Executive Summary

Drivers for the forest products industry include balancing of lumber supply and demand, favorable log prices and mixed housing data.

- Lumber supply and demand have been nearing an equilibrium the last few months, reducing market volatility.

- Log prices are holding up generally well as mills build and maintain inventories ahead of winter.

- The housing market is cooling based on macroeconomic trends and rising interest rates; however, long-term fundamentals remain favorable.

12-Month Profitability Outlook

Northwest FCS’ 12-month outlook sees forest products manufacturers and timberland owners as profitable. Lumber supply and demand is at or approaching a balanced level and prices seem to be settling above historical averages. Log prices have held up well so far.

Supply

Logs

Wildfires were minimal and well contained this season. Mills are seeking large and small diameter logs, though there is more small diameter supply than demand. Mill log inventories are generally strong given the moderate wildfire season and

falling finished product demand.

Lumber

Since June, lumber and plywood mills went from running at near full capacity (with labor the greatest limiting factor) to production curtailments based on lower demand. Inventories are at adequate to above average levels across the region and

lumber capacity improvements are largely concentrated in the U.S. South (most are not at full production). Rail and truck capacity along with elevated input costs remain a challenge.

Demand

Mills are building and maintaining inventories in preparation for winter, prioritizing large diameter and specialty grade green logs. Log exports to Japan remain favorable and have offset declines to China. Unfortunately, both countries face significant

challenges that may eventually hamper demand. Japan’s currency is down 22% year over year against the dollar, reflecting their central bank’s efforts to maintain low interest rates at the expense of diminishing its purchasing power.

China faces a rapidly deteriorating property market and continues a zero COVID-19 policy in which strict city and region wide lockdowns are implemented.

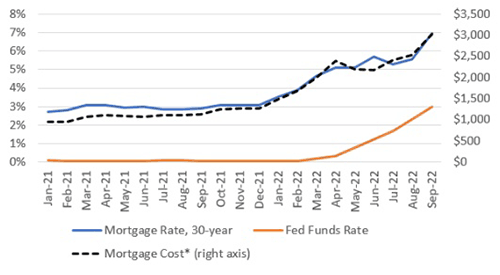

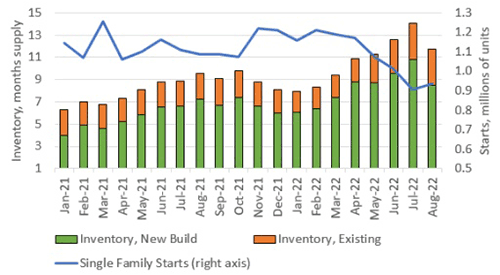

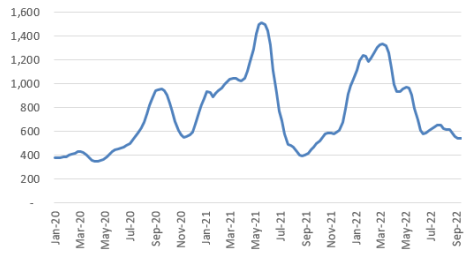

Lumber demand has come off historic highs and is more in balance with production capacity. While demand should generally hold stable, indications show housing construction slowing, particularly in the single-family market. Home affordability is declining rapidly as mortgage rates climb (see chart below). Leading indicators such as home builder confidence, permits issued, new/existing home inventories and new/existing home sales point to a slowdown.

Fed Funds Rate, Average 30-year Fixed Mortgage Rate and Estimated Mortgage Payment for a New Home

Single-Family Housing Inventory and Construction Starts

Source: Board of Governors of the Federal Reserve System, Freddie Mac, Census Bureau and National Association of Realtors. Mortgage payment estimated using average 30Y fixed interest rate and average new home price. Data as of Sept 27, 2020.

Despite these developments, most in the industry are optimistic over the long term. The millennial population just entered their prime home buying years and is expected to drive demand for the foreseeable future. Single family housing starts, while down year over year, are near their 20-year average and multi-family starts are strengthening.

Pricing

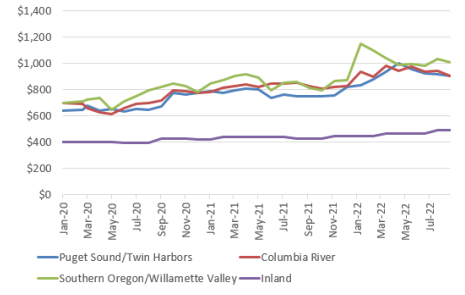

Source: RISI Log Lines.

Lumber

Lumber prices are down 70% from their summer highs, but have stabilized at levels above historical averages. As North America wraps up summer holidays and suppliers push out remaining high priced inventories, look for prices to recover slightly

near year-end.

Profitability

Logs

Current prices support profitability and should increase moderately from September levels as mills build winter inventories. Economic weakness in Japan and China, as well as a slowdown in housing construction, are potential headwinds that

could be felt by mid-2023.

Lumber

Lumber prices seem to be stabilizing above historical averages, which should drive profitability despite elevated input costs. Slowing housing construction presents a headwind. Manufacturers have already generated immense profitability thus

far in 2022.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

Additional Information

Northwest FCS Business Management Center

www.northwestfcs.com/Resources/IndustryInsights

Forest Economic Advisors (FEA)

www.getfea.com

Random Lengths

www.randomlengths.com

Fastmarkets RISI Log Lines

www.risiinfo.com

Learn More

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe