Executive Summary

Drivers for the Northwest apple industry include stable demand, favorable pricing to finish the 2021-22 crop and a small 2022-23 crop with mixed quality.

- Challenging weather conditions the past 15 months have led to a small 2022-23 crop with mixed quality.

- Harvest labor has been sufficient given the smaller crop and availability of local and H2A Visa labor.

- Demand should remain stable in 2023, but consumer preferences for varieties may change due to inflation.

12-Month Profitability Outlook

Northwest FCS’ 12-month outlook expects breakeven conditions. Excessive heat in 2021 and cool, wet weather in the spring of 2022 will lead to a small crop. While demand remains strong, high-cost producers and packers with insufficient throughput may struggle. Crop insurance will be important for many growers.

Supply

The 2021-22 crop is nearly all shipped and there should be little to no overlap with the 2022-23 crop.

The 2022-23 Fresh Apple Crop Estimate from Aug. 1 came in at 108.7 million boxes (12.5% below the five-year average), but anecdotal reports suggest it could be lower. Trees were impacted by excessive summer heat in 2021, frost and hailstorms in spring 2022 and a lack of cool nights in July and August. The crop is also 10 to 14 days behind on growth, which will incentivize producers to delay harvest to achieve optimum color, size and ripeness. A dominant La Nina weather pattern in the Pacific Ocean is increasing the chances of higher-than-average precipitation this fall in the Northwest. Wet weather could slow down operations and with a delayed harvest, there is risk of early season frost for late season varieties such as Fuji and Pink Lady.

Harvest for early season varieties is nearing the end and fruit has generally been small with inconsistent coloring. Quality is reportedly better on mid- to late-season varieties, especially on younger trees. Gas and diesel prices are off their June highs, but still well above levels experienced last year and this will add to the cost of harvest.

National production is forecasted larger than last season, but below the five-year average (see below). New York apples are expected to come in at 32.3 million bushels, in line with the state’s average. Michigan’s 2022-23 crop estimate came in at 29.5 million bushels, nearly double last season and 30% above their five-year average, reportedly due to favorable weather conditions. Quality is good and the crop is expected to sell through year end.

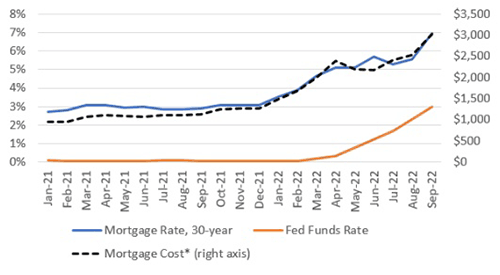

2022-23 Apple Crop Estimate by State and Estimated Mortgage Payment for a New Home

10.7 billion pounds, or 255 million bushels

7% larger than 2021-22 season

3.5% less than five-year average

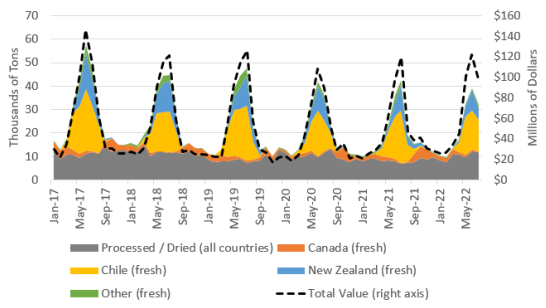

Apple imports peaked in May and are on track to match 2021 levels. The dollar has strengthened significantly relative to New Zealand and Chilean currencies over the last year and while one would expect this to put downward pressure on import prices, the opposite occurred. The average per unit value (a proxy for prices) of fresh and processed fruit was 25% and 4% above 2021 levels as of July.

Source: U.S Census Bureau

Demand

Aggregate demand for apples should remain stable through 2023; however, persistently high inflation is eroding consumer wealth and in response, people may choose less expensive varieties.

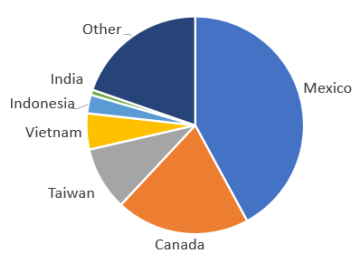

The 2021-22 season saw net apple exports decrease by 9.3% year over year (partly due to a smaller crop). Losses in Vietnam, Indonesia and India, among most other countries, offset gains in Canada, Mexico and Taiwan. Less than 5% of premium varieties are exported.

Source: WSTFA 2022 August Export Reports

The dollar strengthened significantly against most currencies over the last year, minus a few exceptions including the Mexican Peso. While U.S. apples in this market should not experience significant price increases, fruit from other countries may become more cost competitive. In addition, Taiwanese, Vietnamese, Indonesian and Indian currencies have depreciated significantly against the U.S. dollar. If this trend continues, Northwest apples will have an increasingly difficult time competing in those markets.

Pricing

Prices generally strengthened in recent weeks, but will likely soften as the 2022-23 crop hits markets. Prices will eventually recover as the industry readjusts to the limited apple supply.

Profitability

The 2022-23 crop will be the smallest in several decades, which will lead to a challenging season for high-cost producers and packers without sufficient throughput to cover fixed costs. Crop insurance will help to offset losses for many producers; however, there is no such safety net for the fruit packers. While a strengthening dollar reduces access to export markets, it comes at a time when there is less available supply. Overall, expect break-even conditions over the next year.

Share your feedback! Click Here to complete a two-minute survey about this Snapshot.

Additional Information

Northwest FCS Business Management Center

www.northwestfcs.com/Resources/Industry-Insights

US Apple Association

www.usapple.org/

USDA Agricultural Marketing Service

www.ams.usda.gov/

Washington State Tree Fruit Association

www.wstfa.org/

Learn More

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@northwestfcs.com.

To receive email notifications about Northwest and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.northwestfcs.com/subscribe or contact the Business Management Center.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe