The sugar beet industry is unique in the world of agriculture. Private companies and cooperatives buy sugar beets from growers and process the beets into various sugar products for industrial and consumer use. The primary product of sugar beet processing is white crystal sugar, with byproducts including sugar syrups, molasses and beet pulp.

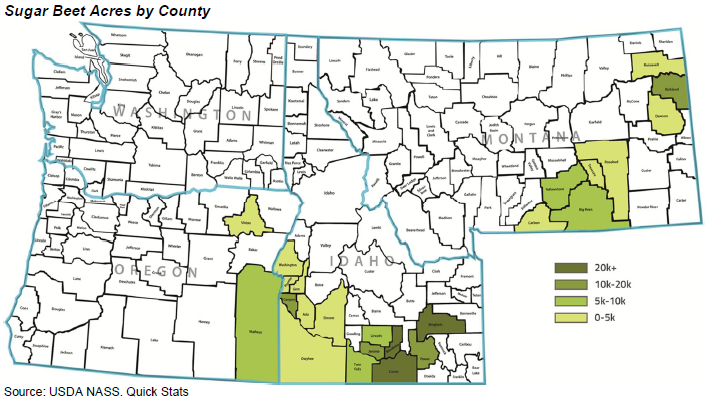

The two primary sugar beet growing regions in the Northwest are in Southern Idaho and

Eastern Montana. However, sugar better are grown is Oregon and Washington as well.

Production

The United States ranks sixth in global sugar production, following Brazil, India, the European

Union, China and Thailand. Unlike most sugar-producing countries, the United States has highly

developed industries for processing both sugar cane and sugar beets. Sugar cane is grown in

tropical or semitropical climates, while sugar beets are grown in a wide variety of temperate

climates including the Northwest.

Southern Idaho and Eastern Montana are the primary production areas in the Northwest.

Sugar beets are the first crop planted in the spring (generally April), and the last crop harvested

in October. Early planted beets have the highest potential yields but are susceptible to frost damage. Plants are grown in corrugated (or furrowed) fields irrigated by flooding or overhead sprinklers. During harvest, beets are topped (removing the leafy portion of the plant) and then dug from the ground using specialized equipment.

Over the past 15 years, the United States' sugar beet refining industry has completed a major transformation, with the majority of companies becoming grower-owned cooperatives. Four principal cooperative companies dominate the processing industry, including American Crystal Sugar Company (Minnesota), Amalgamated Sugar Company (Idaho), Western Sugar Cooperative (Colorado) and the Michigan Sugar Company (Michigan). Amalgamated Sugar Company is the largest Northwest sugar beet processor and serves growers across Southern Idaho and Eastern Oregon. Western Sugar Company sources sugar beets from Montana, Colorado, Wyoming and Nebraska.

Amalgamated Sugar owns processing facilities in Nampa, Twin Falls and Paul. Built in 1916 and 1917 respectively, the Twin Falls and Paul factories have been updated and are two of the largest beet processing factories in North America. Montana processing facilities are in Billings and Sidney.

Value Chain

Sugar beet growers produce beets according to contracts or shares.

- Contracts are for specific tonnage of sugar beets and generally have sliding price scales based on sugar content.

- Shares represent units of production. Generally, one share obligates the owner/grower to deliver sugar beets from one acre to a processing facility. Shares have value and can be traded. In years where sugar prices are high or expected to be high, the value of a beet share increases. When sugar prices are low, growers obligated to deliver sugar beets may do so at a loss.

Once sugar beets mature in October or November, the grower harvests the beets. The beets are transferred into trucks and delivered either directly to the processor or to a beet dump. Owned or managed by a processor, a beet dump stores beets from many growers for later processing. Independent trucking companies haul beets from beet dumps to the processor.

The processor washes and slices the beets and extracts the sugar. From the extract, a variety of branded and industrial products are produced including granulated sugar with various crystal sizes, brown sugar, powdered sugar and liquid products.

Finished sugar products may be shipped in 50-pound bags, FIBC bulk bags, by bulk trucks or bulk rail. A large portion of sugar production is marketed to bottlers, canners and other food manufacturers. Branded consumer products are packaged in a variety of sizes.

By-products include food- and feed-grade molasses, wet or dry beet pulp and betaine. These products are primarily used as animal feed.

Drivers

U.S. Consumer Preferences

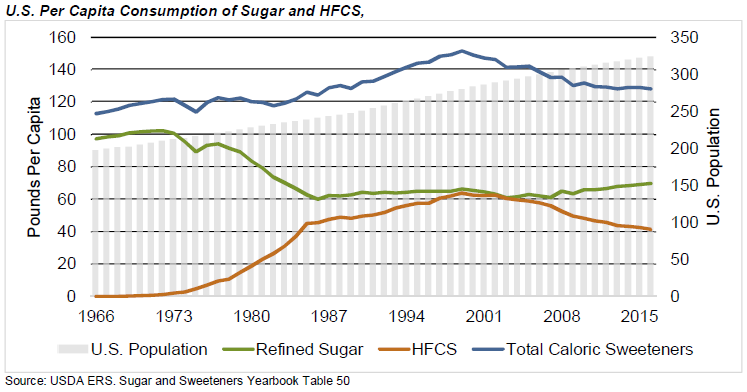

The U.S. is the largest consumer of sweeteners in the world, with annual per capita

consumption peaking in 1972 at 102.3 pounds. Facing competition from high fructose corn syrup (HFCS), sugar consumption fell to a low of 60.0 pounds per capita in 1986. In 1999, sugar and HFCS per capita consumption was nearly equal, at 66.4 pounds and 63.8 pounds respectively. In 2015, per capita refined sugar consumption was 69.1 pounds and HFCS consumption was 42.5 pounds. Although U.S. consumer preferences currently trend toward sugar over HFCS, overall interest in sweeteners is declining as consumers seek lower-calorie diets. Total caloric sweetener consumption has decreased 15 percent since its peak in 1999.

Food Processing Trends

Food processors' demand for sugar has risen in recent years. Products such as Pepsi's

'Throwback' soft drinks have popularized sugar and displaced high fructose corn syrup.

Genetics

Northwest sugar beet yields continue to increase, driven by improved farming practices and seed technologies. Sugar beet seed advances emphasize sucrose content, yield, disease resistance and herbicide resistance.

Sugar beet production and growers' returns have generally shown positive results since the introduction of a genetically enhanced seed resistant to Roundup® herbicide. This seed requires less labor and agricultural chemicals. After several years of field trials, Roundup Ready® beet seed was approved for use in 2008 and received non-regulated status by the United States Department of Agriculture's (USDA) Animal Plant Health Inspection Service (APHIS) in 2012.

Several large food companies, most notably Hershey's, have committed to eliminating GMO (genetically modified organism) sugar from their products. This has created a varying price difference between beet and cane sugars.

Policy

United States

The farm bill is the primary vehicle for setting U.S. sugar policy. Policy is based on three pillars: non-recourse marketing assistance loans, domestic market controls and tariff-rate quotas (TRQ).

The USDA provides loans to sugar beet producers and processors that guarantee a minimum price regardless of market conditions. At the end of the loan term, sugar producers and processors can:

- Turn over the sugar that they pledged as collateral for the loan to the government, or

- Sell their sugar on the market and repay the loan.

The loan rate is 24.09 cents per pound for refined beet sugar.

Each year, the USDA assigns each sugar processor a share of the anticipated U.S. sugar market. The allotment determines the amount of sugar each company is allowed to sell in a year. Even if a company over-produces sugar, they are not a not allowed to market sugar in excess of their allotment. Excess sugar must be stored and sold at a later date.

The USDA ensures that U.S. growers supply a minimum of 85 percent of domestic sugar demand. The agency accomplishes this by first estimating the demand for sugar, and then limiting sugar imports. Sugar imports are controlled using tariff-rate quotas, which are import taxes that increase in stages as sugar imports increase. At high tariff rates, imports become uncompetitive in the domestic market.

Free Trade Agreements

The U.S. restricts import quantities based on a calculation of the supplies needed to fill U.S.

demand.

The main challenge to U.S. policy comes from sugar imports from Mexico, which enter duty free under the terms of the North American Free Trade Agreement (NAFTA). As of 2015, sugar imports from Mexico are constrained from entering the United States as a result of an antidumping and countervailing duty case initiated by members of the U.S. sugar industry in 2014. The terms of the agreement between the U.S. and Mexico limit the price at which Mexican sugar can be shipped into the United States.

Global Sugar Production

Brazil, India, the European Union, China and Thailand are the world's top five sugar producers, representing approximately 60 percent of total global production in 2014-15.

Many countries around the world subsidize their domestic sugar industries. Support can be in the form of domestic market controls, import controls and export assistance. A second layer of backing also exists in the form of direct financial aid and indirect long-term support.

Countries including China, the EU, India and Thailand have domestic market controls. These controls are either support prices or supply management programs. Colombia, Mexico, South Africa and Thailand implement market share and sales quotas. All of these countries also implement import controls. Four general options exist for import controls: import quotas or TRQs, import tariffs, import licenses and quality restrictions.

Several countries around the world implement export subsidies or single-desk selling (sales by a monopoly marketer of a product with multiple suppliers). Colombia, the EU, Guatemala, India and South Africa use these market controls.

Indirect supports include state ownership, income support, debt financing and input subsides. Australia, Brazil, the EU, India, Indonesia, Mexico and Thailand use these approaches. Several of these countries also implement indirect long-term supports comprising programs to improve efficiency, mandates and tax breaks for ethanol programs, and consumer demand support.

Appendix A

Best Practices

To survive in competitive industries, sugar beet producers must focus on many business aspects at once. Basic production factors such as planter spacing, irrigation timing and weed management are necessary to grow a good crop, but additional actions can help ensure long-term viability in an industry and even provide a competitive edge.

Production

Sugar beet producers and industry specialists have worked closely on developing practices and technologies that will drive increases in yield and/or quality. Best practices in production include:

- Managing crop rotations to four or more years between particular crops

- Implementing GPS-based tillage, planting, cultivation and yield monitoring

- Using variable-rate fertilization to enhance production efficiency

- Applying regular and focused pesticide and herbicide

- Incorporating expertise from industry experts such as seed company representatives, fertilizer and chemical representatives, agronomists, university extension agents, etc., to increase overall knowledge and decision-making effectiveness

Growers continue to see savings with Roundup Ready seed because it reduces hand labor, the amount of chemicals applied to a field and the number of tractor passes through a field. While growers are saving money with the new seed, some of these savings have gone to pay for increased technological fees

associated with patented seed.

Labor Management

Best practices in successful labor management focus on strategies to retain better-educated and trained workers by:

- Improving working conditions

- Providing competitive compensation and benefits packages

- Adapting to workers' flexible scheduling needs

Cost Containment

Shifting economic conditions have contributed to changes in cost expectations, but managing costs

remains a critical component in guiding an operation toward profitability. Best practices in this area

include:

- Careful budgeting and variance monitoring

- Forward contracting of input costs to lock in rates

- Production break-even analysis to ensure that a positive margin is locked in

- Purchasing alliances to take advantage of volume discounts

- Overall cost control, offsetting increases in one area with reductions in another

While the adoption of various technologies is a proven way to cut production costs, it usually requires a significant capital investment. Growers should perform a cost-benefit analysis to determine whether the capital investments provide the increased return to make them viable and if the size and scope of the

capital investments are sustainable on a long-term basis with commodity prices at a level that is more in line with historical performance.

Long-term success requires that sugar beet producers not only be superior growers, but also sound business managers who proactively and creatively manage production expenses, labor needs and marketing issues, and position their operations solidly within lending guidelines for their respective industries.

Appendix B

Glossary

Beet dump/yard: A temporary, physical storage location for sugar beets prior to transportation into a processing plant

Caloric sweeteners: Sugar and HFCS

Cossettes: French fry-sized slices of sugar beets ready for processing

CSB: Molasses with additional sugar removed

HFCS: High fructose corn syrup

FIBC bulk bag: Flexible industrial bulk container made of polywoven fabric sewn into large bags designed for transport and storage of dry, flowable products Intense sweeteners: Food additives with a relative sweetness many times that of sugar. Sweeteners include sucralose (Splenda), aspartame (NutraSweet, Equal), stevia, saccharin (Sweet-N-Low) and others

Juice: liquid extracted from sliced beets that is further refined into crystallized sugars

Molasses: Remaining syrup after sugar crystals have been extracted; primarily used for animal feed

Pulp: The portion of the sugar beet that remains after the sugar has been extracted Roundup® Ready beet seed: genetically modified beet seed engineered with resistance to Roundup® brand (glyphosate) herbicides for weed control in the growing crop Single desk selling: A monopoly marketer and buyer of a product with multiple suppliers

Sugar Lime: lime used to purify sugar during processing, a co-product sold as a soil amendment

Tailings: Leafy tops and chunks of sugar beets separated prior to processing

Vertical integration: Alignment of agricultural business ventures concerning crop production beginning with planting to growing, harvesting, storage, processing and marketing of a commodity.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe