Executive Summary

Drivers in the industry include favorable prices, harvest delays and stable demand for onions.

- The 2022-23 Northwest onion production is lighter than historical averages, with spring planting issues causing harvest delays and impacting onion size profiles.

- Favorable onion prices placed Northwest growers in a strong financial position to mitigate elevated input expenses and 2023 production costs uncertainties.

12-Month Profitability Outlook

Northwest FCS’ 12-month profitability outlook suggests profitable onion returns. Additional heat units in July and August improved onion quality. Market demand is stable for all onion colors. Jumbos and larger are in high demand. Producers with larger size profiles will benefit from high prices and strong demand.

Northwest Situation

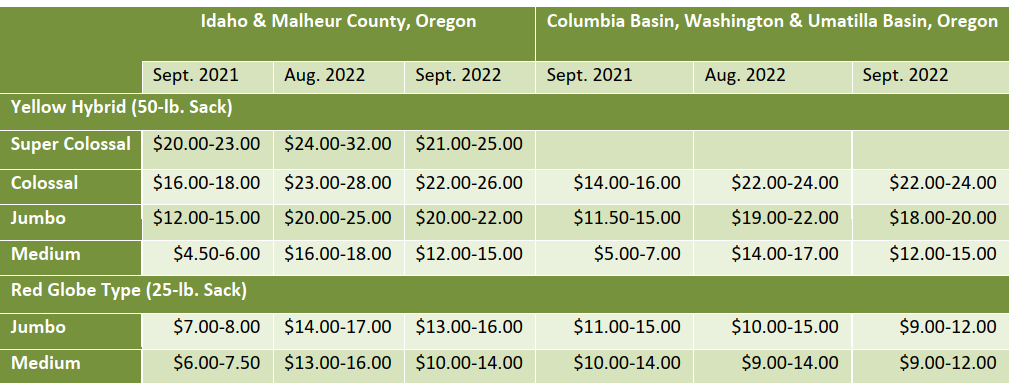

In Idaho and Malheur County, Oregon, record setting August heat (with 23 days over 100°F), assisted onion growth. The summertime heat allowed onions to bulk up from planting delays and slowed initial growth due to cool spring weather. Onion harvest was delayed by three to four weeks in most areas. Yields are forecasted to be down 20% due to delays. Profile size has been a bit smaller with lots of medium onions, but quality is unaffected. All colors (yellow, red and some whites) are available.

The Columba Basin had early demand pressures as shippers turned towards Washington onions to fill the market lull created by Idaho’s late harvest. Washington was less impacted by cold spring weather. Harvest was delayed only by a week and shipping began in early August. Onion quality has been good and strong prices have offset increases in production costs. Medium yellows in the Columbia Basin are trading at mostly $13 per 50-lb. sack, nearly double what they would have sold for a year ago.

Market demand slowed in mid-September with packing sheds responding by lowering prices. Jumbo yellow prices in Idaho softened the most, from $22 per 50-lb. sack on Sept. 13 to $18 per 50-lb. sack on Sept. 26. Northwest medium yellow prices decreased by $5 in the final weeks of September to $15 per 50 lb. sack. Prices for reds and whites also weakened. Even with prices softening, market demand is strong for large onions (jumbos or larger). Favorable onion prices have created tailwinds positioning Northwest growers to be able to manage rising costs.

Source: National Potato and Onion Report, USDA Agricultural Marketing Service. Sept. 26, 2022.

National Onion Situation

In the Northwest, harvest delays caused shipments from Idaho and Oregon which are down 19% season to date. The Columbia Basin was the only major onion production region in the U.S. with increased shipments season to date, up 2.2% year over year.

National onion shipments are down 15.1% season to date. Shipments were down in the San Joaquin Valley, Georgia, and New Mexico by 15.7%, 7.2% and 26.1% respectively. Season to date onion imports increased by 2.1%, including nearly double last year’s volume from Canada.

Onion Imports by Volume, 2022-23 Market Year (January - July)-chart.png?sfvrsn=1b74962a_1)

Source: Economic Research Service (USDA), Onion Imports/Exports. Sept. 7, 2022.

Onion exports for the 2022-23 crop season to date are down 12.8% year over year. Dried onions were the only export category to increase following strong summertime demand from Japan (the largest export destination for U.S. dried onions), up 24.4% year to date. Fresh or chilled onion exports declined to 308.5 million lbs., down 53 million lbs. from 2021.

Onion Exports by Volume, 2022-23 Market Year (January - July)-chart.png?sfvrsn=8384a44a_1)

Source: Economic Research Service (USDA), Onion Imports/Exports. Sept. 7, 2022.

Transportation

On Sept. 15, an emergency board brokered an agreement avoiding a national rail strike by mere hours. Contract negations between rail companies and railroad unions representing over 100,000 workers reached a temporary resolution while negotiations remain ongoing. Rail plays a vital role for agricultural infrastructure, especially for Northwest onion growers who shipped 8% of onions via rail in 2021.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

Additional Information

Learn More

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notification

for this and other market information in the form of an eNewsletter, visit www.northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe