Executive Summary

Producers face rising interest rates, elevated input costs, a possible recession and drought conditions. While property listing times appear to be rising and many are concerned about land values eventually falling, sales data shows demand continuing to exceed supply. Market participants include local operators, local and out-of-area investors, and rural residential buyers.

Northwest Region Trend

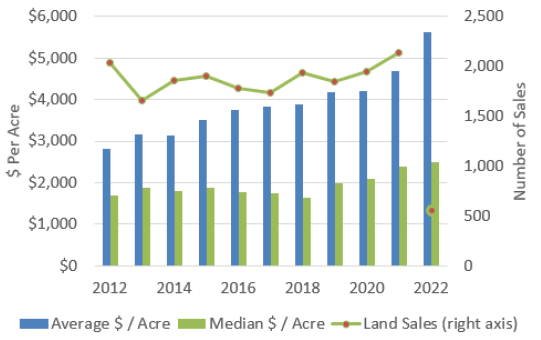

Demand is generally strong, but varies by property type and market segment. Sales between landlords and tenants are common and investor interest has increased, especially for high-quality land. Many areas report sustained demand with low inventory. Farmland values continue to rise (chart below). As of Sept. 19, 2022, Northwest FCS staff collected 648 land sales with an average value of $5,633 per acre.

Land Values and Sales, Transactions Over 40 Acres, Northwest

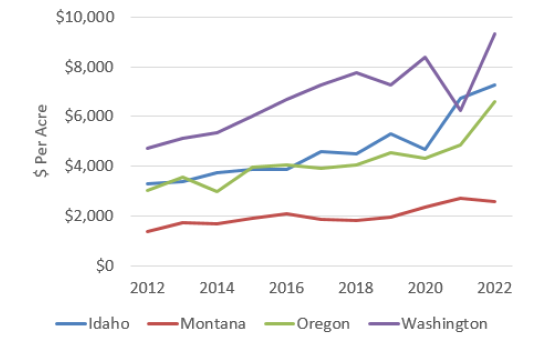

Average Land Values, Transactions Over 40 Acres, by State

Source: Northwest FCS’ proprietary sales database. Data as of Sept 19, 2022 (include 3 to 6-month lag).

Land Value Considerations

There are several factors influencing land values:

- Inventory – Reports indicate limited land inventory for sale, with a disproportionate number of lower-quality properties that received higher-than-expected prices due to a lack of higher-quality alternatives.

- Commodity and Input Prices – Commodity prices generally increased year over year, driving profitability for many producers. Fuel and fertilizer prices are off their summer highs, but evolving trends suggest this could be short lived (see Crop Inputs Snapshot for more information).

- Federal Assistance – The Inflation Reduction Act signed into law in early September included $3.1 billion for distressed farmers, though it remains unclear how it will be dispersed. This comes in addition to the moratorium on foreclosures, which may be extended in October.

- Interest Rates – Interest rates are rising, largely driven by Federal Reserve policy (see Quarterly Economic Update for more information) and affordability is declining as a result. While the presence of cash buyers may support demand, there is a potential for land values to come down. The housing market is cooling as listing times increase and prices decrease. Even with falling home prices, a lack of affordable housing remains a challenge.

- Drought Conditions – While most areas throughout the Northwest continue to experience some level of drought, conditions are improving with fewer areas considered “extreme” or “exceptional” as reported by University of Nebraska’s Drought Monitor.

Considerations by State

Washington

- Agricultural investment firms are increasingly prevalent within the vertically integrated tree fruit industry.

- Existing landowners and operators are investing in permanent crops such as apples, cherries and blueberries.

- Land with permanent planted crops generally have stable values. There are marginal properties sold and cleared for re-development while other high-quality properties are sold at premium prices for continued agricultural production. There are fewer listed “middle-ground” properties.

- Dryland values are stable due to increased outside investment as well as growers looking to expand.

- There is limited supply of irrigated agricultural real estate and market participants are cautious due to increasing interest rates and record input prices.

- Rural residential lots and small farm tracts (1-15 acres) in part time use continue to see good demand. Buyers include long-time rural residents and urban city dwellers. Sales of properties purchased strictly for residential purposes have begun to slow due to caution around rising interest rates.

- Increasing interest rates have dampened demand but land values are holding steady for the time being.

- Western Washington continues to see limited supply of land suitable for agriculture production.

Oregon

- While demand is slightly less than a year ago, it continues to exceed supply and support values.

- Buyers are increasingly cautious in higher priced areas; however, plenty of institutional and private investment demand exists, especially for larger opportunities.

- Rural residential demand remains high due to the increased ability to work remotely.

- Lands suitable for vineyards and existing vineyard properties remain active with stable to increasing values.

Montana

- Real estate markets in Montana appear to be in a state of transition. Despite continued interest in properties as well as increased sales volumes, anecdotal reports from industry professionals suggest softening demand. Prices movements are mixed, both increasing and decreasing depending on location and property type.

- Buyer interest in high-profile ranches is strong but there is limited supply on the open market. Sales activity is down year over year in 2022.

- Out-of-state buyers leaving densely populated areas continue to drive demand, particularly for smaller tracts.

Idaho

- Drought conditions continue throughout much of Idaho; however, a cool and wet spring with late rains allowed for normal irrigation allotments in most areas.

- Despite rising input prices, agricultural operations generally report positive returns and land continues to be in high demand statewide.

- Idaho is ranked as one of the most unaffordable housing markets, largely due to out-of-state buyers who have greater purchasing power than local residents.

- Idaho is expected to see continued population growth over the next ten years, especially in the Boise Metropolitan Area, putting upward pressure on land values and increasing development on farmlands.

- The number of agricultural properties for sale decreased year over year in 2022, resulting from low inventory and rising interest rates.

- Listing times for properties have increased; however, land values remain stable to increasing with strong demand for high quality agricultural land when available.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

About Northwest FCS Appraisal Services

Northwest FCS appraisers provide appraisal services on rural properties throughout the Northwest. The Appraisal Services team continually researches sales and tracks market data throughout Idaho, Montana, Oregon and Washington. They compile the market data and analyze it using a central database.

This report provides a high-level look at trends and market characteristics and does not provide detail for specific areas or land types. The report should not be used to identify a value for a specific property. This information is limited only to an analysis of trends in identified land values within the geographic area served by Northwest FCS.

Learn More

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe