Executive Summary

Drivers for the nursery and greenhouse industry include strong pricing, rising input costs, challenges around sourcing containers and other materials, and a slowing housing market.

- Strong prices have offset rising input costs and driven profitability.

- Deliveries increased in the Northwest, but remain slightly behind due to excessive heat in other regions.

- Shortages of input materials and labor remain a significant challenge for growers.

Housing sales and construction are falling and inventories are rising, suggesting a slowdown.

12-Month Profitability Outlook

Northwest FCS’ 12-month profitability outlook anticipates profits for the nursery/greenhouse industry. Prices and demand are strong and have offset rising input costs. The industry faces headwinds, including input material and labor shortages as well as declining consumer wealth and home affordability. Fortunately, the customer base grew during pandemic lockdowns and this should support demand.

Supply

Nursery inventories have come down on stronger summer sales; however, excessive heat and limited water availability (and the risk it poses to plants) in other regions of the U.S. have slowed deliveries to these areas. Demand remains high (see below) and production capacity is increasing moderately to meet it; however, land and labor availability remain the most significant challenges to industry growth. Container and other growing material shortages continue to hinder the industry. Fertilizer and herbicide costs appear to have flattened.

Demand

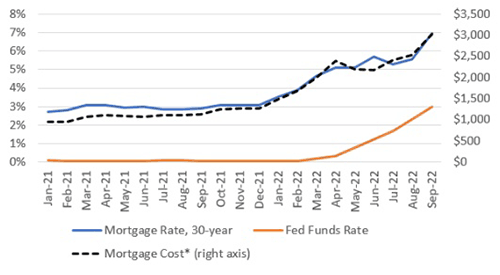

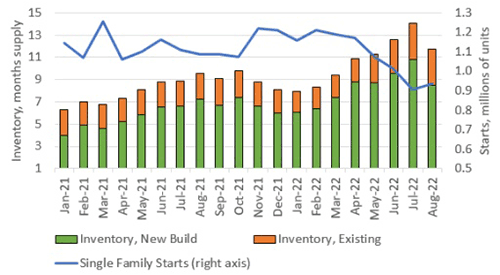

Retail sales peaked on drier weather in the Northwest. Some growers have held close-out sales, suggesting prices may be nearing their upper limits. There are indications housing construction is slowing, particularly in the single-family market (a big demand driver). Home affordability is declining rapidly as mortgage rates climb (see chart below). Leading indicators such as home builder confidence, permits issued, new / existing home inventories and new / existing home sales point to a slowdown. Further, consumer wealth continues to weaken as inflation adjusted earnings and savings fall and credit card debt increases, though it is unclear how this will impact the industry. Demand for nursery-greenhouse products may fall as people allocate more income to food and energy; however, this may be offset by people traveling less and investing in more homebased activities such as gardening. Coronavirus lockdowns led to about 18 million additional nursery-greenhouse customers from the millennial generation, which should drive demand for years to come.

Fed Funds Rate, Average 30-year Fixed Mortgage Rate and Estimated Mortgage Payment for a New Home

Single-Family Housing Inventory and Construction Starts

Source: Board of Governors of the Federal Reserve System, Freddie Mac, Census Bureau and National Association of Realtors. Mortgage payment estimated using average 30Y fixed interest rate and average new home price. Data as of Sept 27, 2020.

Profitability

Strong demand and pricing are driving profitability and most in the industry feel optimistic about the future; however, there are emerging headwinds. Rising input costs are beginning to chip away at margins in a period when prices may be reaching a top.

Input material and labor shortages continue to hamper operations. While single-family home construction is strong by historical standards, it is trending down due to declining affordability. If this persists, demand for greenhouse-nursery products

may eventually soften. Fortunately, demand from millennials should continue for years and while inflation may be impacting consumer wealth, reduced travel may lead to more gardening and landscaping activities.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

Additional Information

Northwest FCS Business Management Center

www.northwestfcs.com/Resources/IndustryInsights

Nursery Management

https://www.nurserymag.com/

Learn More

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe