The U.S. beef industry consists of many production segments that collectively bring beef from the pasture to the dinner plate. The process, which starts at the ranch and ends at the retail counter or restaurant, can involve up to six different production

stages. Productions stages include seed-stock, commercial cow/calf, backgrounding, finishing, processing and retailing. Though some vertical integration exists, most operations specialize in just one or two segments of the production chain.

The

United States ranks fourth in the world for number of cattle behind India, Brazil and China. Although U.S. cattle account for a small portion of the world's cattle inventory, the United States ranks number one in beef production.

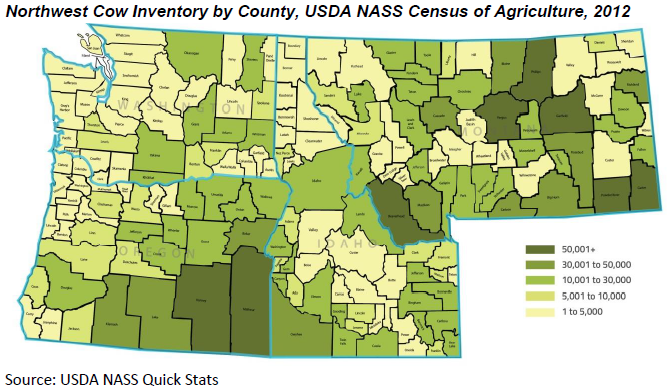

Northwest Production

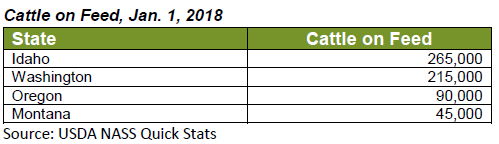

Montana's expansive landscape provides the necessary resources for many cow/calf operations. The state ranks seventh nationally in total beef cow inventory with 1.5 million head.1 Oregon and Idaho follow with 536,000 and 510,000 head, respectively. Washington

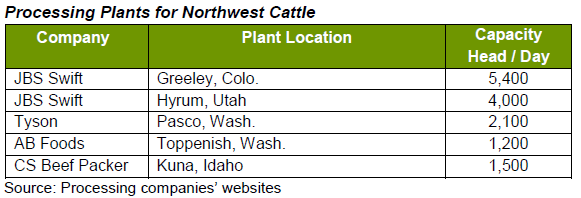

ranks 32 in the nation with 236,000 head. Cattle feeding is a significant component of Idaho's beef industry. The state ranks twelfth in the country for cattle on feed.2 Washington ranks 14 in cattle on feed. Washington is home to two commercial packing

houses. In May 2017, CS Beef completed construction and began operating a new meat packing plant near Kuna, Idaho. The CS plant is the only commercial processing plant in Idaho.

The primary destinations for cattle fed at Northwest feedlots include CS Beef in Idaho, two commercial beef processing plants in Washington state, and two JBS Swift plants in Utah and Colorado. The following table details the location

and slaughter capacity of each primary facility in the Northwest.

There are other small meat processing facilities located in the Northwest, but none have the head-per-day capacity to be considered material to the market.

Value Chain

The first stage of beef production lies in the genetic make-up of the cattle herd. Purebred cattle producers, also known as seed-stock producers, are responsible for engineering the genetic traits that are bred into U.S. cattle herds. These ranchers raise breeding stock, which are sold to the second segment of the value chain - the commercial cow/calf operation. Commercial cow/calf operations maintain a herd that produces calves for consumption. Calves are weaned between 6 and 8 months of age and weigh 450 and 600 pounds.

After weaning, calves enter the third stage of production, called backgrounding. Backgrounding, which can take place in a feedlot or on the range (an operation that backgrounds cattle on range or pasture is referred to as a "stocker" operation), is the time when weaned calves, or feeder calves, grow into yearlings. During this time, the calves usually gain 300 to 500 pounds over a period of 4 to 6 months. After the backgrounding process is complete, yearlings weigh between 800 and 950 pounds. At this point, they are ready to enter the fourth production segment, called finishing. Finishing is a process in which an energy rich ration is fed to the cattle until they reach a market weight of 1,200 to 1,400 pounds. Finishing usually occurs in a feedlot and takes between three and five months.

Once cattle have reached their market weight, they are ready for the fifth stage of production, known as processing. Beef processing occurs in large indoor facilities, known as packing plants. The beef carcass is segmented into eight primal cuts, known as the chuck, brisket, rib, plate, short-loin, flank, sirloin, and round. Primal cuts are then reduced into sub primal cuts. Individual portions derived from sub primal cuts are segmented into individual steaks and roasts, as well as ground beef. The steaks, roasts, and ground beef are packaged into boxes and shipped to retail outlets. Then, the boxed beef enters the sixth and final production stage. Retailing is the process in which the boxed beef is prepared for consumer purchase at either the grocery store or restaurant.

Many business alliances have developed linking the different stages of the production process. For example, operations that specialize in backgrounding may or may not own the cattle they are backgrounding. The cattle could be owned completely or in part by the cow/calf operation or feedlot. Other alliances come in the form of branded beef programs. Under these programs, operations in the early production stages can receive premiums (paid by operations in the later production stages) for producing cattle that meet certain quality criteria. Alliances continue to develop and can span the entire spectrum of the production chain.

Feedlot Distribution

The United States' cattle feeding and packing industries are centered in the Midwest, with small regional centers in southern Washington, Southern Idaho, Central California, and Arizona. The commonality among these regions is access to high quality feed.

The Northwest cattle feeding industry is relatively small in comparison to the Midwest. Within the Northwest, there are nine beef cattle feeding companies with a one-time capacity of 10,000 head or more.

The larger segment of the feeding industry

in the Northwest is the backgrounding and ‘grow lot' segment. These operations feed both owned and custom cattle, and are usually part of a larger, more diversified cow/calf or yearling operation. Backgrounding and grow lots generally range

from 1,000 to 6,000 head with some as large as 20,000 head. This segment of the feeding industry enjoys increased marketing options and can add less expensive pounds to lighter weight cattle. The following practices are typical of backgrounding and

grow lot operations:

- Background/grow feeder cattle from fall weaning (usually 450 - 600 pounds), and then fed to 800 - 900 pounds for sale into a finishing lot in February to April.

- Maintain and grow light-weight calves (400 - 600 pounds) to return to summer grazing. These cattle are generally sold directly from pasture to a finishing lot between August and September and typically weigh 850 to 950 pounds.

- Develop beef replacement heifers for sale or placement in the operation's breeding herd.

U.S. Beef Processing Industry

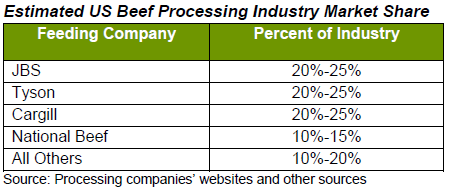

The United States' beef processing industry is dominated by four primary players. The following table summarizes industry market share.

JBS is the largest animal protein company in the world. JBS has its U.S. headquarters in Greeley, Colorado. However, the United States division is part

of a larger, global company headquartered in Sao Paulo, Brazil. JBS is the world's largest meat processor and the company has a strong export market. JBS purchased the United States' largest cattle feeding company (Five Rivers Cattle Feeding) and

several large American beef packing companies between 2007 and 2008. In doing so, JBS went from an unknown in the United States to the country's largest cattle feeder and beef packer.

Tyson Foods originated in the poultry industry but expanded into the beef packing industry with the acquisition of IBP Inc. in late 2001. At that time, Tyson was the largest beef packer in the United States. Today, Tyson is JBS' largest competitor in the U.S., and is the largest beef packer in Canada.

Cargill is a privately held, multi-national company specializing in food, agricultural, and industrial products and services. Cargill has a long history in the protein industries, and its beef packing division rivals the size of JBS and Tyson.

National

Beef Packing Company is a farmer - rancher owned business specializing in the beef industry. It is the fourth largest beef packer in the Unites States.

Industry Drivers

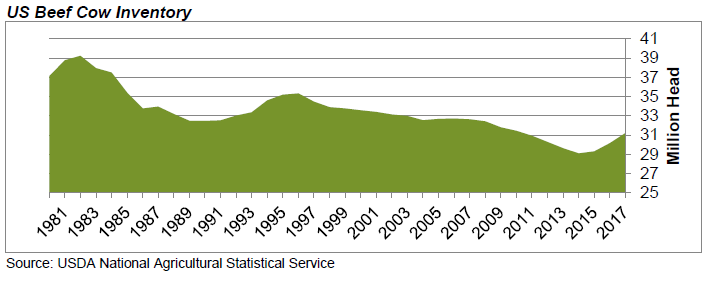

The size of the domestic beef cattle herd and the financial health of the American consumer underpin the current dynamics of the U.S. beef industry. Over the past 40 years, the U.S. beef cattle herd has declined as beef production becomes more efficient and consumer demand for beef has generally eroded. Export markets and environmental conditions also play a key role in cattle and beef markets.

Cow/Calf Segment

Cow Herd Cycle

In the 20 years between 1987 and 2007, the national beef cattle herd shrank by nearly 4 percent. The beef cattle herd shrank by an additional 11 percent in the U.S. between 2007 and 2014. Economic

recovery took hold in the U.S. during 2014. Strong cattle prices encouraged cow-calf producers to build cattle herds beginning in 2014. According to the USDA, the nation's inventory of beef cows rebounded from a 63-year low of 29 million to over

31 million head as of Jan. 1 2017.

Availability of Feeder Cattle

Canada and Mexico are an important source of feeder cattle for the U.S., particularly for feedlots near the international borders including those in the Northwest and Texas. Imports of Canadian and Mexican feeder cattle reached record levels in 2014.

Beef Trade

The health of the global economy affects demand for U.S. beef exports. As foreign consumers' standard of living improves, their diets include more protein. Since 2010, exports have been a significant demand driver for U.S. beef. Exports not only provide new markets for U.S. beef, but exports also support the value of beef byproducts including variety meats (e.g. tongue, cheek meat, and hearts), tallow, and hide. Increased sales and higher prices for these items result in stronger overall live cattle values and help to improve packer's margins.

The Environment

Weather conditions determine availability of feed and can, at times, be a major driver for the cattle industry. Widespread drought forced continued herd liquidation between 2011 and 2013. Consumers enter the Great Recession. Lower

household income and wealth negatively impacted demand for beef.

Best Practices

Successful Northwest cattle producers and cattle feeders understand that consumers are the main demand driver in the beef industry. Cattle operations need to observe trends throughout the protein complex; especially supply and demand drivers for protein on a regional, national, and global scale.

The primary goal of a cattle operation is to consistently provide beef with characteristics consumers

demand - mainly consistent taste and quality at a fair price. Additionally, the successful operator understands his or her target market and attempts to position his or her operation to take advantage of multiple opportunities within that market.

Successful operations focus on the factors in their immediate control such as input costs, feed availability, resource control, cattle genetics, and herd health and welfare to meet consumers' expectations. Effective marketing plans and margin management

are supported by implementing appropriate risk management strategies. In addressing these factors Northwest producers and feeders employ "best practices", which fall into three main areas:

1. General and Financial Management

2. Production

Management

3. Marketing Management

General and Financial Management

Continuing Education

Successful producers routinely seek out and attend industry conferences and educational seminars to enhance their understanding of the industry,

support issues they cannot influence individually, and improve management skills.

Record Keeping

Good record keeping is essential to the successful producer. Well-maintained financial records help operators track profitability and operating

costs and provide a basis to make effective budgeting decisions. Successful producers also use key financial ratios and metrics in business planning. This includes calculating break-evens, completing a sensitivity analysis of all projections, and

using benchmarking as an analysis tool. Good production records assist in making good marketing and herd health decisions. Documenting genetic, nutrition, and herd health management practices are the cornerstone of higher bids at sale time. In addition,

food safety and traceability issues need to be addressed and embraced by producers. Well-kept records aid in maintaining and providing this information.

Profitability and Cost Control

Profitability in the cattle industry is a function of

maximizing revenues and controlling costs. Operations with low breakeven prices are better positioned to withstand volatile markets. However, successful producers understand that low-cost production is not equivalent to keeping all fixed and variable

costs to a minimum. Simply stated, low-cost cow/calf operators produce the highest number of quality calves or feeders possible while managing fixed costs and variable costs with a long-term outlook in mind.

Cost control strategies involve monitoring variables in the input and output markets that have the largest effect on profitability and focusing on the ones the operation can impact the most. This may involve prepaying or forward contracting for inputs or participating with other producers in bulk input purchases. These practices should be employed as part of a three-phase risk management approach that involves the areas of inputs, interest rates, and marketing (output). Locking in input costs without considering sales price creates market risk.

Managing herd health is an important part of a low-cost strategy. Low-cost producers shift herd health expenditures to preventative measures rather than treatment. A few low-cost strategies for cow/calf producers and feeders include improving herd health, weaning percentages, and weaning weights, as well as screening herds for health issues like Bovine Viral Diarrhea (BVD). Ultimately, monitoring and improvement in these areas increases feed yard performance. Obtaining Beef Quality Assurance (BQA) certification is also a best practice, as it increases revenue potential and lowers cost in the long run. Cutting corners when it comes to herd health is not recommended for cow/calf or feedlot producers.

Successful producers find a way to manage risk within their operation. Financial planning and responsible debt structuring are key ways to minimize interest rate cost and risk. Due to high risk and volatility within the cattle-feeding segment, a strong risk management program is key for cattle feeders. Those with a strong price risk management program will often forgo some profits in good times, but also limit losses in bad times. Most importantly, price risk management programs guard against catastrophic losses that can result from extraordinary events such as changes in public policy, bad press, and sudden loss of markets. Additionally, successful feeders view their relationship with the packer as a partnership, as packers are looking for a reliable and uniform stream of cattle through their plants. These partnerships sometimes use profit/loss sharing agreements to incentivize both parties in the relationship towards a common goal. In the current market, many feedlot operators and processors also view known history of cattle on feed as a tool to manage risk, determine marketing options, and predict performance and retail value of cattle. The added value of this information is often bid into the price of the cattle when marketed.

Due diligence analysis of suppliers and buyers is also a best practice for all producers. Most operations prepay or forward contract for inputs or supplies and also use standard and/or forward contracts for the sale and/or purchase of their cattle. Determining the financial condition and stability of buyers and suppliers is a key component of keeping costs low. The ability of business partners to deliver or fulfill their contracts is critical.

Production Management

As illustrated in the supply

and demand section, the production chain in the beef industry starts with the cow/calf segment and progresses through to the beef retail segment. The discussion in this section focuses on the cow/calf and feeding sectors of the chain. The cow/calf

segment of the industry is the design engineer for the end consumer product. Accordingly, genetic, nutrition, and health management become cornerstones of end product quality and revenue enhancement of all segments of the supply chain. Cattle feeders

are challenged to source profitable cattle, which gain weight efficiently, from the cow/calf segment.

Calving and Weaning Rates

Calving and weaning rates refer to the number of calves born and ultimately weaned versus the number of cows

exposed to breeding. Based on CattleFax data, industry benchmarks are 91 percent for calving and 88 percent or better for weaning, with most successful operators reaching a 90 percent weaning ratio. Calving and weaning rates have a significant effect

on profitability. Spreading costs over more calves lowers cattle producers' overall cost of production. Successful producers employ measures to maximize the number of calves weaned per cow, and thereby the number of pounds sold per cow.

Regardless of the age at weaning, calves should be able to gain weight quickly and efficiently. Weaning weights can be affected by several factors, including weather, genetics, feed availability, and health. Successful cow/calf operators purchase quality bulls to improve the genetics and performance of feeder calves. The use of growth implants in calves varies greatly among operations depending on their marketing program. Natural and organic beef are marketed through contract arrangements that prohibit the use of growth implants in calves. Organic programs further limit the use of medicines and feed additives. Nevertheless, implants are a viable option to increase weight at weaning.

Low Death Loss

Death loss refers to the percentage of

calves born compared to calves weaned. For feeding operations, death loss increases breakeven costs for the remaining animals and reduces profit potential. Most feeding operations strive for 1 percent death loss or less. Successful producers employ

good herd health practices, understanding the costs of herd health support long-term gains. Preventing death loss usually includes regular inspections of the herd or feedlot pens throughout the production period.

Short Calving Season

For

the cow/calf producer, managing the cow herd to calve within a predetermined range (typically 60-80 days) is an important step toward increasing efficiency and profitability. Time and labor are important and expensive commodities for a cow/calf producer,

and this also helps in marketing a more uniform calf crop for buyers.

Preconditioning

Preconditioning calves has become a common practice amongst cow/calf producers. Preconditioning calves 30 to 45 days prior to sale is one strategy at the

forefront of successful herd maintenance and health practices. Practice has demonstrated that preconditioned calves have a lower mortality rate and perform better in feedlots. Feedlots want cattle that have been weaned and preconditioned with an identified

health program. They are willing to pay cattle producers a premium averaging between $4.00 and $8.00 per cwt for calves properly preconditioned and accompanied by verification (i.e. records).

Feed Availability for Cow/Calf Producers

Successful

operations also monitor the availability and quality of feed for the cow herd. In dry weather and drought conditions, herd numbers will be reduced to match available forage. In situations where feed quality is poor, supplements will be provided in

the most cost effective manner.

Some of the best practices employed by successful producers include:

- Matching the cow production cycle to the grazing season

- Matching cow breed and size to the feed and forage available

- Maximizing the use of crop residue for fall forage

- Testing the quality of forages and winter feed supplies and only supplementing deficiencies

- Matching feed to the different stages of production (e.g. lower quality forage for dry-cows)

- Minimizing cow costs and maximizing forage resources through early weaning (as above)

- Increasing carrying capacity through proper range management

- Sorting cows into smaller groups to manage for their specific nutritional needs

Feed availability and forage quality also involve several land use and control issues. Land available for grazing continues to decrease through increased regulation of public lands, increased wildlife and endangered species regulations, and the sale of private lands to non-agricultural interests. Successful producers seek to control forage resources through least-cost combinations of land ownership, long-term leases, and share-cattle agreements.

Efficiency Measures for Feedlots

There are several industry measures related to production efficiency that feedlot managers use to evaluate performance and profitability. The following terms and related formulas are the most common efficiency measures.

- Cost of Gain, calculated as: (total variable costs - feeder cost) / pounds of gain

- Average Daily Gain, calculated as: pounds of gain / days on feed

- Feed Conversion, calculated as: pounds of feed (dry) / pounds of gain

- Break-even, defined as the sale price ($ per cwt) at which the owner of the cattle does not make or lose money

The benchmark measurement for cost analysis is cost of gain, which simply states how much it costs a feedlot to grow an animal by one pound. Average daily gain is a measure of how quickly an animal is grown to market weight. The higher the average daily

gain, the fewer fixed costs required for finishing. Two and a half pounds to 4 pounds per day is a general range of average daily gain, with 4 pounds per day being very good and 2.5 pounds per day being low. The cost of a bushel of corn has the largest

influence on the cost of gain in feedlots.

Feed conversion, also known as the feed to gain ratio, is a measure of how efficiently an animal converts the feed ration into pounds of beef. This ratio can vary widely depending on several factors

including age, breed, diet, implants, management, and environmental conditions. The most important factor is probably age. In general, younger animals consume less feed per unit of weight gain than older animals; heavier weight cattle are typically

less efficient at utilizing feed, so feed conversions decrease as placement weights rise. Feed conversions average anywhere from 5 to 9 pounds of feed per pound of gain. Break-even analysis allows the feedlot operator an estimate of how much they

can pay for their calves. Breakeven prices can be calculated for the entire feeding period or only a certain part of the feeding program. By looking at different parts of the feeding program (e.g. growing versus 10 finishing) a producer

can determine where the most returns can be obtained. All successful operations employ some type of analysis of input variables as well as output price risk management.

Marketing Planning

Understanding volatile market cycles, marketing options and quality requirements, and planning accordingly for these factors, is a best practice for producers. With increased market volatility, margin management is critical. Producers should not allow market predictions or opinions to prevent them from taking advantage of profitable opportunities. In addition, it will be critical for producers to bridge the gap between knowing what should be done and executing.

Disciplined planning and risk management are critical to success.

Good marketing

managers understand available risk management tools and employ them appropriately. They know their cost of production and know that awareness of breakeven costs is critical to developing an effective marketing strategy. Breakeven analysis also includes

a sensitivity analysis on all available options. This information is used to develop a flexible marketing plan. A comprehensive marketing plan designed to obtain maximum value will include several of the following best practices:

- Analyze and track seasonal market cycles for the classes of cattle sold

- Complete breakeven and sensitivity analysis of all marketing options to take advantage of selling opportunities

- Utilize forward contracting, hedging, or options as a price risk management tool

- Obtain livestock revenue insurance as a price risk management tool

- Develop alliances with feedlots, packers, and/or retailers stressing specific traits

- Profit and loss sharing agreements with packers to manage risk and volatility

- Participate in special seasonal sales featuring specific traits such as age and source verified calves

- Participate in video, local auction and/or private treaty sales

- Enlist the assistance of seed stock providers to promote genetics

- Make copies of production records to promote the genetics, past performance, nutrition management, and health and welfare management of the cattle

- Maintain age and source verification records

- Sort and sell cattle in uniform groups to match market demand

- Diversify by managing a portion of the calf crop through the stocker or finishing phase (specific to cow/calf and yearling operations)

- Maintain partial retained ownership through the finish phase (specific to cow/calf and yearling operations)

Other practices can also be beneficial to a comprehensive marketing plan. Alliances in certified beef and natural beef programs are popular. Overall, carcass certification programs vary widely in evaluating quality. Although cattle breed and/or carcass characteristics may be certified by the USDA, certification of these characteristics is beyond requirements for USDA grades.

Natural beef programs are found throughout the U.S., with Northwest programs including Country Natural Beef, Painted Hills, Meyers Natural Angus, and Montana Ranch Brand. Responding to consumer demand, natural beef can be purchased at all retail levels, including restaurants, specialty and natural markets, and grocery stores. Industry data over the previous four years shows participation in a premium program like Certified Angus Beef (CAB) or a natural program adds $3 to $7 per cwt to the sale prices. Similar premiums are paid for NHTC (non-hormone treated cattle), Wagyu and GAP (Global Animal Partnership) certification.

Other value-added practices include backgrounding calves through the winter and selling them in the spring as feeder cattle, or alternatively, grazing calves during the summer and selling them as feeder cattle in the fall. Sometimes, producers

retain ownership of their cattle through finishing. Additionally, cattle producers may retain partial ownership or total ownership to participate in traceability programs targeting food safety. Feeding operations span the range from total custom feeding

for other producers to total ownership and feeding of all cattle in the lot. Some feeding operations advertise specific feeding programs for certain value-added program participation. Regardless of the strategy, cattle producers' goal is making the

most profit given market conditions.

Glossary

Antibiotic - Product produced by living organisms such as yeast that destroys or inhibits the growth of other organisms, especially bacteria.

Average daily gain (ADG) - Pounds of live weight gained per day.

Backgrounding - Growing program (grazing or fed harvested feed) for feeder cattle from time calves are weaned until they are on a finishing ration in the feedlot.

Basis - Difference between the cash market price and the futures market price.

Bovine spongiform encephalopathy (BSE) - A degenerative disease that affects the central nervous system of cattle.

Branded beef product - A specifically labeled product that is differentiated from commodity items by its brand name.

Certified Angus Beef, Laura's Lean, or Cattlemen's Collection are examples.

Breakeven price - Volume of output required for revenue to equal the total of fixed and variable expenses.

Breeding stock - male and/or female bovine used to produce calves.

Calf - Young male or female bovine animal under 1 year of age.

Calve - Giving birth to a calf. Same as parturition.

Cattle-Fax - Nonprofit marketing organization governed by cattle producers. Market analysis and information is provided to members by a staff of market analysts.

Choice - USDA carcass quality grade between Prime and Select. See quality grades.

Cost of gain - Total of all costs divided by the total pounds gained; usually expressed on a per-pound basis.

Cow-calf operation - Management unit that maintains a breeding herd and produces weaned calves.

Custom feeding - Cattle feeders who provide facilities, labor, feed, and care as a service but they do not own the cattle.

Feed conversion - See "feed efficiency."

Feed efficiency - The amount of feed required to produce a unit of weight gain or milk, or alternatively the amount of gain made per unit of feed.

Fed cattle - Steers and heifers that have been fed concentrates, usually for 90-120 days in a feedlot or until they reach a desired slaughter weight.

Finished cattle - Fed cattle whose time in the feedlot is completed and are now ready for slaughter.

Forward contracting - Future delivery of a specified type and amount of product at a specified price.

Hedge - Risk management strategy that allows a producer to lock in a price for a given commodity at a specified time.

Heifer - Young female bovine cow prior to the time that she has produced her first calf.

National Cattlemen's Beef Association (NCBA) - National organization for cattle breeders, producers, feeders, and affiliated organizations with offices in Englewood, CO, and Washington, DC. Previously known as the National Cattlemen's Association or NCA.

National Cattlemen Magazine - Monthly magazine owned by the National Cattlemen's Beef Association (NCBA).

Natural beef - Refers to beef from cattle that have not been fed growth stimulants or antibiotics.

Packing plant - Facility in which cattle are slaughtered and processed.

Parturition - Process of giving birth.

Preconditioning - Preparation of feeder calves for marketing and shipment; may include vaccinations, castration, and training calves to eat and drink in pens.

Prime - USDA highest carcass quality in terms of marbling. Ranks above grades such as Choice, Select, and Standard. See quality grades.

Purebred - Animal eligible for registry with a recognized breed association.

Quality grades - Grades such as Prime, Choice, Select, Standard and Utility that group slaughter cattle and carcasses into value- and palatability-based categories. Grades are determined primarily by marbling and age of animal.

Seed-stock - Breeding animals. Sometimes used interchangeably with purebred.

Select - USDA carcass quality grade between Choice and Standard See quality grades.

Steer - Bovine male castrated prior to puberty.

Weaning (wean) - Separating young animals from their dams so that the offspring can no longer suckle.

Yield grades - USDA grades identifying differences in cutability - the boneless, fat trimmed retail cuts from the round, loin, rib, and chuck

Stay up to date

Receive email notifications about Northwest and global and agricultural and economic perspectives, trends, programs, events, webinars and articles.

Subscribe