The Northwest is a large potato-producing region most known for the Idaho Potato. Washington and Oregon farmers also grow a large volume of potatoes that are either fresh packed or processed for consumers, both domestic and international.

Production

Potatoes are a primary food crop, with more than 385 million metric tons produced worldwide in 2014. Today, the United States ranks fifth in the world for potato production, behind China, India, Russia and the Ukraine. In the U.S., potatoes are grown in every state, with more than a million acres of potatoes harvested on an annual basis, making it one of the largest food crops in terms of cash receipts.

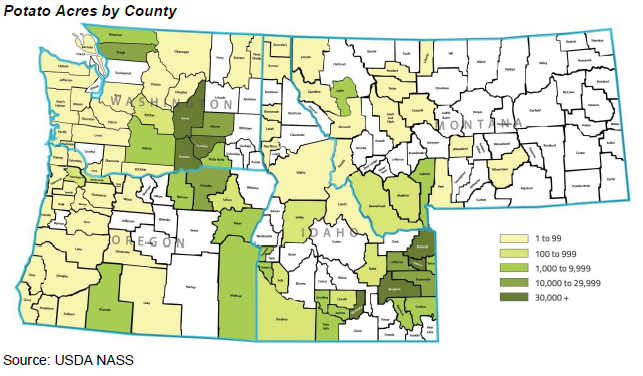

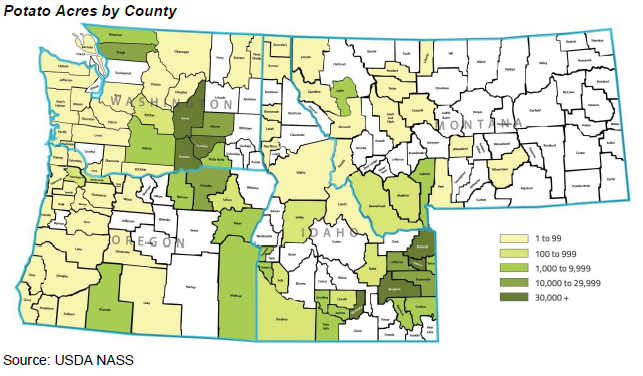

Northwest producers harvested 525,100 acres of potatoes in 2017, representing approximately half of the national total. Idaho leads the nation with 30 percent of all potato acres, while Washington is second at 16 percent. Oregon accounts for 4 percent and Montana accounts for 1 percent of the nation's potato acreage. The largest U.S. potato-producing region lies along the Snake River Plain in Eastern and Southern Idaho, where approximately 95 percent of Idaho's potato crop is grown annually. Other major regions in the Northwest include the Columbia Basin in Oregon and Washington, the Klamath Basin and Willamette Valley in Oregon, and the Treasure Valley along the Oregon and Idaho border. These regions have soil types, climates, growing seasons and irrigation infrastructure well suited for potato production.

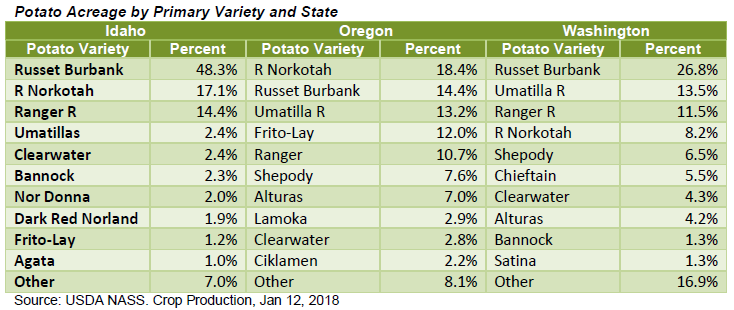

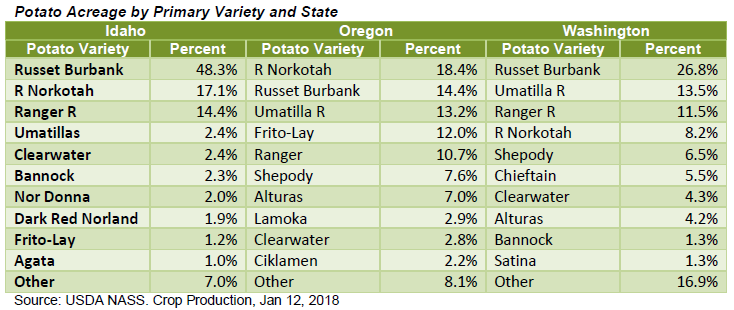

Both in the Northwest and nationally, russet potatoes - particularly the Russet Burbank variety - dominate the market, representing 70 percent of all potatoes grown. The popularity and prominence of the Russet Burbank, however, has declined over the last several years as newer potato varieties provide greater efficiencies in yielding the quality and characteristics processors and consumers are demanding. Other mainstay russet potato varieties include the Norkotah (primarily for fresh markets) and Ranger (primarily for processing). The following table illustrates Northwest potato acreage by selected variety.

Specialty white, red and yellow potato varieties are becoming increasingly popular in the valueadded segment of the market. In descending order, specialty white, red and yellow potato varieties now account for 19, 6 and 2 percent of the U.S. market. Specialty varieties are expected to see continued growth in the coming years due to increasing consumer demand.

Value Chain

Generations

Potatoes are identified by their generation. The parent stock, referred to as nuclear seed, is harvested from potato plants with desirable characteristics, then grown in the laboratory to maturity. The resulting tubers, or seed potatoes, are harvested and sold as generation 1 (G1) seed. G1 seed is then planted and grown for generation 2 (G2) seed, and the process repeats up to generation 5 in Washington state and generation 6 in Idaho. Commercial growers generally purchase G3 to G6 seed.

Planting generally occurs from late February through early May; harvest begins in July and continues through October. In some cases, potato plant foliage is desiccated to minimize greenvine interference during harvest. Then potatoes are dug and transferred to semi-trucks, which haul potatoes directly to processors/packing sheds or to storage facilities known as cellars where they are "laid in." Potato cellars range from sheds with dirt floors to high-tech, climatecontrolled buildings with ventilated concrete floors. Newer cellars have some type of forced-air system to control the temperature and humidity. Newer cellars can store potatoes longer into the marketing season, up to one year with high-quality potatoes. As potatoes are marketed year around, potatoes are generally removed from older storage facilities first. Growers with newer storage can benefit from better pricing later in the marketing year.

Grading and Sizing

Potatoes are graded according to USDA standards. Categories are U.S. No. 1, U.S. Commercial and U.S. No. 2. No. 1 potatoes are the best quality and are firm, fairly clean, well shaped, free from defect and greater than 1⅞"" in diameter. U.S. commercial potatoes meet the requirements of U.S. No.1, but with relaxed tolerance for defects. No. 2 potatoes are not seriously misshapen, free from serious defects and larger than 1 1/2" in diameter.

Fresh-pack potatoes are also categorized by the number of potatoes in a 50-lb carton. Cartons are packed in sizes from 40 to 120. A 50-count carton of potatoes would have 50, 16-ounce potatoes while a 120 count would have 120, 6.6-ounce potatoes.

Grading for processing normally will also include a measurement of specific gravity or density and a bruise factor.

Processing

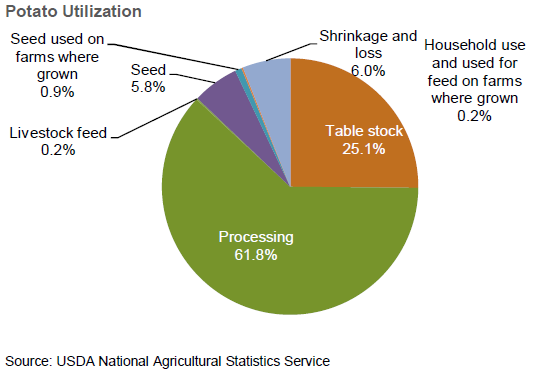

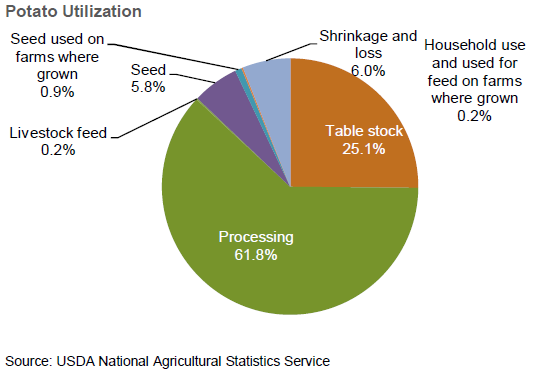

Potatoes are usually grouped into two categories, fresh and processing. Roughly a quarter of U.S. potato production is sold in the fresh market and used as table-stock at home or in restaurants. Processing potatoes are typically fried, frozen or dehydrated, but are also canned or included in other food items. Additional potato uses include seed and livestock and pet food. Sales of potatoes for seed generally account for 6 percent of total annual potato production in the United States, while potatoes sold as livestock feed (e.g., potato slurry) typically account for less than 1 percent. Potatoes used for pet food constitute a relatively insignificant percentage of total production, but is growing rapidly as pet owners move away from grain-based feeds.

Fryers and dehydrating plants are often clustered near large production centers to take advantage of freight rates for raw product. For example, a large number of dehydrating plants in the Northwest are concentrated in Eastern Idaho due to the consistent supply of potatoes not meeting fresh- or other processing-quality standards. Chip plants are usually located closer to population centers to offset comparatively expensive freight rates for potato chip bags that mostly contain air, versus freight rates for the raw product.

Although few individual producers are of sufficient size where their production and marketing activities can directly affect potato markets, cooperative commodity groups can have a meaningful impact on their respective markets. For example, most potato producers across the nation have joined grass-roots groups such as the United Potato Growers, the Southern Idaho Potato Cooperative (SIPCO), Potato Growers of Washington or state-based negotiating associations.

Both fresh- and processed-potato markets make use of open-market pricing and contracting, but fresh-market potatoes are typically grown for and sold on the open market. A fresh-packing warehouse may purchase a specific lot of potatoes and take the sales risk itself, but more often a warehouse agrees to package and sell a producer's potatoes for a price per unit, returning the net price to the producer. The price to the producer is generally based on a blend of the boxes, bags and other units sold from that specific lot. Coordination and collaboration between growers and shippers are necessary to maintain consistent price levels in the open market. Balancing efficiency in the warehouse and net returns to the producer becomes even more important when producers also own the fresh-pack facility.

Given the industry's limited ability to market excess product in an equitable and efficient manner, overproduction from high yields, increased acres or diminished demand remain problematic. The trend of higher input costs in recent years could magnify future losses from overproduction.

Some processors and fresh-pack warehouses offer forward-sales contracts to ensure at least a portion of their inventory supply. These contracts offer some market risk protection for producers. Process potatoes are normally grown under contract with a particular processor. For many years, groups of potato producers collectively negotiated prices and terms with processors, but the actual contracts have always been executed between the processor and the individual producer. Contracts are either for a certain quantity of potatoes (measured in sacks or tons), or they can be for the entire production generated on a certain number of acres. Both have advantages and disadvantages, and virtually all processor contracts have incentives and disincentives for storage, sizes and many other quality measurements. Early contract negotiations establish market expectations for the crop year.

Many potato producers have taken the opportunity to become joint-venture growers with local processors. These opportunities mitigate risk in many ways, but growers in a joint venture are sometimes called to provide product even when the timing isn't ideal for the crop. This has resulted in decreased yields in many instances, as growers are asked to harvest crops early to provide needed product. In most cases, the per-unit prices will be increased to help negate the reduced yields.

Industry Drivers

Fresh and Process Markets

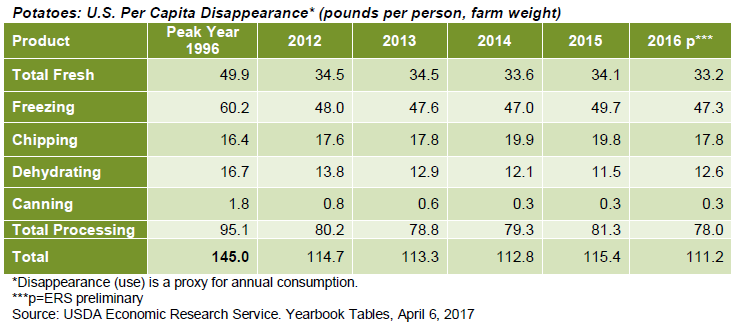

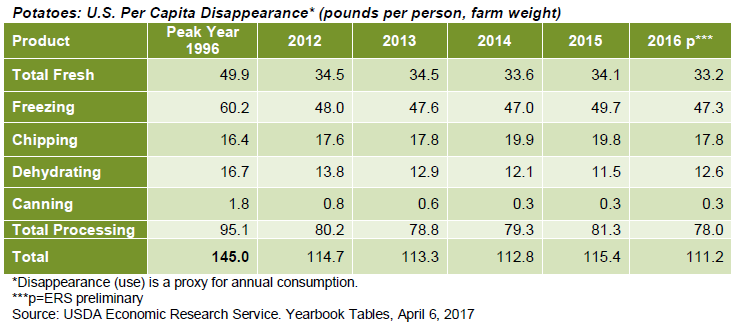

U.S. potato disappearance is a major factor driving the growth or decline of the U.S. potato industry. Potato disappearance is generally split between the fresh market (e.g., homes and restaurants) and the process market (e.g., frozen, chipping, dehydrating and canning). The following graphic illustrates how U.S. potatoes are allocated between fresh and process markets.

Consumer Preferences

Price is secondary to numerous factors influencing consumers' demand for potatoes. Advertising, media, branding and past experiences affect consumers' perception and preference when considering these potato attributes:

Exports

Exports are a growth opportunity for the U.S. potato industry. Japan, Canada and Mexico are top importers of U.S. potatoes, accounting for 53 percent of all U.S. potato exports. South Korea and China are the next two largest markets.

Appendix A

Best Practices

Basic production factors including planter spacing, irrigation timing and weed management are necessary to grow a good crop, but additional actions can help ensure long-term viability in an industry and even provide a competitive edge. Best practices for row crops are grouped by their area of applicability and include production, marketing, labor management and cost containment.

Production

Potato producers and industry specialists have worked closely on developing practices and technologies that will drive increases in yield and/or quality. Best practices in production include:

Experts have also found that boosting the level of organic matter in volcanic ash soil helps with water retention, soil aeration, yield and quality. Growers are turning to natural manure and using grains, grasses and other composting materials to increase the amount of organic matter in the soil. This can be made easier by partnering with dairies and other confined animal-feeding operations that have a ready supply of natural manure and/or compost that is available to improve soil quality. Natural fertilizer content can also replace a portion of petroleum-based fertilizers that are normally applied, further reducing overall costs.

Marketing

Few potato producers are large enough to take on the challenge of marketing their own crops directly to the consumer, so most producers rely on a processor or fresh-packing facility to take care of marketing. However, producers can increase the demand and marketing potential of their crops by using the following strategies.

Differentiation: Potato producers can differentiate their crops in the marketplace. Changing production methods to certify crops as organic, or working with processors to grow specialty varieties for products such as "skin-on" red mashed potatoes or Yukon Gold french fries, are both examples of ways to differentiate crops in the market and cater to new buyers.

Collective Bargaining: Grower cooperatives serve as marketing cooperatives, partnerships and integration between producers and packers. Participation in these groups has benefitted growers with increased effectiveness in negotiating contracts with processors.

Vertical Integration: Many potato-grower groups and producers have invested in freshpacking facilities; others have expanded into processing or dehydrating facilities.

Each of these options may have the potential to increase revenue, reduce costs or maintain a market for growers. However, each also has the potential to dilute capital and push an individual or grower group beyond core competencies, so producers must carefully evaluate available opportunities.

In the case of fresh-potato integrated operations, capturing the profit slice of the packing revenues helps hedge against potential price variability. In the Columbia Basin, very few independent fresh-potato growers still exist that have not become packers. However, simply becoming a packer is not the ultimate solution. Potato packers must be cost competitive and represented by or operate a best-of-class marketing desk.

Labor Management

Best practices in successful labor management focus on strategies to retain better-educated and trained workers by:

Shifting economic conditions have contributed to changes in cost expectations, but managing costs remains a critical component in guiding an operation toward profitability. Best practices in this area include:

Long-term success requires that potato producers be superior growers and sound business managers who proactively and creatively manage production expenses, labor and marketing.

Appendix B

Glossary

Chippers - A potato processor that specializes in providing washed potatoes to companies such as Frito Lay. Normally, operations have partners to supply specialized varieties that meet the needs of the chipping company they sell to. Common chipping varieties included Snowden, Dakota Pearl, Atlantic and other company-specific developed varieties. Typically they are white, round-potato varieties that are ideally shaped to be sliced into potato chips. Numerous varieties of chipping potatoes exist, with most maturities ranging from mid- to late-season.

Collective marketing groups or sales desks - Marketing and sales groups representing several suppliers united to market commodities under a common trade label. The groups can provide large-volume buyers a consistent supply of product throughout the calendar year.

CWT - Abbreviation for hundredweight (100 pounds)

Dehy - Short for dehydrated; a method of removing moisture from raw potatoes and processing into a finished product suitable for long-term, consumable food storage. Typical products are potato flakes, potato granules, potato flour, etc.

Fryers - A description of potato processors that primarily produce french fry products. A term used within the potato-processing industry that describes a conversion process of raw potatoes into frozen french fries

Grower Return Index (GRI) - Measurement of financial returns to the grower (primarily used in Idaho)

Potato slurry - Mixture of potato tailings and water generated as a by-product of potato processing from a raw potato toward a finished product

Russet Burbank - A late-maturing variety that requires a 140- to 150-day growing season

Russet Norkotah - Released in 1987 by North Dakota State University, this variety now ranks second in popularity for fresh-market use. Attractive type (refers to consistent oval shape); ahigh percentage of No. 1 potatoes is common with this early-maturing variety.

Ranger Russet - A medium- to late-maturing russet potato jointly released by the USDA and the University of Idaho in 1991. It has high solids and is used mostly for frozen processing and occasionally for fresh pack.

Sacks - Descriptive term in potato volume measurement. Synonymous with cwt, or 100 pounds

Vertical integration - Alignment of agricultural business ventures beginning with crop production from planting, to growing, harvesting, storage, processing and marketing of a commodity.

Production

Potatoes are a primary food crop, with more than 385 million metric tons produced worldwide in 2014. Today, the United States ranks fifth in the world for potato production, behind China, India, Russia and the Ukraine. In the U.S., potatoes are grown in every state, with more than a million acres of potatoes harvested on an annual basis, making it one of the largest food crops in terms of cash receipts.

Northwest producers harvested 525,100 acres of potatoes in 2017, representing approximately half of the national total. Idaho leads the nation with 30 percent of all potato acres, while Washington is second at 16 percent. Oregon accounts for 4 percent and Montana accounts for 1 percent of the nation's potato acreage. The largest U.S. potato-producing region lies along the Snake River Plain in Eastern and Southern Idaho, where approximately 95 percent of Idaho's potato crop is grown annually. Other major regions in the Northwest include the Columbia Basin in Oregon and Washington, the Klamath Basin and Willamette Valley in Oregon, and the Treasure Valley along the Oregon and Idaho border. These regions have soil types, climates, growing seasons and irrigation infrastructure well suited for potato production.

Both in the Northwest and nationally, russet potatoes - particularly the Russet Burbank variety - dominate the market, representing 70 percent of all potatoes grown. The popularity and prominence of the Russet Burbank, however, has declined over the last several years as newer potato varieties provide greater efficiencies in yielding the quality and characteristics processors and consumers are demanding. Other mainstay russet potato varieties include the Norkotah (primarily for fresh markets) and Ranger (primarily for processing). The following table illustrates Northwest potato acreage by selected variety.

Specialty white, red and yellow potato varieties are becoming increasingly popular in the valueadded segment of the market. In descending order, specialty white, red and yellow potato varieties now account for 19, 6 and 2 percent of the U.S. market. Specialty varieties are expected to see continued growth in the coming years due to increasing consumer demand.

Value Chain

Generations

Potatoes are identified by their generation. The parent stock, referred to as nuclear seed, is harvested from potato plants with desirable characteristics, then grown in the laboratory to maturity. The resulting tubers, or seed potatoes, are harvested and sold as generation 1 (G1) seed. G1 seed is then planted and grown for generation 2 (G2) seed, and the process repeats up to generation 5 in Washington state and generation 6 in Idaho. Commercial growers generally purchase G3 to G6 seed.

Planting generally occurs from late February through early May; harvest begins in July and continues through October. In some cases, potato plant foliage is desiccated to minimize greenvine interference during harvest. Then potatoes are dug and transferred to semi-trucks, which haul potatoes directly to processors/packing sheds or to storage facilities known as cellars where they are "laid in." Potato cellars range from sheds with dirt floors to high-tech, climatecontrolled buildings with ventilated concrete floors. Newer cellars have some type of forced-air system to control the temperature and humidity. Newer cellars can store potatoes longer into the marketing season, up to one year with high-quality potatoes. As potatoes are marketed year around, potatoes are generally removed from older storage facilities first. Growers with newer storage can benefit from better pricing later in the marketing year.

Grading and Sizing

Potatoes are graded according to USDA standards. Categories are U.S. No. 1, U.S. Commercial and U.S. No. 2. No. 1 potatoes are the best quality and are firm, fairly clean, well shaped, free from defect and greater than 1⅞"" in diameter. U.S. commercial potatoes meet the requirements of U.S. No.1, but with relaxed tolerance for defects. No. 2 potatoes are not seriously misshapen, free from serious defects and larger than 1 1/2" in diameter.

Fresh-pack potatoes are also categorized by the number of potatoes in a 50-lb carton. Cartons are packed in sizes from 40 to 120. A 50-count carton of potatoes would have 50, 16-ounce potatoes while a 120 count would have 120, 6.6-ounce potatoes.

Grading for processing normally will also include a measurement of specific gravity or density and a bruise factor.

Processing

Potatoes are usually grouped into two categories, fresh and processing. Roughly a quarter of U.S. potato production is sold in the fresh market and used as table-stock at home or in restaurants. Processing potatoes are typically fried, frozen or dehydrated, but are also canned or included in other food items. Additional potato uses include seed and livestock and pet food. Sales of potatoes for seed generally account for 6 percent of total annual potato production in the United States, while potatoes sold as livestock feed (e.g., potato slurry) typically account for less than 1 percent. Potatoes used for pet food constitute a relatively insignificant percentage of total production, but is growing rapidly as pet owners move away from grain-based feeds.

Fryers and dehydrating plants are often clustered near large production centers to take advantage of freight rates for raw product. For example, a large number of dehydrating plants in the Northwest are concentrated in Eastern Idaho due to the consistent supply of potatoes not meeting fresh- or other processing-quality standards. Chip plants are usually located closer to population centers to offset comparatively expensive freight rates for potato chip bags that mostly contain air, versus freight rates for the raw product.

Although few individual producers are of sufficient size where their production and marketing activities can directly affect potato markets, cooperative commodity groups can have a meaningful impact on their respective markets. For example, most potato producers across the nation have joined grass-roots groups such as the United Potato Growers, the Southern Idaho Potato Cooperative (SIPCO), Potato Growers of Washington or state-based negotiating associations.

Both fresh- and processed-potato markets make use of open-market pricing and contracting, but fresh-market potatoes are typically grown for and sold on the open market. A fresh-packing warehouse may purchase a specific lot of potatoes and take the sales risk itself, but more often a warehouse agrees to package and sell a producer's potatoes for a price per unit, returning the net price to the producer. The price to the producer is generally based on a blend of the boxes, bags and other units sold from that specific lot. Coordination and collaboration between growers and shippers are necessary to maintain consistent price levels in the open market. Balancing efficiency in the warehouse and net returns to the producer becomes even more important when producers also own the fresh-pack facility.

Given the industry's limited ability to market excess product in an equitable and efficient manner, overproduction from high yields, increased acres or diminished demand remain problematic. The trend of higher input costs in recent years could magnify future losses from overproduction.

Some processors and fresh-pack warehouses offer forward-sales contracts to ensure at least a portion of their inventory supply. These contracts offer some market risk protection for producers. Process potatoes are normally grown under contract with a particular processor. For many years, groups of potato producers collectively negotiated prices and terms with processors, but the actual contracts have always been executed between the processor and the individual producer. Contracts are either for a certain quantity of potatoes (measured in sacks or tons), or they can be for the entire production generated on a certain number of acres. Both have advantages and disadvantages, and virtually all processor contracts have incentives and disincentives for storage, sizes and many other quality measurements. Early contract negotiations establish market expectations for the crop year.

Many potato producers have taken the opportunity to become joint-venture growers with local processors. These opportunities mitigate risk in many ways, but growers in a joint venture are sometimes called to provide product even when the timing isn't ideal for the crop. This has resulted in decreased yields in many instances, as growers are asked to harvest crops early to provide needed product. In most cases, the per-unit prices will be increased to help negate the reduced yields.

Industry Drivers

Fresh and Process Markets

U.S. potato disappearance is a major factor driving the growth or decline of the U.S. potato industry. Potato disappearance is generally split between the fresh market (e.g., homes and restaurants) and the process market (e.g., frozen, chipping, dehydrating and canning). The following graphic illustrates how U.S. potatoes are allocated between fresh and process markets.

Consumer Preferences

Price is secondary to numerous factors influencing consumers' demand for potatoes. Advertising, media, branding and past experiences affect consumers' perception and preference when considering these potato attributes:

- Food safety (pesticides and regulation)

- Nutrition (calories, fat, carbohydrates and protein)

- Sensory traits (appearance, size, taste/flavor, color and smell)

- Value (size, convenience and price)

- Image (brand, labels, packaging and origin)

Exports

Exports are a growth opportunity for the U.S. potato industry. Japan, Canada and Mexico are top importers of U.S. potatoes, accounting for 53 percent of all U.S. potato exports. South Korea and China are the next two largest markets.

Appendix A

Best Practices

Basic production factors including planter spacing, irrigation timing and weed management are necessary to grow a good crop, but additional actions can help ensure long-term viability in an industry and even provide a competitive edge. Best practices for row crops are grouped by their area of applicability and include production, marketing, labor management and cost containment.

Production

Potato producers and industry specialists have worked closely on developing practices and technologies that will drive increases in yield and/or quality. Best practices in production include:

- Managing crop rotations to four or more years between particular row crops

- Implementing GPS-based tillage, planting, cultivation and yield monitoring

- Using variable-rate fertilization to enhance production efficiency

- Developing and/or growing varieties to meet targeted production and consumer needs

- Protecting consumers and raw commodities by adopting phytosanitary practices that prohibit the spread of plant pests or pathogens

- Applying regular and focused pesticide and herbicide

- Incorporating expertise from industry experts such as seed company representatives, fertilizer and chemical representatives, agronomists, university extension agents, etc., to increase overall knowledge and decision-making effectiveness

- Using irrigation monitoring systems

Experts have also found that boosting the level of organic matter in volcanic ash soil helps with water retention, soil aeration, yield and quality. Growers are turning to natural manure and using grains, grasses and other composting materials to increase the amount of organic matter in the soil. This can be made easier by partnering with dairies and other confined animal-feeding operations that have a ready supply of natural manure and/or compost that is available to improve soil quality. Natural fertilizer content can also replace a portion of petroleum-based fertilizers that are normally applied, further reducing overall costs.

Marketing

Few potato producers are large enough to take on the challenge of marketing their own crops directly to the consumer, so most producers rely on a processor or fresh-packing facility to take care of marketing. However, producers can increase the demand and marketing potential of their crops by using the following strategies.

Differentiation: Potato producers can differentiate their crops in the marketplace. Changing production methods to certify crops as organic, or working with processors to grow specialty varieties for products such as "skin-on" red mashed potatoes or Yukon Gold french fries, are both examples of ways to differentiate crops in the market and cater to new buyers.

Collective Bargaining: Grower cooperatives serve as marketing cooperatives, partnerships and integration between producers and packers. Participation in these groups has benefitted growers with increased effectiveness in negotiating contracts with processors.

Vertical Integration: Many potato-grower groups and producers have invested in freshpacking facilities; others have expanded into processing or dehydrating facilities.

Each of these options may have the potential to increase revenue, reduce costs or maintain a market for growers. However, each also has the potential to dilute capital and push an individual or grower group beyond core competencies, so producers must carefully evaluate available opportunities.

In the case of fresh-potato integrated operations, capturing the profit slice of the packing revenues helps hedge against potential price variability. In the Columbia Basin, very few independent fresh-potato growers still exist that have not become packers. However, simply becoming a packer is not the ultimate solution. Potato packers must be cost competitive and represented by or operate a best-of-class marketing desk.

Labor Management

Best practices in successful labor management focus on strategies to retain better-educated and trained workers by:

- Improving working conditions

- Providing competitive compensation and benefits packages

- Adapting to workers' flexible scheduling needs

- Increasing automation/scale in equipment and other processes

Shifting economic conditions have contributed to changes in cost expectations, but managing costs remains a critical component in guiding an operation toward profitability. Best practices in this area include:

- Careful budgeting and variance monitoring

- Forward contracting of commodity prices and input costs to lock in rates

o Production break-even analysis to ensure that a positive margin is being locked in - Purchasing alliances to take advantage of volume discounts

- Overall cost control, offsetting increases in one area with reductions in another

Long-term success requires that potato producers be superior growers and sound business managers who proactively and creatively manage production expenses, labor and marketing.

Appendix B

Glossary

Chippers - A potato processor that specializes in providing washed potatoes to companies such as Frito Lay. Normally, operations have partners to supply specialized varieties that meet the needs of the chipping company they sell to. Common chipping varieties included Snowden, Dakota Pearl, Atlantic and other company-specific developed varieties. Typically they are white, round-potato varieties that are ideally shaped to be sliced into potato chips. Numerous varieties of chipping potatoes exist, with most maturities ranging from mid- to late-season.

Collective marketing groups or sales desks - Marketing and sales groups representing several suppliers united to market commodities under a common trade label. The groups can provide large-volume buyers a consistent supply of product throughout the calendar year.

CWT - Abbreviation for hundredweight (100 pounds)

Dehy - Short for dehydrated; a method of removing moisture from raw potatoes and processing into a finished product suitable for long-term, consumable food storage. Typical products are potato flakes, potato granules, potato flour, etc.

Fryers - A description of potato processors that primarily produce french fry products. A term used within the potato-processing industry that describes a conversion process of raw potatoes into frozen french fries

Grower Return Index (GRI) - Measurement of financial returns to the grower (primarily used in Idaho)

Potato slurry - Mixture of potato tailings and water generated as a by-product of potato processing from a raw potato toward a finished product

Russet Burbank - A late-maturing variety that requires a 140- to 150-day growing season

Russet Norkotah - Released in 1987 by North Dakota State University, this variety now ranks second in popularity for fresh-market use. Attractive type (refers to consistent oval shape); ahigh percentage of No. 1 potatoes is common with this early-maturing variety.

Ranger Russet - A medium- to late-maturing russet potato jointly released by the USDA and the University of Idaho in 1991. It has high solids and is used mostly for frozen processing and occasionally for fresh pack.

Sacks - Descriptive term in potato volume measurement. Synonymous with cwt, or 100 pounds

Vertical integration - Alignment of agricultural business ventures beginning with crop production from planting, to growing, harvesting, storage, processing and marketing of a commodity.

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe