, the Northwest potato crop is large enough for potatoes in storage to sustain processor demand until harvest for the new crop begins.

For many contract potato growers, profits will be negatively impacted by lower-than-normal yields and higher bruising this year. Contract growers negotiated prices in the fall of 2021. While most contracts increased by 20%, prices weren’t enough to overcome rising production expenses. Contract growers’ profits will take a hit from the lackluster 2022-23 crop coupled with high input costs.

In Idaho, early test digs showed small size profiles, and some producers with flexibility decided to delay harvest so potatoes could grow larger. Idaho’s 2022-23 crop experienced headwinds of 25,000 fewer planted acres coupled with yield reductions. In the Columbia Basin, prolonged record heat impacted potato yields and quality. Higher rates of bruising with the 2022-23 crop will cause storage issues and more potato wastage is expected.

The cost to produce an acre of potatoes has soared with costs unlikely to improve in 2023. For contract growers in Idaho, production costs ranged from $2,200 to $2,400 per acre in 2020. The price of nearly every input has surged, causing production costs to range between $3,500 to $4,000 per acre in 2022. Volatility in expenses and inflation have made it harder to estimate rising breakeven prices.

European Production

Drought and excessive heat in Europe have decimated the 2022-23 crop. In northwestern Europe (Belgium, the Netherlands, France, and Germany), yields declined by 12.1% year over year leaving growers unable to fulfill their contract obligations. Greater quality issues are expected to cause higher incidents of weight loss and wastage for potatoes in storage. Northwestern Europe is a major potato exporter, exporting 47.5% of raw potatoes and 52.4% of prepared/preserved potatoes in 2021. The short potato crop will impact global potato and French fry exports.

European growers face the same challenges as U.S. producers. Profit margins for potatoes are tight and contract prices are not keeping pace with rising production costs. Concerned about income, many European producers may consider planting alternative crops next year.

Trade

Total potato imports increased 11.7% from September 2021 through July 2022 compared to the same period a year ago. Stronger imports were led by impressive fresh and chilled volume, which were up 20.6% year over year. To continue operating during local raw potato shortages, processors imported more fresh and chilled potatoes.

Canada is the largest importer of United States’ seed potatoes, accounting for more than 99% of imports. Blight concerns shut down trade between the U.S. and portions of Canada, specifically in some of the largest seed production areas. The shutdowns drove reductions in seed potato imports, down 18.5% year over year.

Potato Imports by Volume, 2021-22 Market Year (September-July)-graph.png?sfvrsn=80b410d2_1)

Source: Economic Research Service (USDA), Potato Imports/Exports. September 7, 2022.

-graph.png?sfvrsn=21164390_1)

Source: Economic Research Service (USDA), Potato Imports/Exports. September 7, 2022.

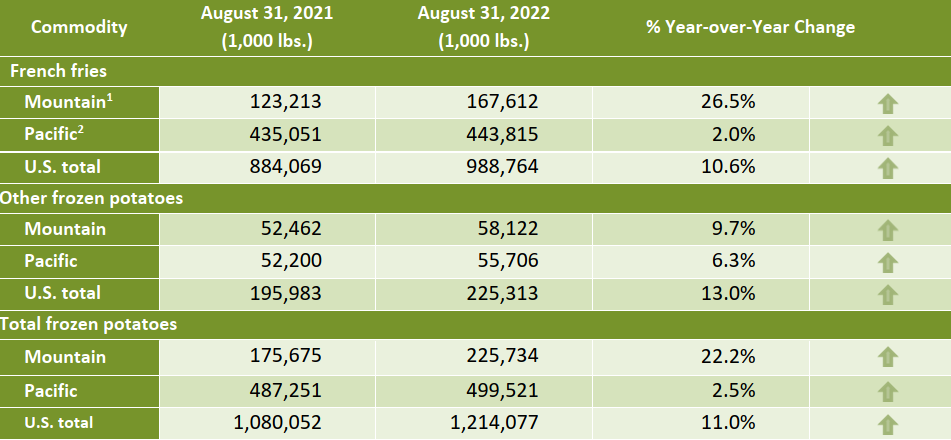

Cold Storage

U.S. total frozen potatoes will serve as a cushion for domestic demand. Expected losses from the new crop will not be fully offset by imports. The increase in U.S. total frozen potatoes in cold storage, up 11% year over year, will assist in meeting national demand. Greater reliance on existing potatoes in cold storage will draw down inventories.

2Pacific = Washington, Oregon, California. Source: USDA National Agricultural Statistics Service, Cold Storage. September 22, 2022.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

Additional Information

Northwest FCS Business Management Center

www.northwestfcs.com/Resources/IndustryInsights

North American Potato Market News

www.napmn.com

USDA Agricultural Marketing Service

www.ams.usda.gov

USDA National Potato and Onion Report

www.ams.usda.gov/mnreports/fvdidnop.pdf

Learn More

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe